- Castle Minerals (CDT) has entered into agreements to purchase two gold projects, Wanganui and Polelle, in Western Australia

- Both projects are located in the productive Meekatharra gold mining district

- To pay for these projects, the company is aiming to raise $488,000 in a placement

- Castle will issue 122 million shares at a price of 0.4¢ each

- On market close, Castle is down 14.3 per cent and is selling shares for 0.6¢ each

Castle Minerals (CDT) has entered into agreements to purchase two gold projects, Wanganui and Polelle, in Western Australia.

Both projects are located in the prolific Meekatharra gold mining district.

Wanganui

The Wanganui project is located 33 kilometres southwest of the active Meekatharra mining centre.

This gold project presents an opportunity to extend shallow mineralisation down-plunge and to outline resources for trucking and sale to one or more processing facilities.

Polelle

The Polelle Project is located 25 kilometres south of Meekatharra. No historical gold working has been reported on the licence.

Mineralisation at Polelle is associated with the Albury Heath shear, which is located east of the project.

Agreements

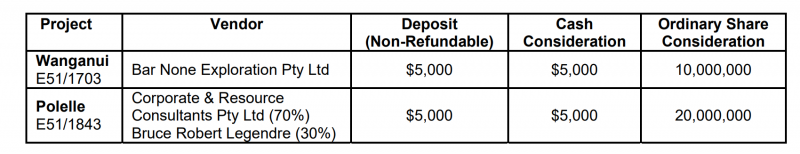

Castle will purchase the gold projects as set out as below:

The company will also complete a minimum of 2000 metre drilling program at Waganui within six months to complete the purchase.

Under the agreement, a one per cent royalty is payable on any gold produced from both projects. A once-only payment of $50,000 will also be paid when a decision is made to mine or an ore reserve of at least 30,000 ounces of gold is declared at any project.

Managing Director Stephen Stone is pleased to have secured these two gold projects.

“The acquisition increases Castle’s exposure to exploration for structurally

controlled orogenic gold deposits which can extend to considerable depths, as is

the case elsewhere in Western Australia and in West Africa where Castle holds

extensive and similarly prospective tenure,” he said.

“It also provides broader jurisdictional balance and, given the current operating

environment, exposure to more serviceable exploration in Western Australia and

hence ultimately improved news flow for shareholders,” he added.

Placement

To pay for these projects, the company is aiming to raise $488,000. The placement will be completed in two tranches.

Castle will issue 122 million shares at a price of 0.4¢ each to sophisticated investors and Directors of the company.

On market close, Castle is down 14.3 per cent and is selling shares for 0.6¢ per share.