- Despite a decline in the number of foreign residential real estate transactions, the value has risen to a three-year high, according to FIRB

- The United States leads the international buyer demand with $13 billion worth of investment in 2019-20, followed by Singapore ($9.5 billion) and mainland China ($7.1 billion)

- China’s investment has bottomed out in recent years, the $7.1 billion invested in real estate in 2019-20 is just a drop in the bucket compared to the $31.9 billion invested in 2015-16

- Victoria is still the darling for foreign investment in the real estate market, with the state receiving the lion’s share with 3000 residential real estate investment proposals

- Just 746 residential real estate cases were identified for investigation, 620 were completed with 259 properties found to be in breach of Australian foreign investment rules

Despite a decline in the number of foreign residential real estate transactions, the value has risen to a three-year high, according to the Foreign Investment Review Board (FIRB) 2019-20 Annual Report.

The United States leads the international buyer demand with $13 billion worth of investment in 2019-20, followed by Singapore ($9.5 billion) and mainland China ($7.1 billion) with Germany ($3.7 billion) and Canada ($3.3 billion) rounding out the top five.

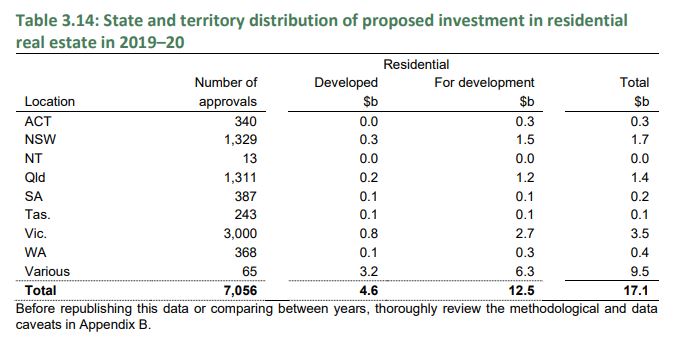

Foreign real estate investment increased to $17.1 billion in the 12 months to June last year from $14.8 billion a year earlier, but it is still less than half of what it was in the 2016-17 fiscal year when it reached $30 billion.

China’s investment has bottomed out in recent years, the $7.1 billion invested in real estate in 2019-20 is just a drop in the bucket compared to the $31.9 billion invested in 2015-16. That significant amount helped push the value of real estate investment for the financial year in 2015-16 to $122 billion.

The number of foreign investment approvals for existing dwellings and new dwellings have both fallen from the previous year and from their respective peaks in 2015-16, to 1105 and 3899 respectively.

However, the values for both categories have risen, with existing dwelling values rising to $4.5 billion in 2019-20 from $1.7 billion in 2018-19 while new dwelling values slightly rose to $4.9 billion from $4.8 billion.

Vacant land approvals have also fallen, from 1784 to 1578 for a value of $700 million, unchanged from the last annual budget.

Victoria is still the darling for foreign investment in the real estate market, with the state receiving the lion’s share with 3000 residential real estate investment proposals, Sydney came in second with 1329 proposals with Queensland just behind with 1311 proposals.

The commercial real estate sector witnessed a decline in both the number and values of approvals in 2019-20, with 440 approvals valued at $38.8 billion, down from 487 approvals valued at $73 billion in 2018-19.

When the federal government established a vacancy charge on foreign-owned residences in the 2018-19 fiscal year, the number of foreign-owned houses left idle for more than 183 days of the year increased to 231 from 118 in the previous year.

In response to the COVID-19 pandemic, the foreign investment policy settings changed, reducing all screening thresholds to $0

Previous thresholds were as high as $1.2 billion for countries Australia has a Free Trade Agreement with.

Of the 715 applications that were withdrawn prior to a decision being made, around 76 per cent related to residential real estate applications.

During the fiscal year, just 746 residential real estate cases were identified for investigation, down from 1220 cases the previous financial year. Of these 620 were completed with 259 properties found to be in breach of Australian foreign investment rules, down from 600.

There were 70 divestment orders issued in the 2019-20 fiscal year, down from 83 in the previous year, with 176 fines issued, totalling $1.3 million.