- Mobile services specialist amaysim (AYS) is set to sell its core mobile phone services business to mobile giant Optus for a neat $250 million

- The sale is part of amaysim’s plan to close shop in 2021, and the majority of the purchase funds will be put straight into the pockets of shareholders

- While the company plans to spend some of the funds on transaction costs and wind-down work, between $207.2 and $225.7 million will go to shareholders

- This is one of the final steps in amaysim’s plans to wind up operations and close down

- If all goes according to plan, amaysim will de-list and wind up in June 2021, and shareholders will get their final payout from today’s purchase in October

- Today, shares in amaysim are almost 10 per cent higher and trading for 74 cents each

Amaysim (AYS) is set to sell its core mobile phone services business to mobile giant Optus for a neat $250 million.

The sale is part of amaysim’s plan to close shop in 2021, and the majority of the purchase funds will be put straight into the pockets of shareholders.

The purchase deal

The deal follows amaysim’s recent $115 million sale of its Click Energy business, which was announced in late-August, as the company plans to de-list from the ASX and wind up operations.

Amaysim said today’s deal is subject to shareholder approval in January 2021. If approved, most of the proceeds will be distributed to shareholders in three tranches.

While the company plans to use some of the $250 million to pay some transaction and wind-up costs, amaysim said it expects between $207.2 million and $225.7 million to go to shareholders.

The mid-point of these figures of $216.4 million represents a purchase price of 70 cents per share, which is a 4.5 per cent premium to amaysim’s last closing price.

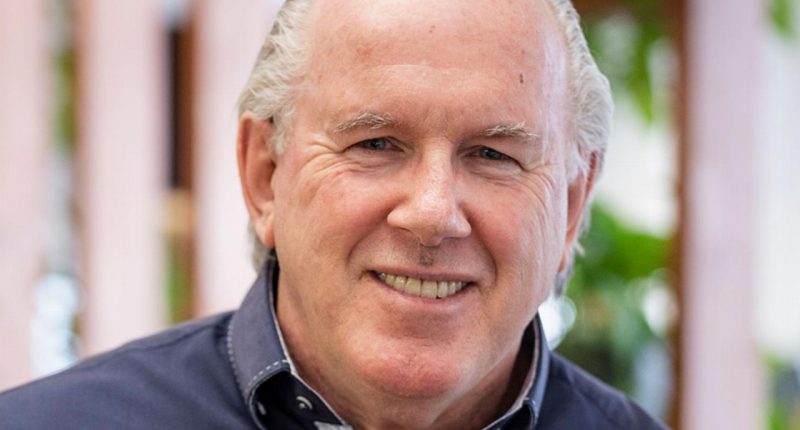

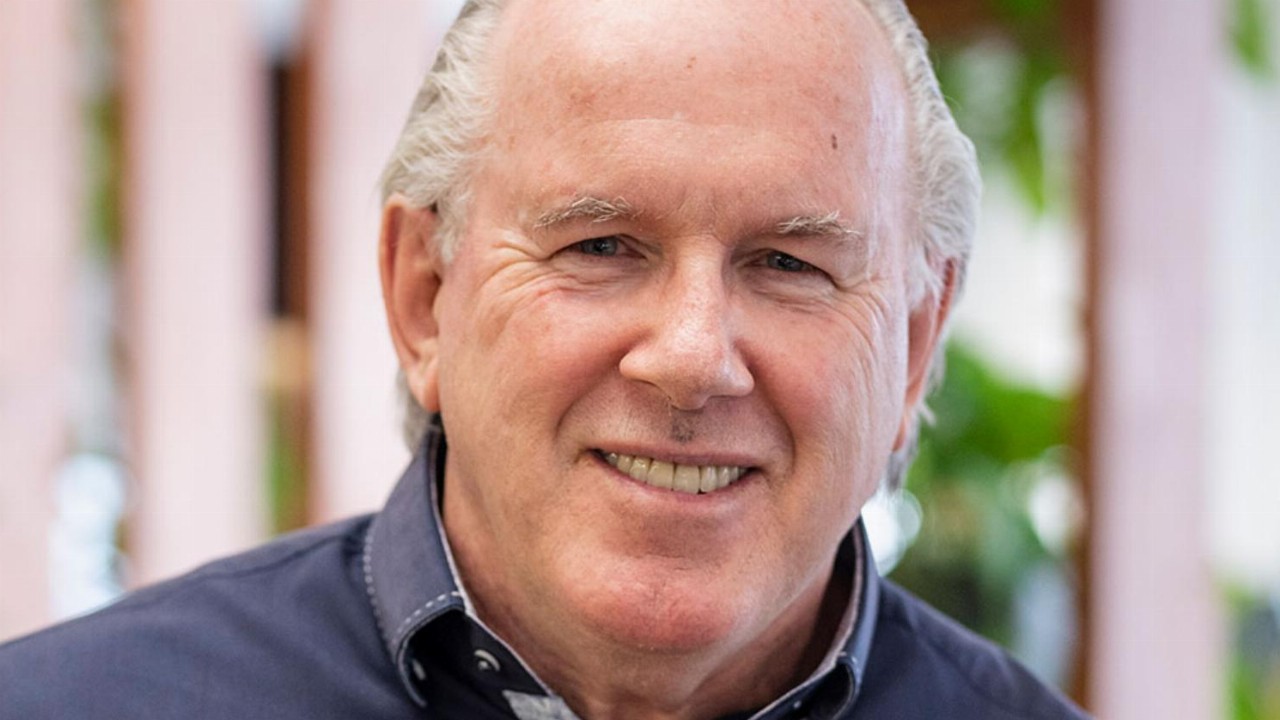

Amaysim CEO and Founder Peter O’Connell said Optus recognised Amaysim’s “first-class” team when it made the call to buy up the company.

“We believe Optus, with its deep knowledge of our operations, is well-placed to look after our customers and staff and take the growth of the business to the next level,” Peter said.

“I am very proud of the business we have built over the last 10 years and, since listing on the ASX in 2015, we have achieved healthy organic growth complemented by successful strategic acquisitions of Vaya, Jeenee and OVO’s customers,” he said.

“We have had to continuously reinvent ourselves and adapt to intense competition and despite the challenges, amaysim has grown its mobile subscriber base, delivered best-in-class customer service and maintained its incredible culture,” he said.

The amaysim board has unanimously recommended the buyout.

What’s next?

For amaysim, this is one of the final steps in the company’s plan to wind-up operations and close down.

The company plans to complete its mobile business sale in January 2021, with the first tranche to be paid out to shareholders in March.

In June, amaysim will de-list and wind up, and the final tranche from the mobile sale will be distributed to shareholders in October 2021.

Following today’s news, shares in amaysim have tacked on a neat 9.7 per cent and are currently trading for 74 cents each. The company has a $216.91 million market cap.