• New $25,000 incentives to budding home renovators and new home builders

• But there is a catch. With extensive eligibility criteria, do you even qualify?

• Will this incentive benefit fringing metropolitan areas?

The recently announced HomeBuilder scheme has got the buzz happening amongst ambitious home-renovators and home builders alike. To prop up the declining construction industry the federal government has introduced a $25,000 incentive scheme for those building a new home or renovating an established one, in the hope of increasing residential construction following the devastating economic effects of Covid-19 within Australia.

On face value, this package is encouraging, given it complements existing state and territory First Home Owner Grant programs, stamp duty concessions, as well as the Commonwealth’s First Home Loan Deposit Scheme and First Home Super Saver Scheme. But there is more to this stimulus than meets the eye. There is an extensive set of eligibility criteria surrounding your annual income, the date at which you enter into a building contract and value of your principal place of residence.

According to the HomeBuilder fact sheet to qualify for the package, you must be substantially renovating your existing home as your principal place of residence, where the renovation contract is between $150,000 and $750,000 and where the value of your existing property does not exceed $1.5 million.

So, where are the most owner-occupied properties under $1.5 million and what will this look like for these suburbs?

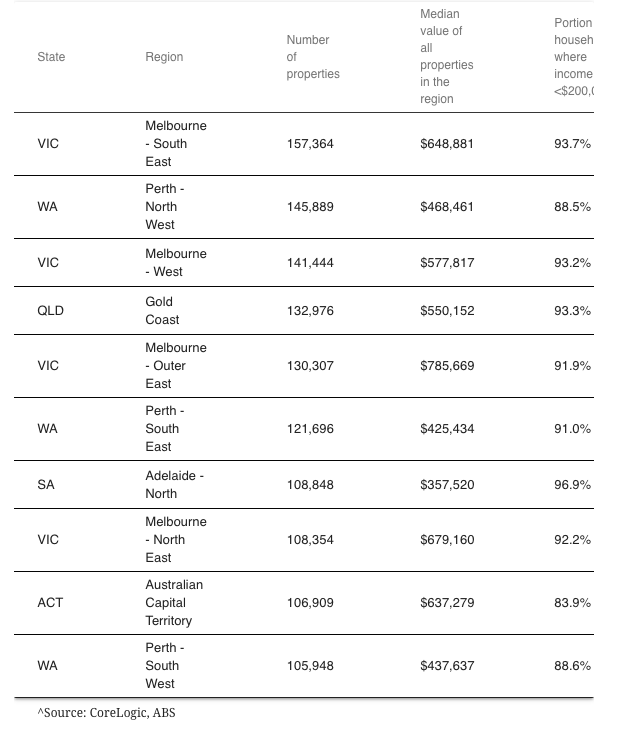

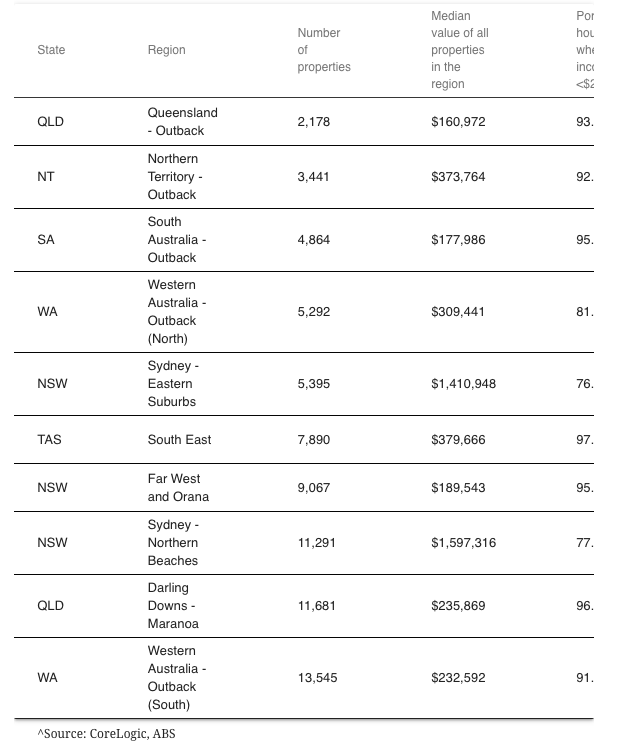

Below is a list of the top 10 & bottom 10 regions by numbers of these properties. What has also been included is an estimate of the portion of all family households that are below the $200,000 income limit for the HomeBuilder scheme, since there is a strict income cap for eligibility as a part of this scheme.

What we can see from this data is that fringing metropolitan suburbs are the most likely areas where there are owner-occupied properties estimated to be valued under $1.5 million. But what is most concerning is that it is these areas that include relatively low-income earners, compared to the inner-city centres.

So, it is questionable whether many of these homeowners will even take up the Homebuilder incentive for renovations. How many of these homeowners can afford renovations within the eligible criteria of $150,000 and $750,000 value? And for many of these areas where house prices are relatively low, are homeowners just simply over-capitalising on renovations, when they may not be able to recoup the cost of upgrades to the property when it comes time to sell anyway?

CoreLogic estimates that there are about 4.4 million owner-occupied properties worth less than $1.5m across Australia. And from these 4.4 million homes the federal government estimates that scheme may only support about 7,000 renovations. Will this be enough to boost Australia’s declining residential construction industry?