Medical imaging is revolutionising the way we think about health. Ever-evolving technology continues to agitate key players in the space, pushing them to deliver new tests that detect problems faster and more accurately than ever before.

But if this is such a crucial field, why haven’t we heard more about it?

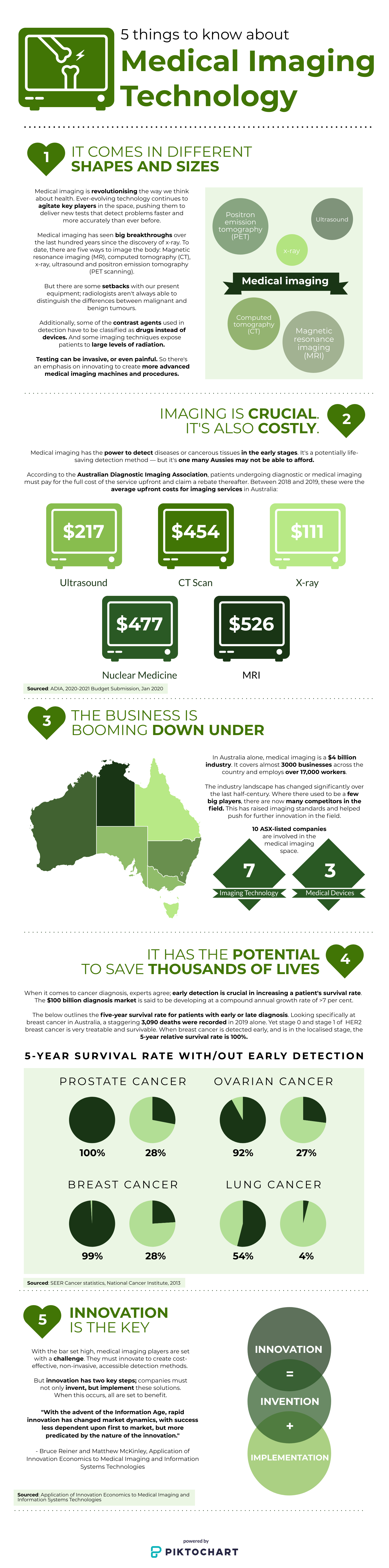

Currently, there’s pain in the pricing. Medical imaging equipment can be expensive for hospitals to install and maintain. Moreover, radiology exams may not be covered by health insurance policies or subsidised by the government — leaving patients out of pocket or unable to afford crucial testing.

On top of that, current imaging technology isn’t always diagnostic; it may not be able to tell if a cancer is malignant or benign and is often invasive, or even painful.

So as healthcare expenditure continues to rise, radiologists face a challenge. They’ll need to work with technology to create cost-effective, efficient and less invasive medical imaging strategies.

In doing so, companies can ensure life-saving testing is more widely accessible. But even more importantly, the growing efficacy of imaging technology will change the way we detect and treat diseases like cancer and arthritis.

Consequently, there’s great value to be had in the medical imaging space — and some of our ASX-listed biotechs are more than ready to shake up the field.

An emerging technology

Over the last few decades, there’s been something of a space race in the medical imaging industry. Companies compete to be the best and brightest in radiology, trying to develop the fastest machine with the highest imaging technology. But nowadays, the bar is even higher.

Karim Boussebaa, senior vice president of Computed Tomography (CT) and Advanced Molecular Imaging (AMI) for Philips, says there’s an emphasis on uncovering advanced imaging strategies.

“Not only are we interested in diagnosing the right disease in our patient but it’s also important that we do it in the most effective and the most efficient way,” Karim explained.

Experts say another catalyst to this competition is rising healthcare costs. In the U.S. alone, health-related expenditure accounted for between six and 15 per cent of the Gross National Product (GNP) in 2012. Moreover, between three and five per cent of this was spent on medical imaging.

“As people are looking to purchase new pieces of equipment it is no longer just about the latest and greatest, but it is going to be more focused,” said Samir Patel, a program director to Radiology, Inc.

The market for medical imaging has also expanded in the last half-century – where there used to be three of four big names in the field, there are now many more looking for a slice in the pie. As a result, fresh faces have brought new standards and are pushing companies to innovate like never before.

The key imaging players

Fortunately, many homegrown biotech companies are actively exploring the medical imaging space.

In fact, there are seven ASX-listed players working in the imaging technology field, such as Imagion Biosystems (ASX:IBX), Resonance Health (ASX:RHT) and Compumedics (ASX:CMP). Meanwhile, names like Uscom (ASX:UCM) and Impedimed (ASX:IPD) are developing monitoring and medical devices.

While each of these companies have different targets, they all have some involvement in administering or developing technology to carry out diagnostic imaging, ultrasounds, CT or PET scans and radiology services.

Yet if medical imagers are to better address the all-important diagnostic market, they’ll need to find ways to stand out from the crowd.

The IBX revolution

Cancer treatment today often runs as such: A patient develops an aggressive tumour, a surgeon operates to remove the tumour, and a few cancer cells remain, hidden in the body. Chemotherapy treatment is given, weakening both the patient and cancer cells. But the cancer does not die; it comes back and eventually kills the patient.

Melbourne-based Imagion Biosystems (ASX:IBX) picture a different scenario: Tiny nanoparticles are injected into the affected area, which bind to the tumour cells, allowing the tumour to be detected and treated The healthy cells around the tumour are left unharmed.

This idea could transform the medical diagnostics space, and the company’s FDA approval amplifies its significance. In fact, Imagion’s MagSense technology was granted “Breakthrough Device” designation by the FDA just last year, meaning Imagion can utilise MagSense in human clinical trials in 2020.

According to IBX CEO Bob Proulx, this is an exciting development for investors looking at biotech opportunities.

Making a difference

Unlike imaging devices that precede it, MagSense doesn’t just provide an image. It’s both noninvasive and radiation-free and can detect cancers with greater specificity by picking them up on the cellular level.

It works by injecting tiny magnetic nanoparticles into the body, which attach to the targeted diseased tissue. The patient is then placed under a magnetic sensor to pick up a magnetic signature.

Imagion Biosystems’ focus on diagnostic imaging addresses a $2 billion worldwide market. Adding therapeutic utility would expand the revenue opportunity for the company in the cancer therapy industry — a market reported to be worth as much as $136 billion.

Already, Israeli researchers have picked up on MagSense’s potential for cancer treatment and are using the company’s nanoparticles. These will be used in hyperthermia treatments to kill cancer cells.

In fact, the Imagion Biosystem’s technology is what brought Mike Harsh, company board member, out of retirement. He’d had a long career in nuclear imaging, and calls MagSense “the sixth generation of imaging.”

“To find out there’s another way that we can look at imaging and get a functional image with no radiation and such sensitivity and specificity. That’s what got me excited,” Mike says.

The future is bright

As medical imagers continue to innovate and invent, there’s an increased pressure to rise to the top and offer something new.

“Rather than pushing off machine intelligence as being a threat to their job, instead radiologists should engage it, because it’s something that can really help patients.”

Brdley Erickson, Director of the Radiology Informtics Lab at Mayo Clinic

The companies that succeed will embrace emerging technology. They’ll deliver cost-efficient, targeted solutions to test and treat a whole range of diseases with greater efficacy. The only question remains; who will get there first?