- Data aggregator of major companies Kyckr gained over 138 per cent this week on the ASX

- Yesterday, the company rocketed over 90 per cent after heavy tech hitter David White became a major shareholder at 19.6 per cent

- Kyckr offers companies data insights into their clients, and has used this watchdog power to stop money laundering

- Richard White’s investment yesterday was part of a $5.2 million capital raising plan from Kyckr

Company data aggregator Kyckr has seen its share price rocket more than 138 per cent this week.

Yesterday alone saw the company’s share price on the ASX jump over 90 per cent after tech entrepreneur David White became a major shareholder.

Today, the company’s shares have shot up again by 25 per cent after releasing an investor presentation.

On Monday this week, the company’s shares opened at 10 cents per share. Today they’re 25 cents each in a $45.86 million market cap.

How it happened and what Kyckr does

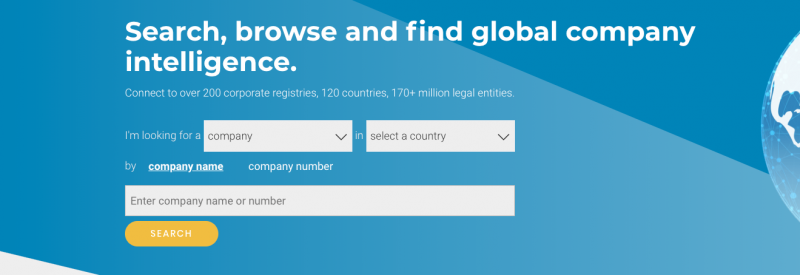

According to the company itself, Kyckr is an aggregator for global company intelligence. A watchdog of data.

Kyckr claims to have data access on over 200 official registries, 120 countries and 170 million legal entities.

Richard White’s investment into the company yesterday helped secure a successful placement for Kyckr that amounted to $5.2 million over roughly 78.35 million shares at 6.6 cents apiece.

Richard White’s holding in Kyckr stands tall at 19.6 per cent.

Richard spoke on his buy-in to the company yesterday.

“I can see in Kyckr, a product, business and opportunity set that can be leveraged and accelerated to major advantage, and I am grateful to be able to help the company accelerate its growth ambitions both in the placement and, time permitting, occasional advice to the team,” Richard said.

In the company’s investor presentation today, Kyckr vowed to double its growth by 2023.

Not only does Kyckr help companies know their clients, it’s also been used in anti-money laundering initiatives as well.

Today, Kyckr is partnered with Dell Services EMEA, Bank of Ireland, and GMO Globalsign.