- Perseus Mining (PRU) has updated its life of mine plan for the Edikan Gold Mine in Ghana, West Africa.

- The total estimated gold output over the life of the mine is 1,307,000 ounces; 95 per cent higher than the previous estimate.

- The underground mine at the facility will run for at least six more years, with an average output of 212 ounces per annum

- Extraction costs for the life of the mine are now approximately A$1.3 billion, down five per cent on previous estimates

- Shares in Perseus are down 5.45 per cent, trading for 95.5 cents each

Perseus Mining (PRU) has updated its life of mine plan for the Edikan Gold Mine in Ghana, West Africa.

The new gold output estimate is 95 per cent high than the previous life of mine plan, with a lower production cost per ounce.

Last week, Perseus announced it would ground all of its workforce’s international travel in a bid to curb the effects of the COVID-19 pandemic in West Africa.

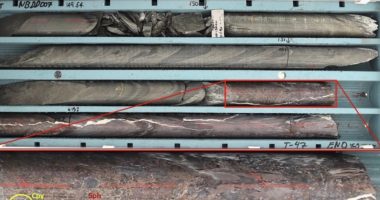

In February this year, the company updated its indicated mineral resource at the site.

The new estimate covers some 83.3 million tonnes of resource, grading at 1.01 g/t gold, containing some 2699 thousand ounces of gold.

“Perseus has identified that as the slightly higher gold price of US$1,300 per ounce and lower cost base than previously assumed, two of its open pits, namely the AFG and Fetish pits, can be significantly increased in size and provide the cash margin consistent with our overall strategy of cash generation,” said Perseus CEO Jeff Quartermaine.

Improved mineralisation mapping, coupled with changing market conditions, has made it economically viable for Perseus to extract more from the Ghana mine than previously thought.

The lowered cost of production is down to the company’s revised mining strategy, implemented in January 2019.

Perseus has moved to a single mining contractor, which means that costs, recoveries and mill throughput rates have all dropped.

The historically strong gold price has meant revenue growth, however, has largely stayed put.

The current net forecast for the mine shows an after-tax cash flow of approximately A$576 million.

The company has also added the Esuajah South deposit to the life of mine plan for the first time.

The underground mine will now proceed after a feasibility study was conducted on the site.

The risks associated with mining the underground deposit have also been reduced, thanks in part to higher than anticipated gold prices.

Shares in Perseus are down 5.45 per cent, trading for 95.5 cents each at 11:48 am AEDT.