- While rental affordability has improved slightly across Australia, home affordability continues to deteriorate for the majority of people

- The latest report by the Real Estate Institute of Australia (REIA) has found rental affordability improved by 0.3 percentage points over the June quarter

- REA president Adrian Kelly says the proportion of income required to rent across the nation has decreased to 22.8 per cent

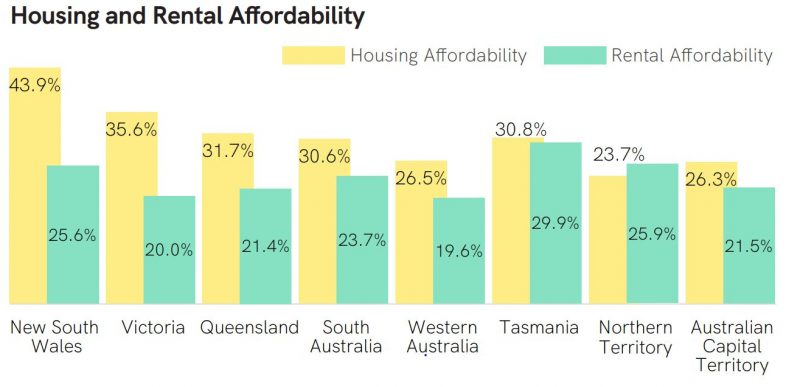

- Housing affordability improved in Tasmania and the Northern Territory but declined in all other states and the Australian Capital Territory

Rental affordability has improved marginally across Australia while housing affordability continues to crumble for most.

The latest quarterly Housing Affordability report by the Real Estate Institute of Australia (REIA) found rental affordability improved by 0.3 percentage points over the June quarter.

REA president Adrian Kelly said the proportion of gross income required to rent across the nation had decreased to 22.8 per cent, with affordability improving in New South Wales, Victoria, Queensland and South Australia while stabilising in Tasmania and the Australia Capital Territory.

“Western Australia remained the most affordable place to rent with median income to rent ratio sitting at 19 per cent while Tasmania was the least affordable with 29.9 per cent of median income required to meet rental commitments,” Mr Kelly said.

Mr Kelly said despite talk of rising rent costs, rental affordability remained by and large constant, a fact that should be reflected in State and Federal housing policy settings.

According to Domain, rents rose 1.2 per cent over the June quarter and 5.9 per cent over the year across the country. However, this is thanks in part to Melbourne and Sydney underperformance.

Perth rentals have risen the most across the country over the year (to 21.6 per cent of median income), followed by Darwin (20.9 per cent) and Brisbane (12.5 per cent).

“Housing affordability improved over the June quarter in Tasmania and the Northern Territory but declined in all other states and the Australian Capital Territory,” he said.

However, increasing unaffordability is still an issue for many first home buyers, with Australian Bureau of Statistics figures showing the number of first home buyers fell 6.8 per cent in July, with the level of commitments falling by 20 per cent in 2021.

Mr Kelly noted that the numbers are still 20 per cent higher than the previous year, but said the removal of HomeBuilder would likely lead to further reductions.

Mr Kelly said with the sustained low interest rate environment, there are still opportunities where it is cheaper to rent than buy.

“As we enter spring selling season, half of Australians are living under lockdown conditions and Australia has only just narrowly missed a technical recession,” he said.