- At current costs, more than half of homes will be cheaper to purchase than rent in the next ten years, according to a report from REA

- For the next ten years, just over half of houses and almost 75 per cent of apartments will be cheaper to buy

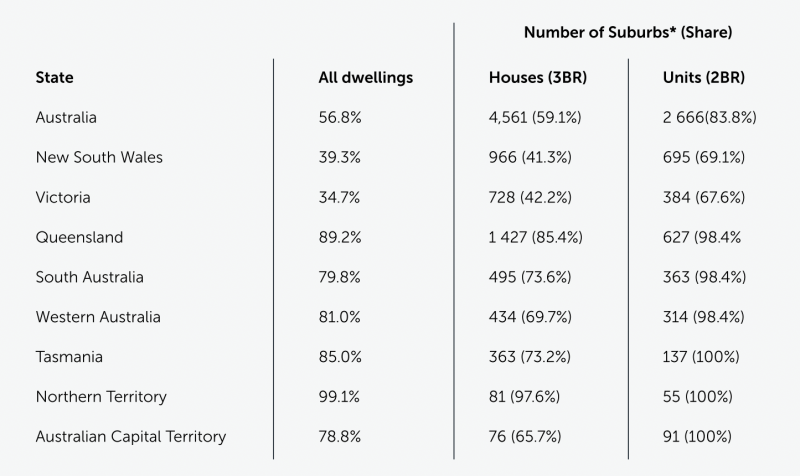

- Buying conditions are particularly favourable outside of New South Wales and Victoria, with more than 80 per cent of houses, and almost all units, estimated to be cheaper to buy than rent

- Renting remains the cheapest option for many, particularly in Sydney and Melbourne, according to the report

- More than 70 per cent of houses, and just under half of units in New South Wales and Victoria are estimated to be cheaper to rent over the next 10 years

At current costs, more than half of homes will be cheaper to purchase than rent in the next ten years, according to a report from REA.

The REA Insights Buy or Rent Report 2021 based the forecast on housing and rental price growth of three per cent per year over the next decade, as well as buyers having a 20 per cent deposit.

The outcomes vary depending on the type of property, according to the report.

For the next ten years, just over half of houses will be cheaper to buy, but almost 75 per cent of apartments will be cheaper to buy.

Buying conditions are particularly favourable outside of New South Wales and Victoria, with more than 80 per cent of houses, and almost all units, estimated to be cheaper to buy than rent.

Renting remains the cheapest option for many however, particularly in Sydney and Melbourne, according to the report.

More than 70 per cent of houses and just under half of units in New South Wales and Victoria are estimated to be cheaper to rent over the next 10 years.

REA Group economist and REA Insights Buy or Rent Report author Paul Ryan said the report findings point to continued strong housing price growth, particularly outside Sydney and Melbourne.

“Price growth has been strong and is likely to remain strong,” he said, “Many regions have hit all-time price records so it’s understandable that many people would be surprised to hear that it’s still more affordable to buy in more places than it is to rent.

“This research shows that much of the increase in demand we have seen in late 2020 and early 2021 has been driven by exceptionally low borrowing costs. The result is that the majority of properties in Australia are cheaper to buy than rent at current prices,” he added.

Ryan said investors are driven by the same comparison between prices and rents, so the finding that so many units, in particular, are cheaper to buy suggests there may be profitable investments currently available.

“On this basis, we expect investor activity in the housing market to increase through 2021,” he concluded.

The number of suburbs where it is cheaper to buy than rent