- Okapi Resources (OKR) has signed an agreement to purchase Bulk Minerals for nearly $1.5 million

- Bulk Minerals holds kaolin halloysite and heavy mineral sands projects across South Australia and Western Australia

- The deal will see around 7.1 million Okapi shares issued to Bulk Minerals

- Okapi has also received firm commitments to raise $700,000 through a placement, offering shares at 21 cents each

- Funds raised from the placement will be used to pay for the costs of the acquisition

- On the market today, Okapi is up 2.38 per cent and is trading at 21.5 cents per share

Okapi Resources (OKR) has signed an agreement to purchase Bulk Minerals for nearly $1.5 million.

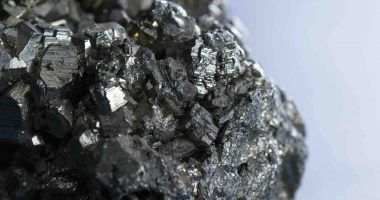

Bulk Minerals holds kaolin halloysite and heavy mineral sands projects across

South Australia and Western Australia. Its assets have a combined land package of around 2127 square kilometres.

The deal will see around 7.1 million Okapi shares issued to Bulk Minerals.

Okapi’s Executive Director David Nour is excited on this exciting new chapter for the company.

“This acquisition puts Okapi in a highly prospective ground in the heart of major known kaolin halloysite deposits neighbouring the likes of Andromeda Metals. Additionally, historical drill results show the potential of the Holly Kaolin Project in which we will commence exploration work immediately to confirm the quality

of the project,” he said.

“With the fast-moving technological advances in kaolin halloysite, the potential application extends beyond traditional uses to now include batteries and supercapacitors, hydrogen storage and construction,” he added.

Capital raise

Okapi has also received firm commitment to raise $700,000 through a placement.

The placement will offer around 3.3 million new shares at 21 cents each with a one free listed option for every new share subscribed.

Funds raised from the placement will be used to pay for costs of the acquisition.

On the market today, Okapi is up 2.38 per cent and is trading at 21.5 cents per share at 11:05 am AEST.