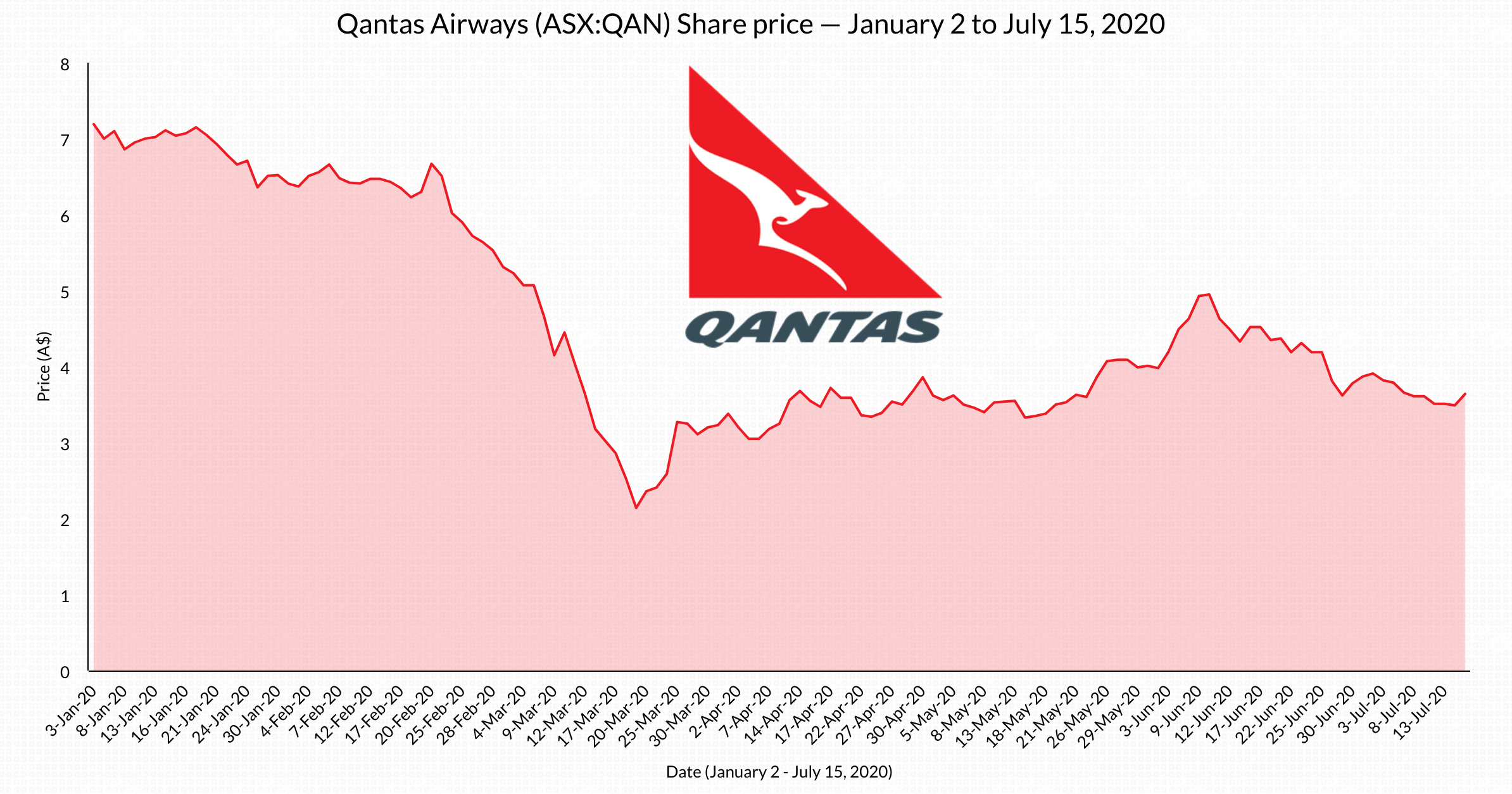

After surviving the initial nosedive brought on by the COVID-19 pandemic, Qantas (QAN) shares have staged a turbulent recovery.

The airline kicked 2020 off with shares priced at $7 a pop, but lost two-thirds of its value when stock bottomed out at $2.14 on March 19. Less than three months later, however, Qantas shares closed at $4.95 each, before retreating back to around $3.60 a month later.

If the Qantas share price is struggling to settle, does this mean the company is a flight risk for investors chasing safe bets?

The general consensus seems to be that while the flying kangaroo is set for a rocky journey until the COVID-19 pandemic settles, the airline is well-prepared to survive a period of hibernation and come back in full swing.

Border control

It seems the biggest controller of Qantas’ share price in the short term is the state of local borders.

The coronavirus takes no break and, in return, state leaders are taking no risks. Western Australia’s Premier, Mark McGowan, for example, has been facing increasing pressure to reopen WA state borders as unemployment across the country rises. But the Premier has stayed firm in his decision to leave borders closed, and now clusters of outbreaks in New South Wales linked to Melbourne travellers might be leaving other state Premiers wishing they’d done the same.

Of course, while closed borders are good for the country’s COVID count, they’re a crucial source of missing income for Qantas. In FY19, Qantas flew 22 million passengers across the country on 4300 flights. And along with Jetstar, Australia’s biggest airline serviced 60 per cent of the country’s domestic flight market.

On the other hand, investors and travellers alike have accepted that international travel is likely off the cards for quite some time, but with more local borders closing than opening over the past four weeks, there is fresh doubt cast upon how well Qantas can weather the storm.

This, at least in part, explains the share price fall in recent weeks. As a repeat of what happened with the first wave of infections, the fresh outbreak in Victoria has struck a heavier blow to Qantas and other travel and airline stocks than the rest of the market.

New cash, steady savings

Along with the Federal Government’s $715 million airline rescue package, Qantas management has taken some drastic steps to ensure it can survive the pandemic.

CEO Alan Joyce was one of the first airline leaders to slash his own paycheck to protect his company. At a nifty $459,000 earned per week, Alan’s decision in March to take no more salary payments for the rest of the year will help the business save some major costs.

Since then, the company took on more debt to ensure it had enough liquidity to last until December 2021, even while burning through $40 million a week.

This is not to mention the massive $1.9 billion capital raise and slashing of 6000 more jobs announced in late-June.

With the company recently grounding around 100 aircraft for up to 12 months, effectively cancelling all international flights until at least March 2021, and permanently retiring its six Boeing 747s, Qantas’ cost-saving has gone into hyperdrive while economic and travel uncertainty continues.

Importantly, Alan Joyce reminded investors in June that the domestic market accounts for around two-thirds of company earnings. Given this segment is likely to recover far quicker than the international market, he said he was optimistic about the outlook the for business.

What are the experts saying?

Though the immediate effects of such intense cost-saving and capital-raising are bleak, the long-term outlook for Qantas remains positive.

Analysts expect that as soon as borders reopen, the airline’s share price will begin to climb again — with healthy bumps along the way from each stage of eased local and global restrictions.

As it stands, out of nine Wall Street Journal analysts, seven have rated Qantas a “buy” with an average price target of $4.56. One analyst rates Qantas a “hold” and one a “sell.” Three months ago, the figures from 10 analysts were slightly different: five buys, four holds, and one sell.

Analysts from major investment banks are similarly bullish for Qantas.

While investment banking giant UBS downgraded its price target for Qantas from $5.50 per share to $4.60 per share following the recent capital raise, this is still a healthy premium to the company’s current share price of $3.64.

Citibank recently gave Qantas the same price target, but this was an upgrade from its initial $3.70 per share target.

Morgan Stanley expects even more from the airline, with the investment bank giving Qantas a $5.30 price target, expecting a return to “normal” profitability by 2022.

As such, the current turbulence in the Qantas share price is likely to be just an uncomfortable leg of a long journey to recovery. While it’s true that nobody knows precisely where this pandemic is heading and things could turn a lot worse before they get better, the general outlook for the future of Qantas is relatively optimistic.