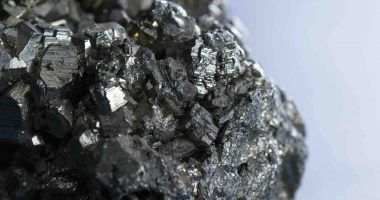

- Nickel producer Western Areas (WSA) has recharged its bank facilities after securing a $75 million credit approval from one of Australia’s biggest banks, Commonwealth Bank of Australia (CBA)

- Should the revolving credit facility go ahead, it is set to grant the explorer further financial freedoms to develop its Odysseus mine in Western Australia

- WSA says the facility builds on its significant cash reserves, strong balance sheet and cashflows from existing operations

- Statutory accounts from August 2020 report the company has roughly $144.8 million sitting in cash

- Repayment for the loan is expected via lump sums or, bullet at maturity, however, full details should be expected once the full facility agreement is completed in early 2021

- Investors have responded positively to the news, with WSA shares trading up 2.22 per cent at $2.54 each

Nickel producer Western Areas (WSA) has recharged its bank facilities after securing a $75 million credit arrangement from a major Australian bank.

Should the revolving credit facility with Commonwealth Bank of Australia (CBA) go ahead, it is set to grant the explorer further financial freedoms to develop its Odysseus mine in West Australia.

WSA says the facility builds on its significant cash reserves, strong balance sheet and cashflows from existing operations.

There is also potential to increase the facility to $100 million should CBA approve.

Statutory accounts from August 2020 report the company has roughly $144.8 million sitting in cash.

Repayment for the loan is expected via lump sums or, bullet at maturity, however, full details should be expected once the full facility agreement is completed in early 2021.

Western Areas Managing Director, Dan Lougher, said the refresh provides comfort that working capital is in hand.

“Western Areas welcomes CBA as our new primary debt provider and looks forward to completing the facility agreements early in calendar year 2021,” he commented.

Investors have responded positively to the news, with WSA shares trading up 2.22 per cent at $2.54 each at 10:17 AEDT.