- Piedmont Lithium (PLL) completes a Bankable Feasibility Study (BFS) for its proposed Carolina Lithium Project in North Carolina, United States

- The company found its wholly-owned Carolina Lithium subsidiary “could be one of the world’s largest and lowest-cost producers of lithium hydroxide”

- The company is expecting a 3.5 year payback period with steady-state earnings before interest, taxes, depreciation and amortization of $459 million for the first 10 years

- The BFS outcome shows a total initial capital cost of $988 million, a final investment decision on the project is expected early next year

- Piedmont Lithium shares are down 2.52 per cent to 77.5 cents

Piedmont Lithium (PLL) has completed a Bankable Feasibility Study (BFS) for its proposed Carolina Lithium Project in North Carolina, United States

The North Carolina-based integrated lithium business found its wholly-owned Carolina Lithium subsidiary “could be one of the world’s largest and lowest-cost producers of lithium hydroxide”.

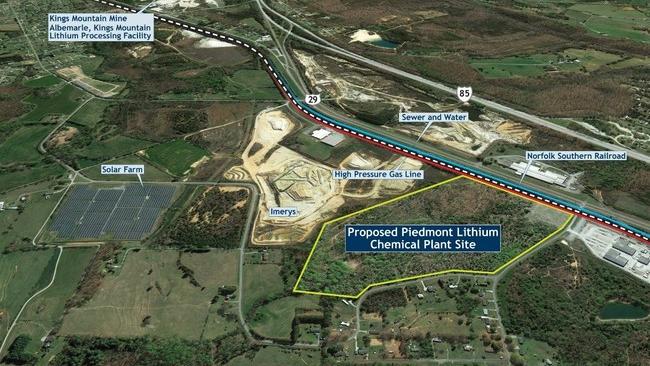

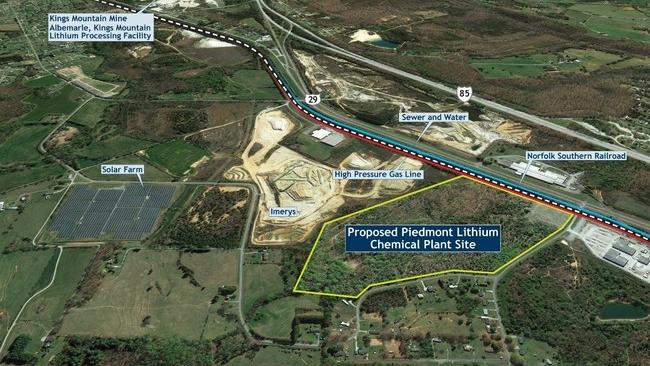

The proposed project would be located in Gaston County, North Carolina, which is also home to the state’s largest city, Charlotte.

Piedmont said the location is ideal, with “exceptional infrastructure, a deep local talent pool, low-cost energy, and proximity to local markets for the monetization of by-product industrial minerals”.

Summary results show the company is expecting a 3.5 year payback period with steady-state earnings before interest, taxes, depreciation and amortization of $459 million for the first 10 years.

For the first ten years, steady-state lithium hydroxide cash costs of US$3657 (A$5141) per tonne are predicted, with an all-in sustaining cost of US$4377 (A$6153) per tonne.

BFS indicates results of net present value (after tax) of $2 billion and post-tax internal return of rate of 27 per cent. The BFS outcome shows a total initial capital cost of $988 million.

According to the company’s research, Carolina Lithium will be more sustainable than existing lithium hydroxide manufacturers in China and South America.

Piedmont envisions a single, integrated site, including quarrying, spodumene concentration, byproducts processing, and spodumene conversion to lithium hydroxide.

The study estimates that once fully functional, the company would be capable of producing 30,000 tonnes of lithium hydroxide per year.

“We will soon commence detailed engineering for the Project with a view to a final investment decision in 2022,” President and CEO Keith Phillips said.

“We are actively engaged in project financing discussions, including possible debt finance via the U.S. Department of Energy’s Advanced Technology Vehicle Manufacturing loan program, and potential strategic equity investments via the partnering process being coordinated by our financial advisors.”

Piedmont Lithium shares are down 2.52 per cent to 77.5 cents at 11:55am AEDT.