- Panoramic Resources (PAN) is looking less like a nickel frontrunner after revealing new grades at its once-fought over Savannah Nickel mine

- The WA project, which remains at the centre of a $312 million hostile takeover bid, holds average nickel grades of 1.39 per cent

- First ore from the project remains on track for 2020’s March quarter

- Investors in Panoramic were once offered a share buyout: one share in Independence Group for every 13 shares in Panoramic

- This deal could still be on the table

- Since telling shareholders to take no action, Panoramic has welcomed a number of industry players, including Independence, to conduct due diligence at Savannah in hopes of a new bid

- No new developments have been made in this respect

- Shares in Panoramic Resources are trading 1.37 per cent higher today for 37 cents each

WA producer Panoramic Resources (PAN) has released revised ore figures after revealing last month that its highly sought-after nickel mine was underperforming.

The company’s Savannah mine remains the subject of a takeover row between PAN and Independence Group (IGO) following the project’s expensive and lengthy restart. This coincided with an uptake in nickel pricing — the reason behind the mine’s previous decommissioning to save costs.

Now, the company has released an average update on the mine site, reiterating once again that first ore is targeted for 2020’s March quarter.

Additionally, the company’s revised release of ore grades misses previous marks, with average nickel grades showing 1.39 per cent – a decrease of five per cent.

The grade revision comes after the company’s major shareholder, Zeta Resources, claimed the Savannah mine was undervalued in response to Independence Group’s hostile share buyout — valued at $312 million.

Despite the no-go from Zeta, Panoramic recently welcomed a number of mining companies to conduct due diligence checks on the project. So far, no recent developments have appeared.

Panoramic continues to advise its shareholders to take no action on Independence Group’s original offer of one IGO share for every 13 PAN shares. But this offer could still be on the table, with Independence yet to withdraw the takeover bid.

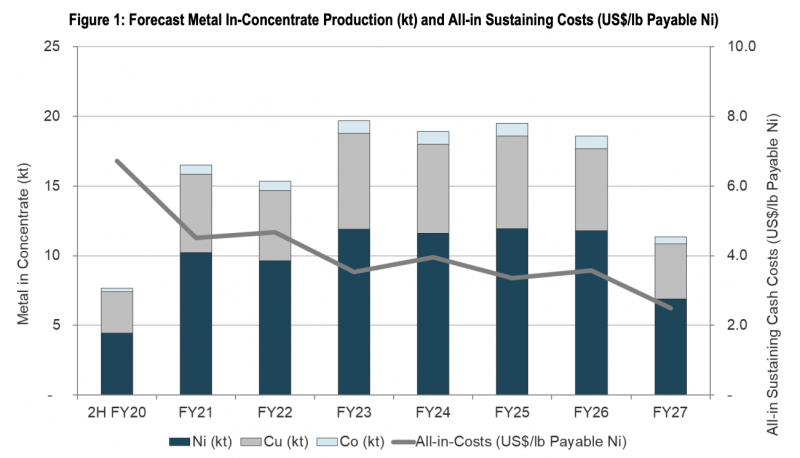

Panoramic Resources also released a forecast of processing costs in the coming financial years at Savannah, which at least shows a decline going into 2027’s business period.

Image sourced from Panoramic Resources

However, this does nothing to alleviate the damp nickel grades, accompanied by 0.66 per cent grade copper and 0.09 per cent grade cobalt on site.

Billion-dollar services company KPMG has also signed on to conduct an independent report on Savannah.

Last month, the company announced prospects of a capital raising. However, Independence Group said it would retract its offer if Panoramic underwent the raise.

Panoramic says it will continue to explore options for short term funding.

“[Panoramic] continues to assess options available to it in relation to its short-term funding requirement which, as previously announced, may include an entitlement offer of new shares to Panoramic shareholders,” the company’s media release read today,

“If an entitlement offer is pursued, the Panoramic board will use its best endeavours to minimise any potential effects of such an offer on control of Panoramic.”

Shares in Panoramic are slightly up today, valued at 37 cents each — an upgrade of 1.37 per cent.