- Iron ore prices continue to sputter in light of China’s recent steel export cuts, though Chinese state-run media claims there could be more to the story

- The benchmark Chinese spot price for iron ore is down some 30 per cent in August so far, fetching just over US$130 per tonne (A$181.6 per tonne)

- China’s state-run tabloid, The Global Times, says a local reduction in steel exports is being compounded by weaker global economic data

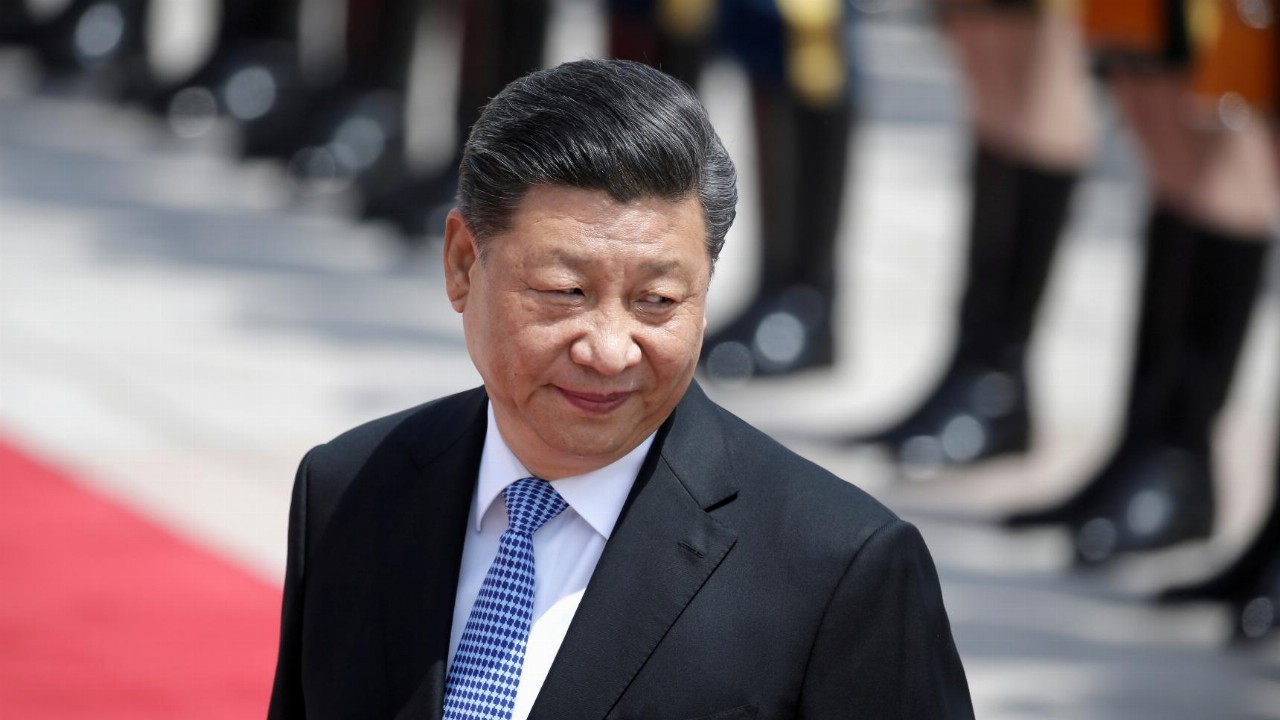

- Beijing has been trying to drive down the price of iron ore for months, saying in June it wanted to “rein in” the high price of the metal

- The Australian Federal Government predicted in its last Budget that iron ore prices would retreat to around US$55 per tonne by the end of March next year

Iron ore prices have continued to sputter in light of China’s recent steel export cuts, though Chinese state-run media claims there could be more to the story.

It’s been a brutal month for iron ore, with the benchmark Chinese spot price of the commodity slipping 30 per cent in August so far to fetch just over US$130 per tonne (A$181.6 per tonne). This is a far cry below iron ore’s mid-May peak of around US$233 (A$325.5) per tonne.

What’s more, the sudden dip comes after iron ore posted sturdy and consistent gains from the early days of the COVID-19 pandemic in May last year.

What’s caused the reversal?

Timing, Chinese steel cuts and weakened economic data

One of the main catalysts for the reversal in iron ore prices seems to be China’s declining steel exports to Australia.

According to Chinese state-run tabloid The Global Times, China’s steel shipments to Australia have dipped by more than 50 per cent in recent months — and this is just the beginning.

The Global Times report said China was working to “wean itself off” from Australian iron ore, with the eastern giant looking for more ways to cut steel output and restrict exports. One of the most important uses of iron ore is in steelmaking.

Beijing has upped the cost of steel exports twice in 2021 and brought back taxes on the metal, too. This is a move analysts allegedly told the Global Times would weigh on the Australian economy which “relies heavily” on steel imports from China.

“As Australia reboots its economy, demand for steel is set to further jump with the rollout of more housing infrastructure construction,” research director at the Beijing Lange Steel Information Research Center Wang Guoqing reportedly told the Global Times.

“That, combined with dwindling imports from China, will only widen the supply gap, which no other country could fill,” Mr Wang said.

However, a separate Global Times report suggested that the reduction in steel exports was just one of the factors contributing to the weaker iron ore prices.

China’s industrial output fell short of expectations for the month of July, increasing 6.4 per cent year-on-year. Analysts were forecasting growth of just under 8 per cent after June industrial output grew by 8.3 per cent year-on-year.

Chinese retail sales also came up shy of expectations in July, with an 8.5 per cent increase in July.

However, the Global Times said high levels of rainfall across the country and a fresh outbreak of COVID-19 disrupted production activities in China. This has been compounded by an expected upcoming shift in monetary policy from the US Federal Reserve, driving iron ore prices lower.

Nevertheless, the recent dip in iron ore prices is something China has been chasing for months. In June Beijing flagged its plans to “rein in” the soaring price of the commodity, which it said was the result of illegal global trade practices.

The Global Times accused Australia of “profiteering” off of the recent highs, and said China’s National Development and Reform Commission (NDRC), along with four other Chinese Communist Party (CCP) departments, would severely punish excessive price speculation, price gouging and other violations”.

Last week, the Global Times said regulatory crackdowns on such “malicious speculation” also contributed to the slipping iron ore prices.

Iron ore declines factored into Australia’s budget

Iron ore is Australia’s most important commodity, with the strong price of the metal helping support the nation through the COVID-19 pandemic.

The good news, then, is that the Federal Government knew all bubbles must eventually burst, and predicted in the last Budget that iron ore spot prices would retreat to around US$55 per tonne by the end of March next year.

This means the tumbling commodity prices are, at the very least, not taking Australia by surprise.

Still, the ASX mining sector has had a tough week since iron ore began its descent.

While the ASX 200 materials index has opened green today, it still sits roughly 8 per cent lower than this time last week, at 16,476 points as of 12:55 pm AEST.