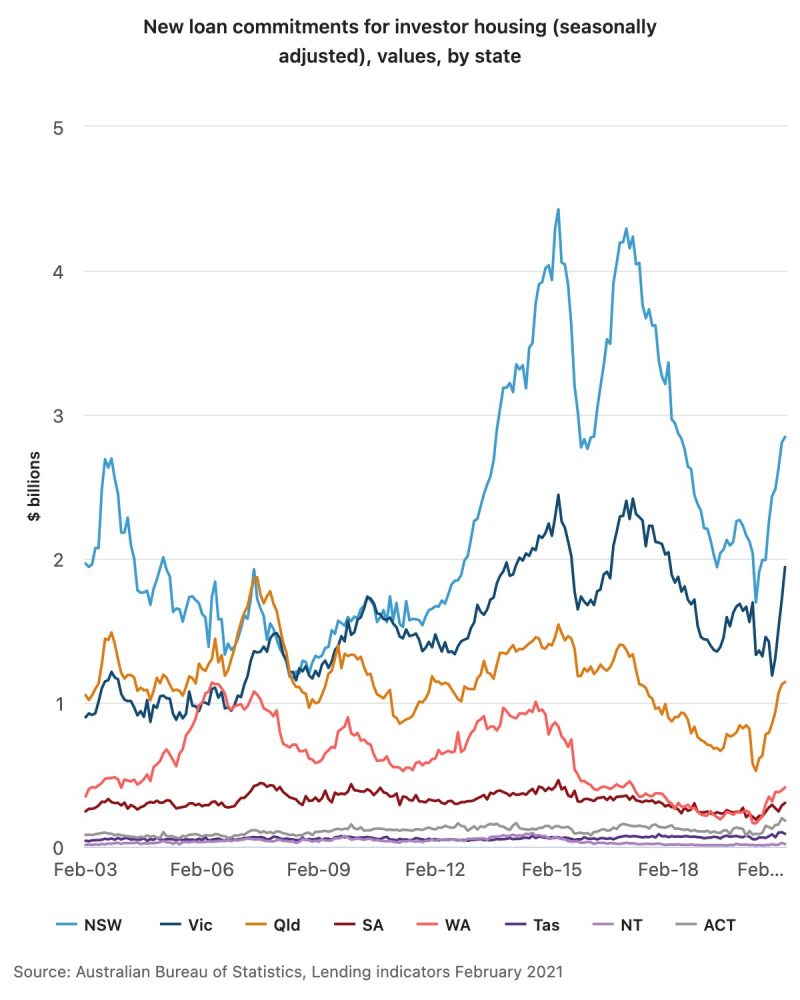

- New Australian Bureau of Statistics (ABS) data shows the value of new loan commitments for investor housing is continuing its growth hot streak

- Investor loan commitment values rose 4.5 per cent to $6.9 billion in February 2021, to be 31.6 per cent higher than the same time last year

- The value of new loan commitments to owner occupiers fell 1.8 per cent

- New South Wales still leads the country in new investor loan commitments, rising to $2.8 billion, followed by Victoria at $1.9 billion and Queensland with $1.1 billion

- The data comes off the back of a record month for detached building approvals, reaching their highest level on record since the ABS began the series in 1983, according to HIA

New Australian Bureau of Statistics (ABS) data shows the value of new loan commitments for investor housing is continuing its growth hot streak.

Values rose 4.5 per cent to $6.9 billion in February 2021, to be 31.6 per cent higher than the same time last year.

“Investor lending continued an unbroken period of growth since reaching a 20 year low in May 2020,” ABS Head of Finance and Wealth Katherine Keenan said.

New South Wales still leads the country in new investor loan commitments, with values rising to $2.8 billion, followed by Victoria at $1.9 billion and Queensland with $1.1 billion.

The value of new loan commitments to owner occupiers fell 1.8 per cent. While this was the first fall since May 2020, it remained 55.2 per cent higher than in February 2020.

First home buyers’ new loan commitments are still at historically elevated levels despite falling 3.3 per cent to 16,117 in February 2021 — the first fall since May 2020.

The data comes off the back of a record month for detached building approvals, reaching their highest level on record since the ABS began the series in 1983, according to Housing Industry Association Chief Economist Tim Reardon.

“The three months to February are also a record period, by a significant margin,” he said. “Detached house approvals in the three months to February 2021 were 50.7 per cent higher than the same time last year.”

Reardon said new home sales spiked in December as buyers rushed to meet the deadline of the first phase of HomeBuilder grants.

“New home sales in March are expected to be comparable to those in December 2020 as home buyers rush to meet the deadline for the second – and final – phase of HomeBuilder,” he said.

“The record volume of work will see home building absorb workers from across the economy in 2021 and into 2022. This positive outlook for detached home building is in stark contrast to that of the multi-unit sector,” he continued.

Reardon said the absence of overseas migrants and students will continue to impede multi-commencements.

“Multi -unit approvals remain lower by 21.6 per cent compared to the same quarter last year,” he said.

“Multi-unit projects that are gaining approval at this time are likely to have commenced the planning and building approval process before the pandemic. The apartment market is likely to be constrained until overseas migration returns,” concluded Reardon.