- Woodside Petroleum (WPL) has slashed expenditure and put major projects on hold while the world reels from COVID-19 and the oil price crash

- Woodside has had to rethink its broader strategies while the effects of a global pandemic and oil price war shake the foundations of the industry

- 2020 production guidance remains unchanged, sitting between 97-103 million barrels of oil equivalent, though a revenue shortfall is expected

- The company has hedged over 13 million barrels through to December 2020, and purchased 7.9 million barrels of call options in an each-way bet on prices

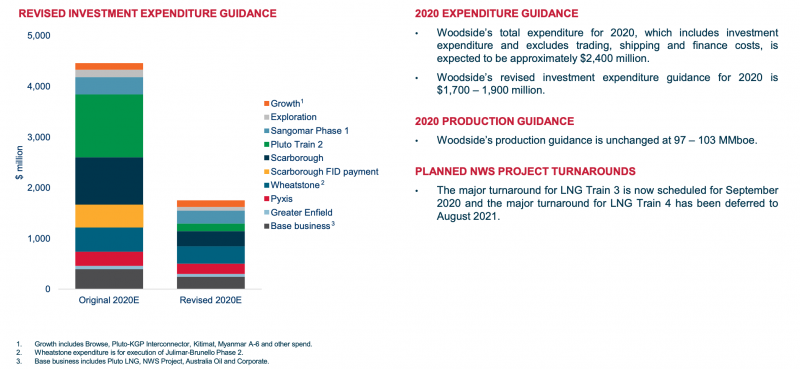

- Expenditures have been slashed by 50 per cent as the major means of balancing the books

- Major developments have been deferred until markets rebound

- Woodside Petroleum is down 0.38 per cent today, with shares priced at $21.14 each

Woodside Petroleum (WPL) has slashed expenditure and put major projects on hold while the world reels from COVID-19 and the oil price crash.

Production

Woodside has had to rethink its broader strategies on all fronts while the effects of a global pandemic and oil price war shake the foundations of the industry. Production was up year-on-year for the March quarter, but fell significantly compared to the December 2019 quarter, largely due to cyclone activity.

The company had some serious challenges in the first three months of 2020, including the devastation of Cyclone Damien in WA’s northwest. Despite the cyclone’s impacts on Woodside’s production facilities on the Burrup Peninsula, normal operations were restored within a matter of days. Total production for the quarter was up by 12 per cent compared to the corresponding period last year, which was also cyclone-affected.

With pandemic quarantine and travel restrictions forcing Woodside to change rostering and operational protocols, the company has devised ways to keep everything ticking at more or less full capacity. 2020 production guidance remains unchanged, sitting between 97-103 million barrels of oil equivalent (MMboe).

Revenues

It doesn’t take a genius to realise a price crash will affect revenues. Sales volumes were actually higher for oil and produced LNG than the prior corresponding quarter, but the results don’t tally at the bottom line. Oil sales increased by 59 per cent, revenues only rose 24 per cent. For produced LNG, a three per cent sales increase yielded a 26 per cent fall in revenues.

When compared to the last three months of 2019, the results are even more stark. Produced LNG sales fell six per cent for a 14 per cent drop in revenue. Oil sales fell by about a quarter, while revenues were almost halved.

While agreements are now in place between OPEC and Russia to reduce production, Woodside is focused more on cost-cutting and hedging to make sure it stays afloat through the turbulent period. The company has hedged 13.35 million barrels of oil through to December 2020 at an average price of US$33.03 per barrel in case prices don’t recover.

Woodside has also purchased 7.9 million barrels of call options, which provide an offset option for the company’s hedged position in the second half of the year if monthly prices average above the strike price of US$40 per barrel. While the company is literally hedging its bets on market conditions, revenues alone won’t be enough to keep a square balance sheet. The company is instead focused on cost-cutting to firm up its bottom line.

Expenditure

Imagine a huge pile of cash, then cut it in half. Woodside’s investment expenditures for 2020 have been revised even more savagely than that.

Efficiencies have been introduced across the business to reduce costs, but it’s the slashed budgets on new projects and exploration which have brought the greatest savings.

Woodside CEO Peter Coleman says good progress has been made across the company’s projects through the year to date, but some milestones have had to be deferred to reduce expenditure.

“We made solid progress on our near-term growth projects during the quarter, taking final investment decision (FID) on Sangomar Field Development Phase 1 in Senegal and the North West Shelf’s Greater Western Flank Phase 3, as well as making significant execution progress on Pyxis Hub and Julimar-Brunello Phase 2,” he said.

“We’ve had to make tough but prudent decisions to ensure the financial integrity of our business, and these mean our spending in 2020 will be reduced by 50 per cent and a targeted FID on our Scarborough and Pluto Train 2 developments has been deferred from this year to next.”

Woodside CEO Peter Coleman

“Still, we are progressing with commercial agreements and regulatory approvals for these world-class developments to ensure they are ready for FID when investment conditions improve,” he added.

All in all, Woodside has cut 2020 expenditures by about half, with yearly guidance now adjusted down from over $4 billion to between $1.7 and $1.9 billion.

Outlook

Woodside appears to be in a relatively stable position going forward, even with some tough economic times ahead. The cost-cutting should keep the balance sheet looking respectable despite fallen revenues, and its hedge position and call options should stabilise some of the turbulence expected in global markets.

While major project works have had to be deferred, it is likely prudent to not over-capitalise while the market is down and there are few certainties to rely on. Woodside should be able to advance works again when the eventual rebound materialises, and do it from a solid enough financial position.

Woodside Petroleum is down 0.38 per cent today, with shares priced at $21.14 each at 12:46 pm AEST.