- Despite decreased volumes and a wave of withdrawals as a result of lockdowns, Australia’s residential auction market held up well in the September quarter

- The capital city weighted average clearing rate for the final week of the quarter was 80.6 per cent, the fourth highest clearance rate on CoreLogic records

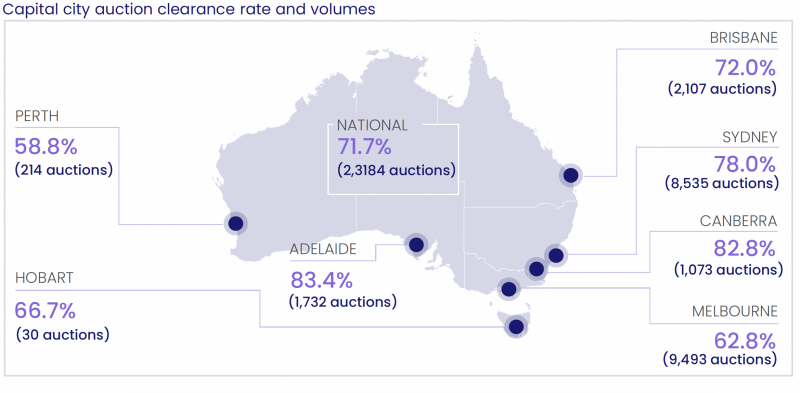

- A total of 23,184 properties were auctioned throughout the combined capital cities in the September quarter, a decrease from 31,605 in the June quarter

- The combined capital city clearing rate of 71.7 per cent for the September quarter was somewhat lower than the 75.7 per cent recorded in the June quarter

Despite decreased volumes and a wave of withdrawals as a result of lockdowns in Sydney, Melbourne and Canberra, Australia’s residential auction market held up well in the September quarter.

According to CoreLogic’s Quarterly Auction Market Review for the three months ending September 2021, 23,184 properties were auctioned throughout the combined capital cities, a decrease from 31,605 in the June quarter.

The combined capital city clearing rate of 71.7 per cent for the September quarter was somewhat lower than the 75.7 per cent recorded in the June quarter, but it was a significant increase from the similar quarter in 2020 when just 59.2 per cent of reported auctions were successful.

This resulted in fewer auctions and reported withdrawal statistics for the quarter averaged 18.3 per cent nationally, substantially higher than the 7.3 per cent withdrawal figure recorded in the June quarter.

According to CoreLogic research director Tim Lawless, despite the limitations, Sydney’s auction clearing rate stayed fairly steady throughout this period, averaging 78 per cent compared to the prior June quarter average of 78.6 per cent.

Withdrawal rates had a significant influence on Melbourne’s clearing rate of 62.8 per cent for the September quarter, which was down from 73.3 per cent the previous quarter.

Mr Lawless added that once the regulations were relaxed on September 18, Melbourne’s clearing rate increased quickly as fewer auctions were cancelled and buyer confidence increased.

CoreLogic head of research Eliza Owen stated that the report revealed that auctions as a sales mechanism were rising in popularity in other Australian capital cities.

“Not only have volumes been higher across Brisbane and Adelaide, but clearance rates have been well above historic averages through the September quarter, which may cement auctions as a more popular sales method across these cities through future housing market upswings,” Ms Owen said.

“One of the most powerful insights through the September quarter was the difference in market outcomes between Melbourne and Sydney. It highlights the importance of physical inspection in instilling buyer confidence and supporting transaction activity.”

The capital city weighted average clearing rate for the final week of the quarter was 80.6 per cent, the fourth highest clearance rate on CoreLogic records which commenced in mid-2008.

A clearing rate of 80 per cent or above is indicative of a seller’s market, according to Mr Lawless, since vendors benefited from robust selling conditions and above-average price growth due to low supply levels.

“The high clearance rate at the end of the quarter implies the spring season is likely to be an active one, with a further rise in scheduled auctions as home owners take advantage of the seller’s market,” he said.

“As lockdowns ease further it’s likely we will see a lift in the number of auctions held, as well as a rise in overall listing numbers, as pent up supply flows into the market. Auction numbers generally peak around late November to mid-December, so there is also the seasonal factor to consider as more auctions would generally be scheduled at this time of the year under normal conditions.”