- Bigtincan Holdings’ (BTH) subsidiary, BTC Mobility, has completed a stock purchase agreement to acquire VoiceVibes

- VoiceVibes’ technology provides automated coaching that helps people sound more natural and polished when they speak

- The VoiceVibes technology will allow Bigtincan to offer automated coaching and sales guidance

- Consideration for the acquisition is a combination of cash and equity made up of a cash payment of US$1,261,600 (roughly A$1,621,823) and a cash payment of US$100,000 (roughly A$128,500) on or before the first anniversary of the buy’s closing

- It also comes with the issue of 750,220 fully paid ordinary shares in Bigtincan at $1.098 per share

- Bigtincan shares are up 0.49 per cent, trading at $1.02 per share

Bigtincan Holdings’ (BTH) subsidiary, BTC Mobility, has completed a stock purchase agreement to acquire VoiceVibes.

Bigtincan helps sales and service teams increase customer satisfaction using their mobile, artificial intelligence (AI)-powered sales enablement automation platform.

VoiceVibes is an audio analytics engine, built by a team of speech and linguistic data science experts to create voice analytics for coaching and engagement analysis.

The data set is then used to figure out how humans perceive emotion and intention from voice, which Bigtincan can utilise to offer automated coaching and sales advice.

BTC Mobility has now acquired 100 per cent of the issued capital in VoiceVibes, although this acquisition is not expected to have a material impact on Bigtincan’s revenue or costs in FY21.

Consideration for the acquisition is a combination of cash and equity made up of a cash payment of US$1,261,600 (roughly A$1,621,823) and a cash payment of around US$100,000 (roughly A$128,500) on or before the first anniversary of closing.

It also comes with the issue of 750,220 fully paid ordinary shares in Bigtincan at $1.098 per share, based on the 30-day volume-weighted average price per share as at January 14, 2021, valued at US$638,400 (around A$821,114.37).

The initial cash component of the acquisition was fully funded from existing cash reserves raised through the institutional placement completed December 2020.

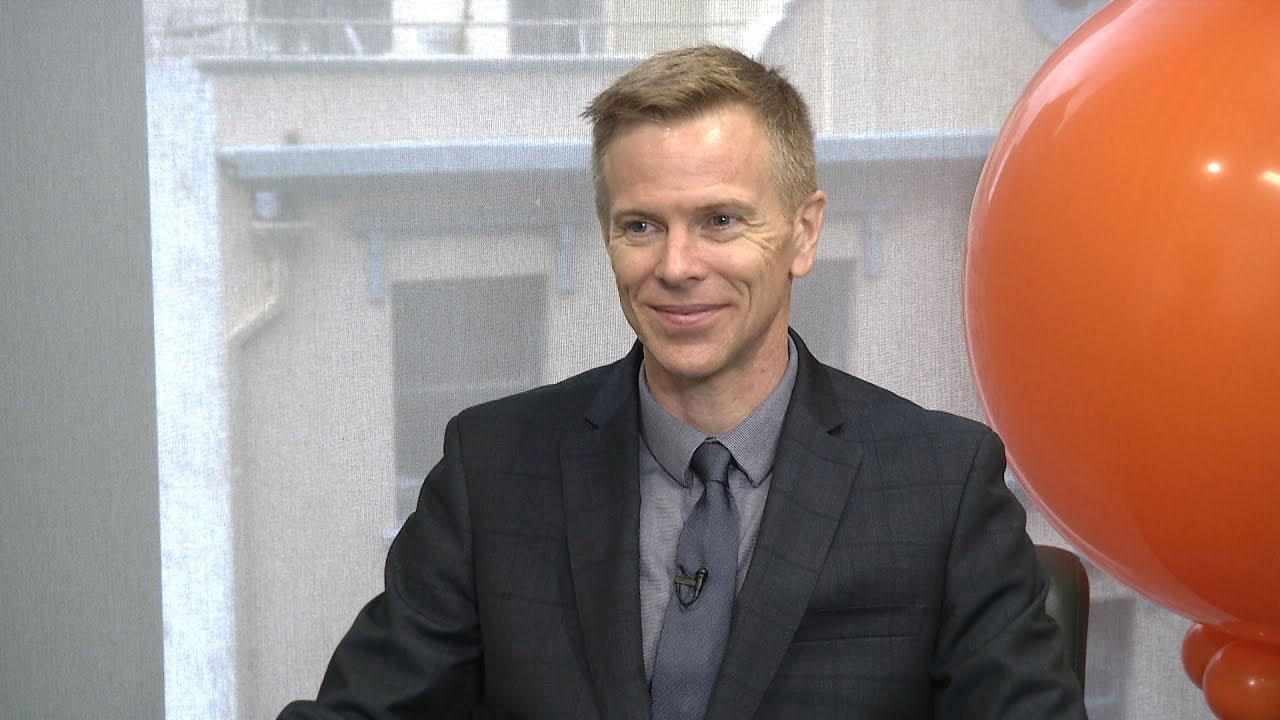

“VoiceVibes’ AI-powered coaching platform helps professionals make the best impression, every time they speak. By adding the patented VoiceVibes technology, Bigtincan expands our lead in AI for sales enablement and helps our customers train their sellers faster,” said Co-founder and CEO of Bigtincan, David Keane.

Bigtincan plans to retain the VoiceVibes team and integrate VoiceVibes’ technology into existing Bigtincan offerings.

Bigtincan shares are up 0.49 per cent, trading at $1.02 per share at 12:03 pm AEDT.