- St George Mining (SGQ) has revealed its intentions to increase its previously announced share purchase plan (SPP) from $1.6 million to $3.6 million

- The company said that the decision follows “very strong interest” from its shareholders

- Eligible shareholders will be able to purchase between $2000 and $20,000 worth of shares at a price of $0.08 each

- Under the terms of the plan, these purchases will not incur brokerage or transaction costs

- St George Mining is currently trading 5.71 per cent lower today, with shares selling for 9.9 cents per share

St George Mining (SGQ) has revealed its intentions to increase its previously announced share purchase plan (SPP) from $1.6 million to $3.6 million.

The original plan was announced on May 11 this year, but after “very strong interest” from the company’s shareholders, the decision was made to increase the size of the plan.

St George noted that such an increase will comply with the maximum number of shares permitted for issuance under the ASX Listing Rules, and that a scale back may be undertaken depending on the volume of applications received.

Under the terms of the share purchase plan, eligible shareholders will be able to purchase between $2000 and $20,000 shares at an offer price of $0.08 each. In total, St George expects to issue approximately 45,000,000 fully-paid ordinary shares.

In addition, these purchases will not be subject to any brokerage or transaction costs.

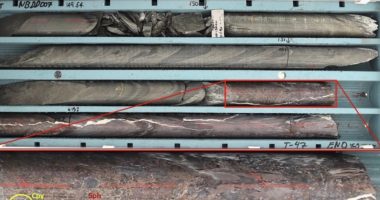

The funds raised will be used to support the company’s various exploration activities, including a drill program at the high-grade nickel-copper sulphide Mt Alexander Project later this year.

John Prineas, Executive Chairman of St George Mining, expressed his appreciation for the continued support.

“We appreciate the outstanding support of existing shareholders for the SPP and are pleased to increase the target amount so that there is a more fair and equitable allocation to shareholders,” John commented.

“The additional funds being raised under the SPP will allow us to prioritise an acceleration of the Mt Alexander drill programme with an additional diamond drill rig to be deployed for testing the new, deeper nickel‐copper sulphide targets,” he said.

The share purchase plan is expected to close at 5:00 pm AWST on Friday, May 29, 2020.

St George Mining is currently trading 5.71 per cent lower today, with shares selling for 9.9 cents per share at 10:41 am AEST.