- Increased online purchasing has shifted eCommerce logistics patterns, raising the need for urban logistical infrastructure

- A new Knight Frank report said that this shift has made retailers focus on automation to create smaller but more efficient delivery routes

- The demand for urban logistics facilities is being led by grocery giants as they attempt to deliver online orders faster while competing for market share

- Strong demand for industrial and logistical infrastructure, fuelled by the eCommerce boom, has resulted in a significant increase in industrial land prices

Increased online spending has led to a shift in eCommerce logistics patterns, which has uplifted demand for urban logistics infrastructure.

A new Knight Frank report said that this shift has made retailers focus on the spoke model, which uses automation to create smaller but more efficient delivery routes.

During the pandemic, internet purchasing soon became the primary point of sale and this tendency has progressed to the repurposing of redundant (or enforced closed) stores into micro centres to meet the enormous increase in online demand, the report noted.

“In the early stages of the pandemic, Kmart converted three of their stores (Vic, NSW, Qld) into online fulfilment centres,” Knight Frank associate director and report author Katy Dean said.

“Country Road, which also owns Witchery, used some of their traditional bricks and mortar stores as ‘dark stores’ during the pandemic, as did Accent Group, which owns Platypus and Athlete’s Foot.

“Kmart has since gone on to announce it would be rebranding 80+ Target Country branches to Kmart’s streamlined KHub brand. The closures and conversions, which are predominantly occurring through 2021, will make the stores smaller, and more digitally enabled.”

Ms Dean said Domino’s Pizza recently announced it would be targeting its new store openings by taking over or buying vacant or underutilised retail or food stores in densely populated areas in order to encourage takeaway orders and reduce delivery times.

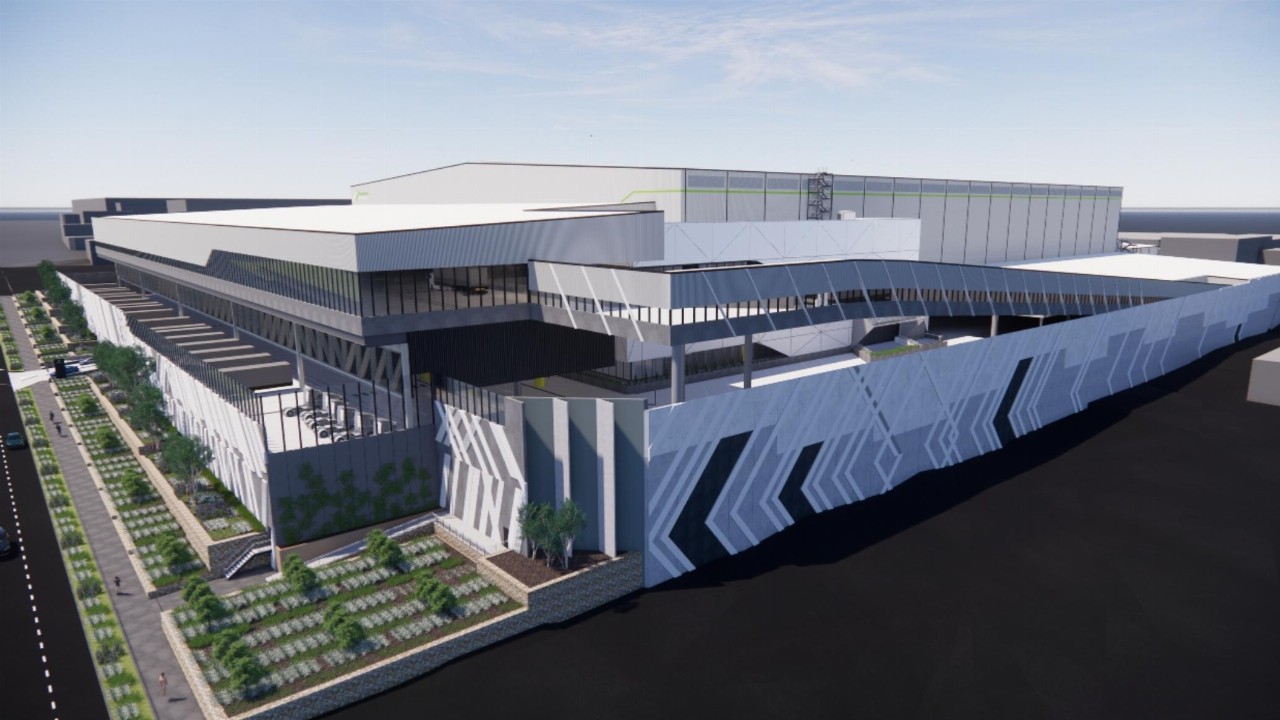

“Major retailers already have the existing real estate infrastructure in place and therefore can scale up to provide automated micro fulfilment centres (MFCs), which are typically housed at the back of existing stores or in urban locations where space is usually at a premium.”

The demand for urban logistics facilities is being led by grocery giants, the report stated, as they attempt to deliver online orders faster while competing for market share.

“The expansion of Coles and Woolworths is clearly demonstrated in the industrial leasing take-up volumes recorded across Sydney, Brisbane and Melbourne over the last five years,” Ms Dean said.

“Both retailers have been actively scaling up their e-commerce capabilities with a focus on creating supply chain efficiencies. They have commissioned various fulfilment and distribution centres often through lease pre-commitments on new developments.”

The report said that in the five years to 2021, more than 350,000sqm of industrial and logistics space was leased to Coles and Woolworths on the east coast with a further 165,000sqm in the pipeline.

Strong demand for industrial and logistical infrastructure, fuelled by the e-commerce boom, has resulted in a significant increase in industrial land prices in metropolitan areas in recent years, coupled with yield compression.

“This has been especially noticeable in areas where there is a scarcity of industrial-zoned (employment) land,” Ms Dean said.

“In the Sydney and Melbourne markets, there has been rapid growth of land values in infill locations relative to the outer areas. While this may not have specifically been driven by the need for compact or micro fulfilment, the growth divergence is a strong signal that developers are focusing on last-mile locations.”