- Australia can phase out coal-fired power by 2043, according to the energy market operator in a draft plan for electricity investments required to reach net-zero

- According to the Department of Industry, Science, Energy, and Resources, fossil fuels supplied 76 per cent of total power generation in 2020, with comprising coal 54 per cent

- The Australian Energy Market Operator (AEMO) proposes a 30-year “optimal growth path” for energy investment in the National Electricity Market (NEM)

- In this scenario, the NEM will operate without coal generation by 2043

- The transition for the NEM is forecast to deliver $29 billion in net market benefits, returning 2.5 times the investment value

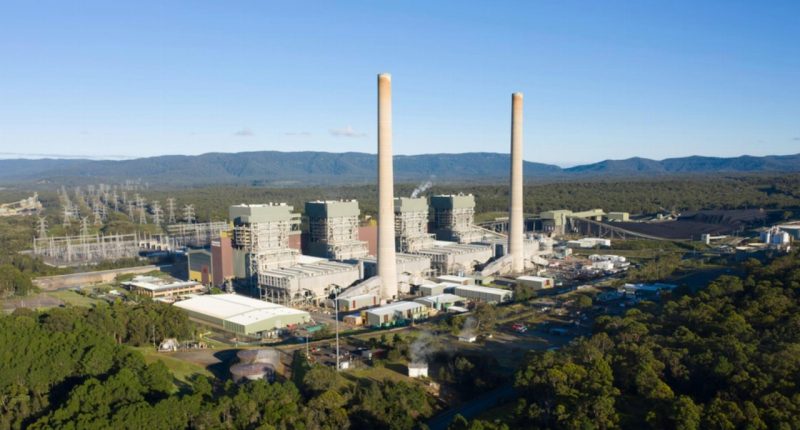

Australia can phase out coal-fired power by 2043, according to the energy market operator in a draft plan for electricity investments required to reach net-zero carbon emissions by 2050.

The Australian Energy Market Operator (AEMO) has released the Draft 2022 Integrated System Plan (ISP), which proposes a 30-year “optimal growth path” for energy investment in the National Electricity Market (NEM).

AEMO has been consulting with stakeholders, including policymakers, consumers, and industry representatives, in order to prepare the Draft ISP since September 2020.

After 18 months of deliberation, stakeholders unanimously chose Step Change as the most likely future scenario. This scenario satisfies Australia’s net-zero policy obligations while also taking into account technological improvements, political aspirations, and consumer preferences.

According to the Department of Industry, Science, Energy, and Resources, fossil fuels supplied 76 per cent of total power generation in 2020, comprising coal (54 per cent), gas (20 per cent), and oil (two per cent). In contrast to the beginning of the century, when coal accounted for more than 80 per cent of energy generation, the percentage of coal in the electrical mix has continued to fall.

Daniel Westerman, CEO of AEMO, stated that the considerable changes currently occurring in the NEM have continued to accelerate in recent years, well surpassing expectations under the 2020 ISP Central scenario.

“The Step Change scenario forecasts a rapid transformation in Australia’s National Electricity Market, consisting of a significant investment in renewable generation, storage and firming generation as coal plants exit, and improvements to transmission,” Mr Westerman said.

“In this scenario, the NEM will operate without coal generation by 2043. This requires a substantial increase in battery and pumped-hydro storage, hydrogen or gas-fired generation for peak demand, all complemented by a market that incentivises energy users to adjust demand based on system conditions.”

Mr Westerman said this transformation will “efficiently deliver secure, reliable and affordable electricity while substantially contributing to national emissions objectives”.

“Enabling this efficient transition for the NEM is forecast to deliver $29 billion in net market benefits, returning 2.5 times the investment value,” he said.

“Investment confidence will be important to delivering benefits to consumers, as the transition described in all the scenarios will require significant investment. AEMO will be further consulting on this Draft ISP to ensure the final version provides appropriate signals for investment.”