- Australian Strategic Materials (ASM) will pocket a $340 million investment from South Korean investors in return for a 20 per cent stake in its Dubbo Project

- Under the deal, the investors will form a magnetic manufacturing business called MagnetCo Fund, which will, in turn, sign an offtake deal with ASM

- The offtake deal will see MagnetCo buy up to 2800 tonnes per annum of neodymium-iron-boron (NdFeB) alloy from ASM’s Korean Metals Plant

- The NdFeB alloy will be made primarily from neodymium produced at the Dubbo Project in New South Wales

- Shares in Australian Strategic Materials are up 9.19 per cent and trading at $8.08 each at 3:43 pm AEST

Australian Strategic Materials (ASM) is set to pocket a $340 million investment from South Korean investors in return for a 20 per cent stake in its Dubbo Project.

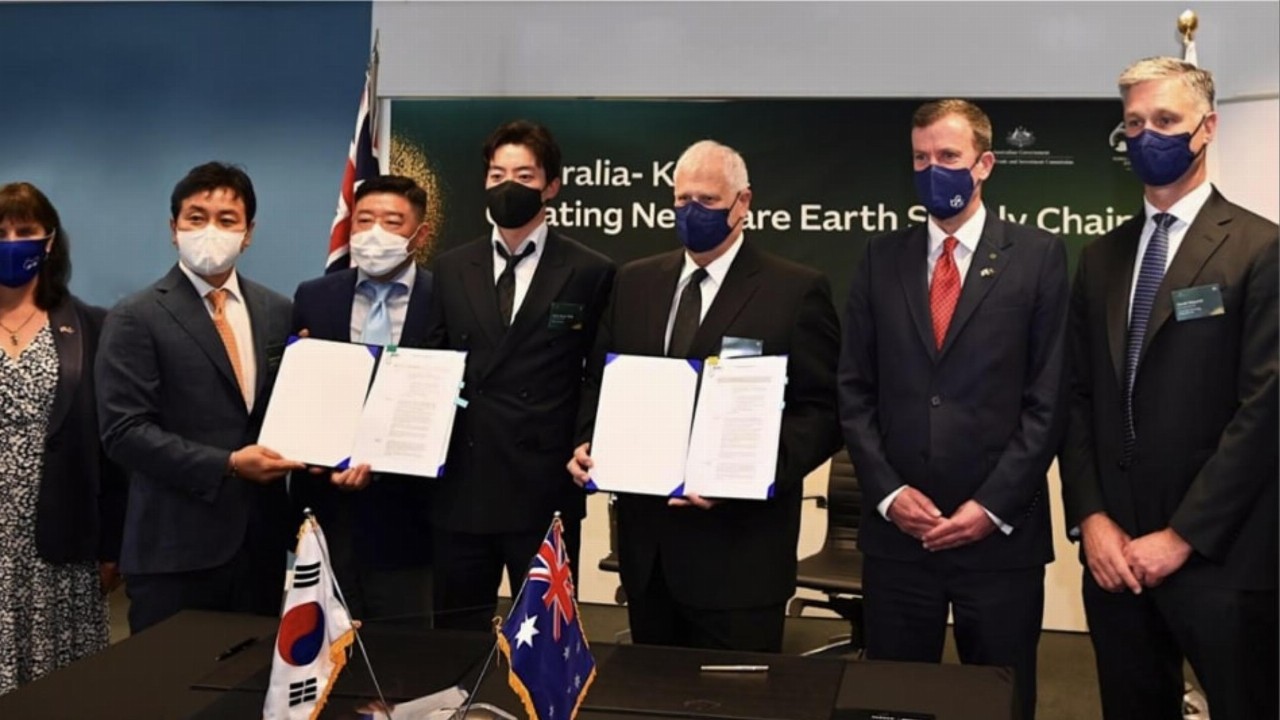

The critical metals company said this morning it had signed the conditional framework for the investment with a consortium of high-profile investors.

The investment deal also comes with an offtake agreement for the neodymium-iron-boron (NdFeB) alloy product to be produced from ASM’s Korean Metals Plant (KMP) in Ochang, South Korea.

Under the deal, three South Korean private equity firms — namely Cerritos, Kamur Partners and ACE Equity Partners — will pay US$250 million (A$340 million) to control 20 per cent of the ASM subsidiary that acts as the holding company for the Dubbo project.

ASM plans to develop the Dubbo project to become a major global supplier of rare earth minerals such as zirconium, niobium, tantalum and yttrium. The major investment from the South Korean consortium creates a pathway for ASM to develop this project, according to the company.

What’s more, the neodymium oxide that ASM plans to produce from the Dubbo project will become the primary source of feed into the Korean Metals Plant, which is currently under construction.

ASM will use this feed to create NdFeB alloy products from the plant.

Under today’s investment deal, the South Korean investors will form a separate consortium fund to establish a magnetic manufacturing business in South Korea called MagnetCo Fund.

The offtake segment of today’s investment deal will then see MagnetCo buy up to 2800 tonnes per annum of NdFeB from the Korean Metals Plant.

Australian Strategic Materials Managing Director David Woodall said the investment deal with the South Korean consortium was an “exciting new phase” in ASM’s growth.

“We are delighted our new South Korean partners have recognised the mutual value of the strategic investment opportunity represented by our integrated manufacturing capability that offers a new, cleaner source of critical metals and alloys to a rapidly expanding market,” Mr Woodall said.

“Cementing our ties with South Korea’s advanced manufacturing sector represents an incredible opportunity to create value from our Dubbo Project.”

Kamur Partners CEO Jerry Kwan said the Dubbo project was a “strategically important project” for both Korea and Australia.

Shares in Australian Strategic Materials were up 9.19 per cent and trading at $8.08 each at 3:43 pm AEST. The company has a $1.13 billion market cap.