- ZipTel (ZIP) has entered a binding agreement to acquire 100 per cent of the issued capital of Douugh Limited

- Once completed, ZipTel will seek re-admission onto the ASX and be renamed Douugh

- ZipTel has been voluntarily suspended from trading since January 28 following the release of an announcement regarding an acquisition

- Douugh is a fintech company that uses artificial intelligence to help people spend their money wisely, save more, and build wealth

- It helps those who lack knowledge around money management

- ZipTel’s shares last traded for 1.7 cents each

ZipTel (ZIP) has entered a binding, conditional agreement to acquire 100 per cent of the issued capital of Douugh Limited.

Once completed, ZipTel will seek re-admission onto the ASX and be renamed Douugh with a proposed ASX Code of DOU.

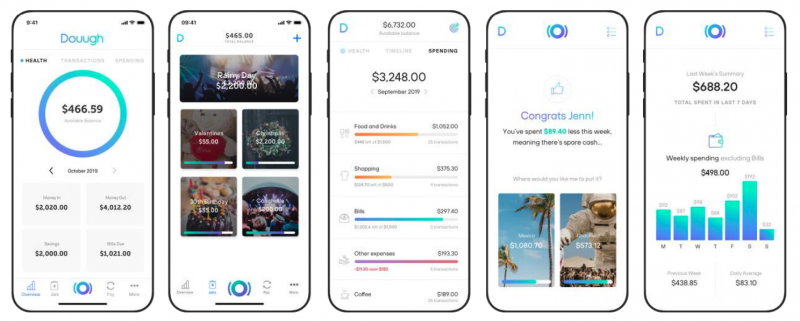

Douugh is a purposed-based fintech company that uses artificial intelligence (AI) to help people spend their money wisely, save more, and build wealth.

Millennials want control of their finances but many lack the knowledge around money management and access to automated tools to enable it.

Douugh’s technology strives to enables users to make the best financial decisions and help them reach their goals.

The banking company who is using the technology provides their banking licence, balance sheet, and underwriting and core banking system.

Unlike the typical neobank (mobile lead, digital only banks) model, the Douugh solution is capital lite, meaning there are no capital holding requirements or restrictions.

Having integrated and deployed its proprietary technology with its U.S. banking partner, Choice Bank, Douugh has launched its smart bank and Mastercard debit card offering in the App Store.

With its focus now on scaling its U.S. customer base and growing monthly recurring revenue, Douugh has also secured a further banking agreement with Regional Australia Bank, and Tokyo-listed financial services company, Monex Group.

Douugh already has potential partners across Australia and Europe which will establish it as a global fintech brand and SaaS (software as a service) platform over time.

In the short-term, Douugh is working on launching a variety of features including enhanced AI-automation, wealth management, cash rewards and instalment loans.

In the long-term, Douugh plans to become a financial identity and payments platform for its users, stimulating a wide variety of partners who can harness the offerings of Douugh and offer complementary services.

Some of these offerings will be integrated within the Douugh application itself, while others will be through an API (application programming interface) device which will ease secure data exchange and payments.

This will enhance Douugh’s ability to coach, manage and execute its services in a more cohesive and intuitive way to benefit customers.

ZipTel has been voluntarily suspended from trading since January 28, pending the release of an announcement regarding an acquisition. Shares were last priced at 1.7 cents in a $3.215 million market cap.