- Castillo Copper (CCZ) has identified a large mineralised system within the Mt Oxide project, which represents a significant number of future drill sites

- Detailed work at the iron oxide copper-gold (IOCG) Flapjack target in northwestern Queensland indicates it is part of a larger mineralised system that comprises the Crescent and Johnnies prospects

- High-grade surface assays reported the potential occurrences for coincident gold and copper mineralisation

- Castillo Managing Director Simon Paull said despite the significant findings, there’s still plenty of work ahead to extend the areas materially

- The company’s stock is up 11.11 per cent with shares trading for two cents each

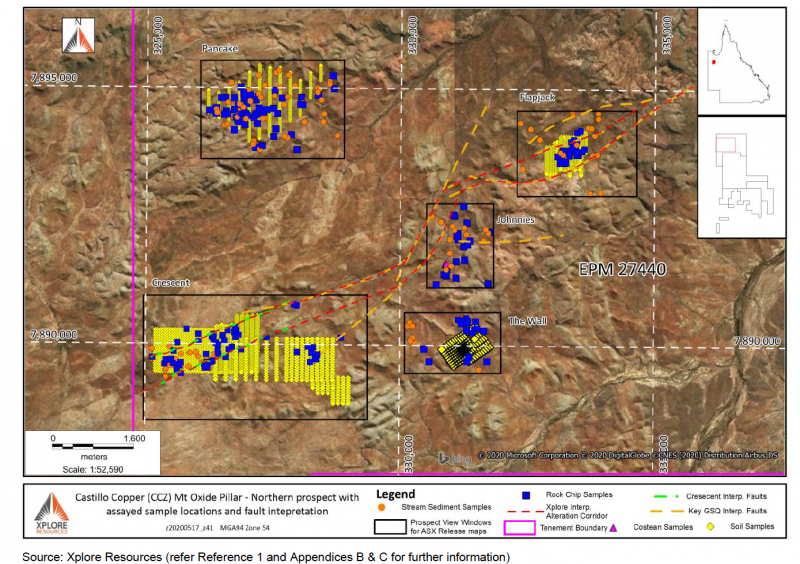

Base metal miner Castillo Copper (CCZ) has identified a large mineralised system within the Mt Oxide project, which represents a significant number of future drill targets.

The company said following a closer review of the Flapjack target in northwestern Queensland, it had verified the project sits within a zone of structurally controlled east-northeast trending haematitic-quartz veins.

Significantly, results from the company’s independent geology consultant indicated both the Flapjack and Crescent prospects are on the same fault system.

“Having a large relatively under-explored mineralised system, comprising three prospects that are known iron oxide copper-gold (IOCG) and shear-hosted copper targets, still leaves plenty of work ahead to extend these areas materially,” Castillo Managing Director Simon Paull commented.

“As we wind up the current geological review on the eight prospects across the Mt Oxide pillar, we continue to be surprised to the upside by the findings.”

Managing Director, Simon Paull

The company said this is a “significant finding,” as the Flapjack and Crescent prospects are both prospective IOCG targets. Further work, specifically targeting the trajectory of the fault, will be required by Castillo to determine the extent and scale of prospective IOCG mineralisation, so test-drill targets can be formulated.

The nitty-gritty

The company claims — at Flapjack specifically — the historic geology reports confirm the presence of haematitic-quartz veins laced with gold and a distinct chlorite alteration, which is an indicator of prospective IOCG mineralisation.

High-grade surface assay results for coincident gold-copper occurrences highlight key evidence supportive for IOCG mineralisation, including;

- Stream sediment up to 820 parts per billion (ppb) of gold, 50 parts per million (ppm) of copper, 57ppm of lead and 374ppm of zinc

- Soil up to 81ppb of gold, 292ppm of copper, 212ppm lead and 803ppm of zinc

- Rock chip up to 1.37ppm of gold, 606ppm of copper, 981ppm of lead and 463ppm zinc

While the company’s primary focus is progressing the Big One Deposit and Arya prospect drilling campaign, Castillo is buoyed by the large mineralised system, encompassing the trio of prospects, which will generate a significant number of future drill targets.

Castillo’s stock is up 11.11 per cent at 1:35 pm AEST with shares trading for two cents each.