- Peppermint Innovation (PIL) granted a license to operate as an electronic money issuer (EMI) by the Central Bank of the Philippines

- The EMI license allows the company to deliver e-wallet services through its “bizmoto” mobile app allowing any Filipino to use the platform to receive digital money

- Additionally, the EMI license significantly extends the company’s opportunity to reach micro-entrepreneurs and provide digital payments for their businesses

- The company will soon start work on a pilot program with a local community to facilitate financial inclusion by encouraging members to become bizmoto users so they can immediately access digital and mobile payments

- PIL shares are up 17.7 per cent on the market this morning and trading at two cents per share

Peppermint Innovation (PIL) has been granted a license to operate as an electronic money issuer (EMI) by the Central Bank of the Philippines.

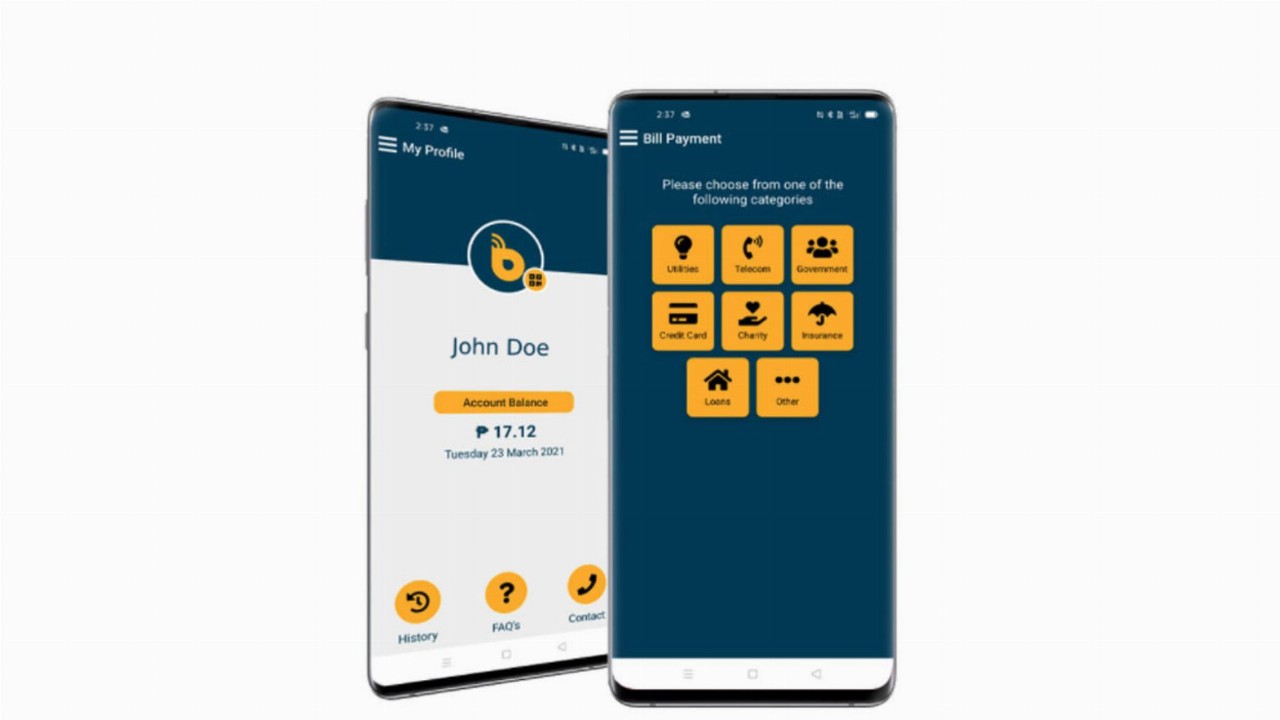

The EMI license authorises the company to deliver e-wallet services through its “bizmoto” mobile app allowing any Filipino to use the platform to receive digital money and access digital services in the Philippines.

Additionally, the EMI license significantly extends the company’s opportunity to reach micro-entrepreneurs and provide digital payments for their businesses who also can apply for bizmoPay loans and future bizmoto platform products and services.

Managing Director and CEO Chris Kain said that the EMI license is one of the company’s objectives which “affirms the company’s … three-phase business strategy”.

“Clearly, the digital revolution is with us and the bizmoto platform can now facilitate any e-money transaction and service open-loop e-wallet accounts, providing Filipinos with a convenient and secure way to receive digital money and services.”

Peppermint aims to connect marginalised Filipinos such as farmers, fishermen and micro-small-medium entrepreneurs, as well as people living on day-to-day pay cheques so they can safely and more quickly receive their salaries, pension, social security benefits and other government financial assistance monies.

“Every Filipino has the opportunity to access a wide range of goods and services from the bizmoto platform, as well as apply for a bizmoPay loan, which gets paid directly to their bizmoto e-wallet to enable seamless transactions across the bizmoto ecosystem,” Mr Kain said.

“Peppermint is committed to digital financial inclusion by, providing digital access to services that benefit the unserved and underserved population and contribute to the continued increase of digital money adoption throughout the Philippines.”

The company will soon start work on a pilot program with a local community to facilitate financial inclusion by encouraging members to become bizmoto users so they can immediately access digital and mobile payments as an alternative to cash transactions within their community.

PIL shares were up 17.7 per cent on the market this morning and trading at two cents per share at 10:41 am AEST.