- A little more than 90 per cent of sellers made a profit in the March quarter this year as the housing boom continues to roll on

- March 2021 marked the fourth quarter where regional Australian resales sustained a higher rate of profitability than in the cities

- While there were fewer loss-making resales in both houses and units in Q1, the rate of loss-making sales in the unit sector remained significantly elevated

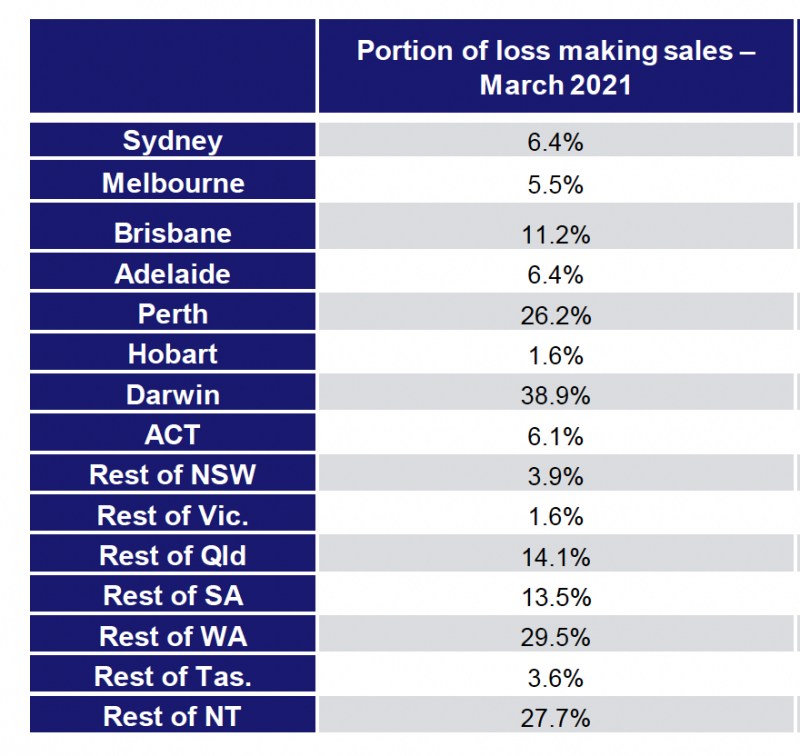

- Resource-based housing markets across WA and the NT still have elevated rates of loss-making sales

A little more than 90 per cent of sellers made a profit in the March quarter this year as the housing boom continues to roll on.

CoreLogic’s Pain and Gain report analysed approximately 98,000 resales across Australia from the March 2021 quarter and found sellers are enjoying high levels of profitable sales.

Regional Australia continued its downward trend of loss-making resales for the sixth consecutive quarter, units were more than twice as likely to sell at a loss as houses, and owner-occupiers had a greater incidence of profitability than investors.

Eliza Owen, head of research Australia at CoreLogic, said increases in the rate of profit for real estate sellers have come off the back of remarkable growth in Australian dwelling values.

“Between the market bottoming out in September 2020, and the end of March 2021, Australian dwelling values have risen 8.2 per cent,” she said.

“The total profit reaped by sellers in Q1 2021 was $30.6 billion nationally. This is actually down from $32.2 billion in the December quarter, but that is likely a reflection of seasonally lower sales activity through the start of the year.”

Ms Owen said March 2021 marked the fourth quarter where regional Australian resales sustained a higher rate of profitability than in the cities.

“90.6 per cent of regional resales saw a profit through the quarter, compared with 90.0 per cent of capital city sales,” she said.

“However, the gap in the rate of profit seen between capital cities and regions has narrowed, and is likely to keep narrowing given capital city growth rates have been closer to regional value growth rates through April and May.”

While there were fewer loss-making resales in both houses and units in Q1, the rate of loss-making sales in the unit sector remained significantly elevated.

“In the three months to March, 16.8% of units sold for a loss across Australia; almost two and a half times the rate of loss making house sales (6.8 per cent),” Ms Owen said.

The research also examined resale performance in lifestyle areas, resource-based housing markets, and the unit market in Melbourne local government area (LGA).

“‘Sea change’ and ‘tree change’ markets have generally seen an uplift in the rate of profit making sales through the March quarter, including an extraordinary 99.5 per cent of Ballarat sales making a profit through the March quarter,” Ms Owen said.

“Resource-based housing markets across WA and the NT still have elevated rates of loss making sales, but they are also seeing the fastest decline in the rate of loss making sales, as increasing mining activity is contributing to a rapid recovery trend in the housing market.

“This particularly true of the WA Outback North SA4 market, which includes the Pilbara region. Loss making sales have gone from 63.6 per cent of all resales in the March 2020 quarter, to 37.0 per cent of resales in the March 2021 quarter.”

Looking ahead, Ms Owen said that with the dwelling market at extraordinary record high values, there are potential headwinds to be cautious of.

“At the national level, these include affordability constraints, eventual mortgage rate rises and the remaining threat of COVID clusters,” she said.

“For some pockets of the market, ongoing international border closures have already led to more subdued price growth, and a decline in rental return. These factors may slow the growth in profitability derived from housing in the coming quarters.”