- Whitebark Energy’s (WBE) joint venture partner, Point Loma Resources, wants to sell its working interest in the Wizard Lake Oil project for around $3.2 million

- Point Loma will sell approximately 40 per cent of its working interest in the Canadian project

- The sale will go to Point Loma’s debenture holders and secured creditor in exchange to have its debts wiped off the books

- However, in relation to the farm-out and option agreement, Whitebark has the right of first refusal

- This means Whitebark has the option to buy more of the oil project, the company has 30 days to decide

- Whitebark Energy is down 20 per cent on market close, trading for 0.4 cents per share

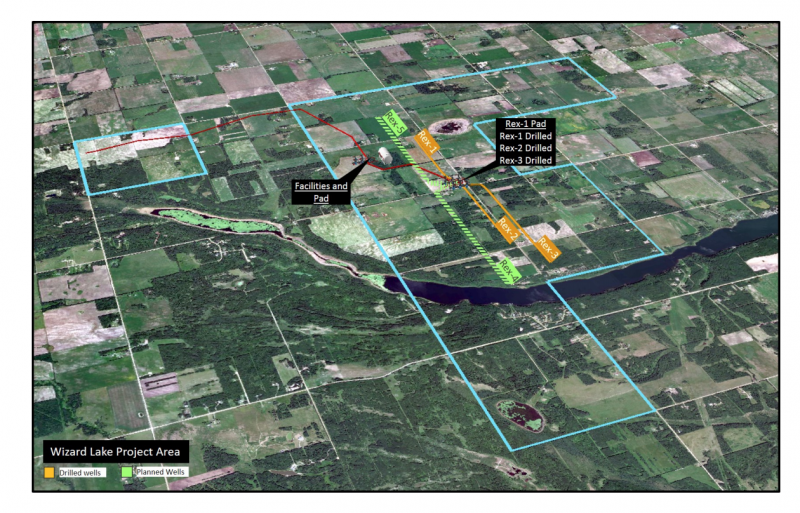

Whitebark Energy’s (WBE) joint venture partner, Point Loma Resources, will sell its working interest in the Wizard Lake Oil project for C$2.9 million (around $3.2 million).

Point Loma will sell 97.5 per cent of its approximately 40 per cent working interest in the Canadian project.

The sale will go to Point Loma’s debenture holders and secured creditor in exchange to have its debts wiped off the books.

However, in relation to the farm-out and option agreement, Whitebark has the right of first refusal.

A right of first refusal is a contract right that gives the holder a right to enter the business transaction with a person or company before anyone else can. This means Whitebark has the option to purchase the working interest.

Whitebark has 30 days to decide if it wants more of Wizard Lake.

“The company will consider the exercise of its right of first refusal over the period,” Whitebark told the market.

Recently, the company announced it has taken steps to maximise returns from Wizard Lake, due to the price drop in oil.

Production from the project will be contained to between 550-650 barrels of oil per day (bopd) and 3-4 million cubic feet of gas per day, equating to 1050-1315 barrels of oil equivalent per day (boepd).

Whitebark Energy is down 20 per cent on market close, trading for 0.4 cents per share.