- Australian Strategic Materials (ASM) has completed an initial scoping study for its proposed Korean Metals Plant with results demonstrating its feasibility

- As such, the ASM board has approved approximately US$1.5 million (A$1.93 million) of expenditure for the engineering design of the 5200-tonne-per-annum plant

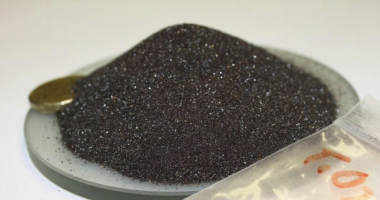

- The proposed plant would produce high-purity neodymium iron boron powder and titanium powder using a patented-process developed by Ziron Tech

- A final investment decision is targeted by June this year

- Shares have been trading 3 per cent higher at $5.48

Australian Strategic Materials (ASM) has completed an initial scoping study for its proposed Korean Metals Plant with results demonstrating its feasibility.

The integrated materials business is proposing to build a plant with an initial 5200-tonne-per-annum (tpa) capacity in Korea to produce high-purity critical metals.

The scoping study contemplates commencing construction in the third quarter of 2021 and beginning production a year later. Capacity would then be incrementally increased to more than 16,000 tpa in 2024.

The study estimated a capital requirement of approximately US$35 million to US$45 million (around A$45 million to A$57.9 million).

It also forecast the plant would generate US$180 million to $190 million (roughly A$231.5 million to A$244.4 million) of revenue annually and $45 million to $50 million (A$57.9 million to A$64.3 million) in EBITDA annually.

As a result, the ASM board has approved approximately US$1.5 million (A$1.93 million) of expenditure for detailed engineering design.

This will provide more detailed capital estimates ahead of a final investment decision, which ASM is targeting by June this year.

“Our ability to commercially produce high- purity critical metals for advanced technology manufacturers in Korea gives ASM an excellent foundation to be an independent fully integrated critical metals producer globally,” said Managing Director David Woodall.

“Korea is phase one. Once complete, this will provide the template for future ASM metals plants in other regions. We’ll now continue to progress our ‘mine to manufacturer’ strategy using our pilot plant furnaces in the second half of 2021,” he added.

The proposed plant would produce high-purity neodymium iron boron powder and titanium powder for the Korean market, using a patented-process developed by Ziron Tech.

Shares have been trading 3 per cent higher at $5.48 at 10:32 am AEDT.