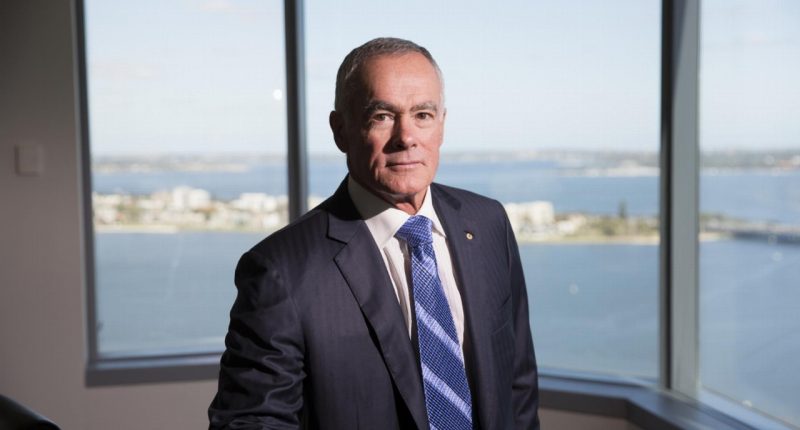

- John Poynton has stepped down as a director of Crown Resorts (CWN) in the latest resignation to shake the casino operator this year

- The Independent Liquor and Gaming Authority (ILGA) found that there was “a perceived lack of independence” regarding Mr. Poynton’s past relationship with James Packer

- He had served on Crown’s Board since November 2018 as a representative of Packer’s Consolidated Press Holdings

- Both Western Australia and Victoria are pursuing investigations into Crown’s operations

- Crown Resorts is up 0.4 per cent to $9.99 per share

John Poynton’s resignation today as a director of Crown Resorts (CWN) over “a perceived lack of independence” regarding his relationship with James Packer is the second time he’s been involved in a high profile, board-level scandal that has led to his departure.

Some observers have suggested that Mr. Poynton’s relationship with Mr. Packer was less a typical director-shareholder relationship, more an informal mentoring one. Some use the example of a conservatorship, the most well-known example being that of Britney Spears concerning her mental health challenges, to explain the relationship.

The first time Mr. Poynton was forced to resign from a major board due to similar perceived conflicts was in early 2007, when he stepped down as Chairman and director of Alinta Gas for his hand in a $6 billion proposal to acquire the Perth-based energy company.

He faced intense criticism for bringing in Macquarie Bank to assist with a management buyout plan, which presented a major conflict of interest since Macquarie had been acting as an advisor to Alinta, and which would have benefitted Mr. Poynton and his associates.

Mr. Poynton argued that his participation in the proposal was only to create value for shareholders — a view dismissed by the rest of the board and one that led to Mr. Poynton’s action being viewed as problematic by many.

Mr. Poynton defends the actions that led him to resigning, though understands the reputational damage it caused him: “Really in an effort to make it look like we weren’t getting an inside run, we were kind of made pariahs,” he said.

According to the Australian Institute of Company Directors, all activities conducted on behalf of shareholders must be done with care and diligence, in good faith, without improper use of directorial positions, and without improper use of information.

While Mr. Poynton’s involvement with the Board of Crown Resorts only dates as far back as November 2018, his history with Burswood Limited — which operates Crown Perth — goes back to 2004, over 17 years of ringside insight into the goings on at Crown. In particular during this time the findings of recent inquiries show Crown was the target of criminal syndicates that it turned a blind eye to in the pursuit of Chinese high-roller revenues.

Crown’s Executive Chairman Helen Coonan described Mr. Poynton as “enormously committed,” although it would appear not committed enough to have any knowledge of the hundreds of millions of dollars allegedly laundered through its gaming floors. The growing pressure on Ms. Coonan and its directors to accept some level of responsibility for the current debacle that is Crown meant that Mr. Poynton had to go.

“As a result, John has agreed to resign in the best interests of Crown and our shareholders, despite no adverse findings by the Commissioner in the ILGA Inquiry in relation to his suitability, integrity or performance,” Ms. Coonan added.

“On behalf of the Board, I thank John for his contribution to Crown over many years.”

Mr. Poynton is the fifth director to step down after the damning report by former NSW Supreme Court judge Patricia Bergin was published last month.

The year-long investigation found that Crown had facilitated money laundering through shell accounts connected to its Perth and Melbourne casinos and was “recklessly indifferent” to the activities of criminals using those accounts to launder money.

It also discovered that Crown had partnered with junket operators linked to organised crime.

As a result, Crown was deemed no longer suitable to hold its Sydney license and new investigations have been ordered to assess its Perth and Melbourne operations.

Crown Resorts is up 0.4 per cent to $9.99 per share at 11:00am AEDT.