- Pensana Rare Earths (PM8) is looking to create a sustainable mine-to-magnet supply chain for Europe from its Longonjo project in Angola

- The company aims to meet growing demand from the electric vehicle (EV) and offshore wind industries

- Updated processing flowsheets for the Longonjo concentrator show it could be more economical to produce a mixed rare earth sulphate

- This would provide ideal feedstock for Pensana’s proposed U.K. magnet metal manufacturing facility

- The facility would be well supported by initiatives from both the U.K. and E.U. governments

- Pensana Rare Earths is up 9.16 per cent to $1.37

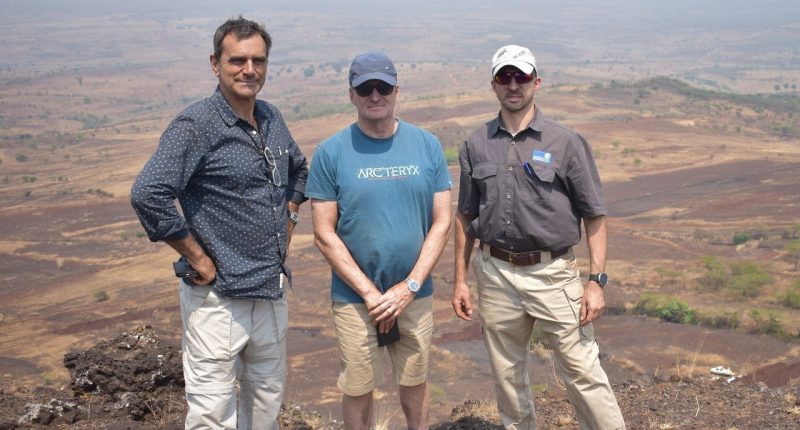

Pensana Rare Earths (PM8) has made further progress in its development of the Longonjo project in Angola.

The company wants to create a sustainable magnet metal supply chain to meet the growing demand from the electric vehicle (EV) and offshore wind industries.

New pathways

Since the project’s pre-feasibility study (PFS), Pensana has begun investigating two new developments in processing and manufacturing.

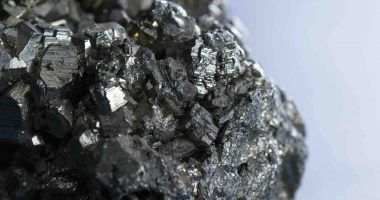

Firstly, the company is investigating the production of a rare earth sulphate which could considerably lower capital and operating costs.

The company successfully produced a rare earth carbonate in October which could be incorporated into the Angolan processing facility’s flowsheet.

Producing a mixed rare earth sulphate instead provides a lower-cost and less energy intensive option for processing at Longonjo.

The rare earth sulphate would also provide the ideal feedstock for a proposed magnet manufacturing facility in the U.K., which is the second new development pathway being incorporated into the bankable feasibility study for Longonjo.

A study evaluating potential sites is nearing conclusion, and so far all signs point to a potential manufacturing facility with competitively low power, labour and reagent costs.

Pensana hopes to take advantage of the U.K. government’s Northern Powerhouse initiative, which aims to bring jobs and infrastructure developments to the north of England as part of the post-pandemic recovery plan.

The government is also facilitating a feasibility study into a fully integrated

supply chain for rare earth permanent magnet production in the U.K., which would give substantial impetus to Pensana’s plans.

The E.U. is also looking to cease its reliance on unsustainably sourced rare earths into European supply chains as it moves to develop the green economy, providing further stimulus for Pensana’s proposed U.K. facility.

Longonjo development

Longonjo Project manager Paradigm is working on supplier and contractor quotes ahead of construction of the initial infrastructure and bulk site services, aimed for the first quarter of 2021.

The mine and concentrator study is well advanced, with capital cost estimates broadly in line with the $130 million estimated for the mining and flotation

operations reported in the project’s PFS from November 2019.

The feasibility study for the U.K. processing plant is also on track for completion in January.

Once those elements are all pinned down, the Longonjo bankable feasibility study will be near-complete.

After that, project approval and financing are the final steps needed to develop one of the world’s largest rare earths deposits and a new, sustainable magnet metal supply chain outside China.

Pensana Rare Earths is up 9.16 per cent to $1.37 at 11:01 am AEDT.