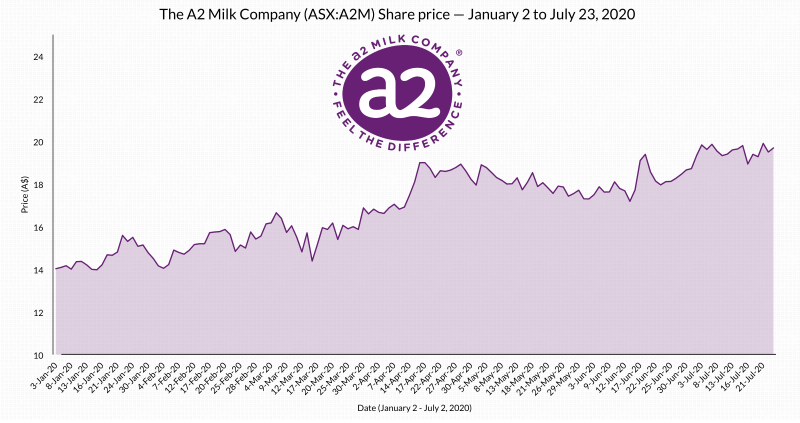

- The a2 Milk Company (A2M) has gone from strength-to-strength since the COVID-19-induced March market crash

- The dairy product company saw sales soar over the March quarter as consumers flocked to stores in a panic-buying frenzy

- As well as slashing costs, a2 Milk said it in April was expecting between $1.7 billion and $1.75 billion in revenue over the 2020 financial year

- The company has remained largely quiet since then, but it seems no news is good news as its share price continues to rise

- Analysts from Wall Street Journal, Citibank, and UBS all have a price target of over $20 per share for a2 Milk

- With the company currently at $19.70 per share, this suggests analysts think a2 Milk is a safe bet amid coronavirus chaos

The a2 Milk Company (A2M) has proven to be one of the few stocks able to benefit from the unique circumstances around the coronavirus pandemic.

The dairy product specialist barely felt the March blow when the pandemic crashed markets around the world.

In mid-March, companies across the globe saw market caps slashed in half in the blink of an eye. a2 Milk, however, didn’t even fall below where it sat at the start of 2020. What’s more, since the March slump, a2 Milk shares have gained over 37 per cent at hit their all-time high close of $19.90 just two days ago.

Interestingly, a2 Milk has been relatively quiet since the early days of the pandemic, with its last business update provided in April.

Why the strong performance?

It seems a2 Milk performed similarly to supermarket stocks when consumers began stockpiling goods in a panic-buying frenzy at the start of the pandemic.

a2 Milk’s infant formula range was among the products being bought out in bulk, and the increased consumer activity largely protected the company from the market crash in March.

Then on April 22, a2 Milk revealed strong revenue growth and lowered costs in the face of the coronavirus crisis.

Revenue over the March quarter came in higher than expected, with a2 Milk citing the panic-buying as a key factor in the increased sales. The company said online and reseller sales saw the most traffic.

In light of this, the company said it was expecting annual revenue for the 2020 financial year to be between $1.7 and $1.75 billion, reflecting an earnings before interest, tax, depreciation, and amortisation (EBITDA) margin of between 31 and 32 per cent.

Combined with the increased sales, a2 Milk took on some cost-cutting measures to maintain cash in the face of the pandemic uncertainty.

Since then, it seems to be a case no “no news is good news” for a2 Milk, with limited operational newsflow coming out of the company.

In April, the company said it was unsure how long the increased demand would last. Given there have been no guidance downgrades or corrections since then, it seems things have been tracking along largely as expected.

Of course, it didn’t hurt that a2 Milk was added to the S&P ASX 50 list as part of the index’s June quarterly rebalance.

What’s ahead?

With the Victorian government recently introducing fresh lockdown restrictions to fight a new wave of coronavirus infections in the state, the only thing clear about the future of the pandemic is that it’s not over yet.

While it’s likely the extreme panic-buying of March is over, at least for now, a2 Milk shares are still performing better than ever — and it seems the experts believe this will continue.

Of 15 analysts at Wall Street Journal, five voted a2 Milk a “buy” and two said it was an “overweight” stock, meaning it’s expected to perform well in the future. Four analysts said a2 Milk is a “hold”, while one said it’s underweight and two rated it a “sell”.

The analysts priced a2 Milk at an average target of $20.09.

In June, UBS Evidence Lab analysts gave a2 Milk a buy rating and a 12-month price target of NZ$22 per share (roughly A$20.50 per share).

Two weeks ago, analysts from Citibank gave a2 Milk a similarly bullish outlook, highlighting a NZ$21.50 (around A$20.08) price target for the company.

While uncertainty continues to cloud the COVID-19 crisis, analysts are suggesting that a2 Milk is a safe bet amid surrounding market chaos.