- While there’s no shortage of mining companies signalling a move towards more sustainable practices, Sovereign Metals (SVM) is one of the few players taking tangible action

- In the business of mining natural rutile — an essential component required for titanium dioxide production — Sovereign holds the key to arguably one of the most significant discoveries in this commodity market to date

- Amid an increase in responsible investing and growing environmental pressures on global miners, Sovereign’s Malawi rutile deposits could prove to be a critical asset in accessing the lucrative commercial opportunities found in greener mining

- A recent study has found Sovereign’s processes of upgrading natural rutile bear striking environmental upside as opposed to its counterpart ilmenite, saving as much as 2.8 tonnes of CO2 per tonne of natural rutile

- What’s more, Sovereign Metals is one of a handful of players operating this market, which is in a near-desperate need of more supply as U.S infrastructure spending reaches unprecedented highs

- Moral or ethical imperatives aside, an appetite for responsible investing and the need for global mining giants to readdress their practices to meet these demands has entered the fore, and SVM’s rutile assets could prove to be a critical asset as this global discourse plays out

- Shares in Sovereign Metals are trading at 61 cents per share

While there’s no shortage of mining companies signalling a move towards more sustainable practices, Sovereign Metals (SVM) is one of the few players taking tangible action.

In the business of mining the critical rutile mineral, Sovereign’s operations represent a return to the practice of excavating a pure resource from the earth with as minimal disturbance to the immediate environment as possible.

An essential component required to make titanium dioxide —a bright white pigment that harbours a plethora of uses in modern society — rutile’s usefulness is highly marketable.

Rutile also has the added benefit of being a commodity in scarcity. What’s more, its myriad uses establish it as more than just a speculative commodity play.

With a clear plan in place for where and how it’s going to mine, Sovereign tables a tactile and attainable production strategy with less strain on the environment.

A greener process

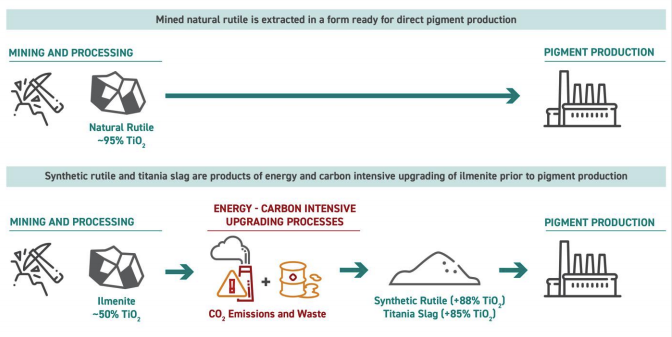

While rutile is not the only ore that can be used to produce titanium oxide, it offers the cleanest and purest form of doing so, with Sovereign distinguishing its methods in particular as a clear point of difference to other competitors in this space.

As the old saying goes, there’s more than one way to skin a cat — similarly, there’s more than one way to produce titanium dioxide. However the environmental output varies greatly depending on the ore used in the first place to create it.

Upgrading rutile to titanium dioxide comes with a far less complicated and environmentally taxing process compared to its counterpart, ilmenite, which is similar in origin and use.

Typically, ilmenite with a purity between 55 per cent and 65 per cent is fed into a rotary kiln to reduce iron oxide content. It’s eventually upgraded to synthetic rutile, which is then required to be washed and transported before it can be made into titanium dioxide.

Source: Shutterstock

Titanium slag is an undesirable consequence of this high-energy and carbon-intensive upgrading process, with large volumes of waste including iron oxide, iron sulphate and other impurities generated in the process.

In the event the ilmenite is not upgraded to synthetic rutile or titania slag, Sovereign estimates it can generate up to 17 tonnes more waste over the course of the process when compared to rutile, which requires 13 times less chlorine for one tonne of pigment.

The results of additional heating needed to run the mills, further emissions and waste have immediate and longer-term effects on the physical environment, as the sheer volume of carbon generated in the process is released into the earth’s atmosphere.

Source: Sovereign Metals

Even then, despite ilmenite undergoing such a process to become synthetic rutile, it seldom matches the quality of titanium dioxide produced from pure rutile.

A recent study by U.K.-based consultancy Minviro found that Sovereign’s natural rutile process could potentially eliminate significant global titanium industry carbon dioxide emissions by displacing and substantially reducing the use of these carbon-intensive upgraded alternatives.

Specifically, it revealed each tonne of natural rutile used could save up to 2.8 tonnes of carbon dioxide equivalent compared to the smelting and chemical upgrading process used for ilmenite.

Ahead of the curve

The ASX-lister has positioned itself as the leading developer in the rutile space by embracing smarter, simpler methodologies.

As companies scramble to meet the ever-increasing pressure to reduce their carbon emissions, they, in turn, look to their existing process and seek resources that can help keep the promises they made.

Sovereign’s return to cleaner mining processes offers a refreshing point of difference in a market plagued by what can often be perceived as tokenistic gestures.

Rio Tinto (RIO), Fortescue Metals (FMG) and BHP (BHP) have all tabled the long-term goals of achieving net-zero emissions — or at least close to that— by 2050. While the exact definition of these promises is set to behold some scrutiny and investigation, it offers a clear intent to take action on their respective carbon footprints.

Specifically, mining giant Rio Tinto is in the business of producing titanium dioxide, but instead uses ilmenite in its process.

“Meanwhile, alumina refining, aluminium smelting and the upgrading of titanium feedstocks are all high temperature, energy-intensive processes … lifting the group’s average carbon intensity.”

Rio Tinto Climate Change Report 2019

When the time comes for the likes of Rio to take even further tangible action in terms of its carbon footprint, Sovereign holds the key to what could be an invaluable asset as demand for rutile and its less environmentally threatening processes become more marketable.

For context, direct use natural rutile currently makes up roughly 26 per cent of the total high-grade titanium feedstock market, with 74 per cent consisting of upgraded alternatives.

Source: Sovereign Metals

What’s more, Sovereign has the advantage of having secured international rutile deposits, demonstrating an understanding of the difficulties faced in mining the commodity on home soils.

The majority of rutile in Australia is located along coastlines, often competing with land used for agriculture, national parks or tourist developments, according to Geoscience Australia.

Sovereign owns one of the most prospective developments taking place in the rutile market today, The Malawi Rutile Province, which touts two confirmed, discrete rutile mineralisation styles and resources that could support long-life, large-scale rutile production.

The ASX-lister has also made solid commitments in its internal governance structure to ensure and integrate sustainability best practices by forming an environmental, social and governance (ESG) committee.

According to Sovereign, this move is set to support its board as it unlocks a new, major and much-needed source of natural rutile.

Foundations for the future

The change of administrations in the U.S. comes with a swathe of broader opportunities connected to an explosion of infrastructure spending, of which Sovereign Metals could become a net beneficiary.

The Democrats have tabled plans to pump US$2 trillion (around A$2.56 trillion) into modernising transport infrastructure such as roadways, railways, bridges and electric vehicle stations as this market expands.

A significant portion of this spend is also set to go towards constructing and upgrading public schools and housing.

All of these upgrades will require mass application of titanium dioxide to use in paints, plastics, paper, titanium metal and welding; all of which can be sourced from rutile.

Sovereign Metals is one of a handful of ASX players operating in a commodity market in a near-desperate need of more supply.

Investors have their own ethical imperatives when it comes to choosing where to put their money. Nevertheless, the commercial opportunities tied to a commodity that could minimise environmental harm in titanium dioxide production are clear.

Rutile is an integral resource in modern society, and as long as that demand continues and companies pivot to greener processes, Sovereign and the rutile play is set to stand true.

Shares in Sovereign Metals are trading at 61 cents per share at the close of market on Tuesday, April 20.