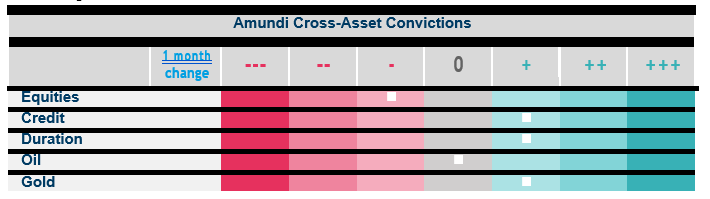

Over the past month, we have witnessed changes on two key fronts: (1) an orderly reopening of economies; and (2) strong fiscal support in the US and important policy actions in Europe, where we believe that the EU Recovery Fund and national fiscal interventions could prove to be a short-term game changer. However, there are no signs of improvement on a third front, the sustainability of corporate earnings. Consequently, we maintain our defensive, balanced and diversified risk stance, and believe investors could play some tactical rotation opportunities in the value and cyclicals sectors, green themes and the US consumer area, which remains supported by fiscal plans. Liquidity buffers are paramount at this stage.

High conviction ideas

On DM equities, we remain conservative and vigilant on hard data, but see tactical opportunities in Europe (a reduction in the political risk premium) in value, utilities related to renewable energy and industrials exposed to green initiatives. In the US, value, banks, credit cards, industrials (recovery exposure) and discretionary names, including autos, look attractive. However, growth names in the software and internet, staples and utilities sectors in the US are expensive.

Our view on EMs remains neutral, with a regional preference for China, South Korea and Taiwan, due to their sector exposure, strong stimulus and better contagion containment. Valuations in some ASEAN countries (Thailand, Indonesia and Philippines) are attractive but we are cautious on some countries due to virus concerns. Overall, it is important to hedge global equity exposure.

On duration, we adhere to our close-to-neutral view on the US owing to the current curve control environment and the Fed’s stance of not hiking policy rates until 2022. The Fed will prevent long- term yields from rising too much to avoid tightening financial conditions. We are monitoring the US 5- 30Y curve, which we believe is quite steep considering the fundamental economic picture and the Fed’s policy, but is still driven in the short term by sentiment and partly by technicals. Fed buying (especially in the short- to medium-term segments), safe-haven demand and the global search for yield, although to a lower extent, enable us to maintain a preference for US 5Y vs. German 5Y. In addition, UST yields still have room to fall if the Fed signals an openness to negative rates.

We are positive on US inflation bonds (medium term), due to depressed valuations and long-term reflationary forces. Euro peripheral debt should be supported by the ECB’s actions (recent PEPP expansion) and the EU Recovery Fund. The latter should reduce the risk premium on peripherals and, collectively, both are putting a ceiling on Italian yields. As a result, we now prefer an outright Italian BTP position over a relative Italy 30Y vs. Germany 30Y position. The former is also less correlated to equities.

Amid continued CB support, we retain our constructive stance on credit, and prefer IG (better valuations) over HY and EUR over US (high leverage). Investors should have a well-diversified exposure across sectors (cyclical, defensive, financial senior debt) with a particular focus on high-rated debt of A, A+ and BBB+ grade. However, liquidity assessment and some protection in HY is important (default risk).

We are neutral on EM debt. The gap between IG and HY countries is declining, with HY spreads strongly compressing but still attractive, while IG has now reached levels more in line with historical averages. In EM FX, we are now constructive on some high yielding currencies as they are benefiting from sentiment, flows and the focus on improving growth dynamics, but some risks factors (oil war, US-China tensions) remain.

Risks and hedging

Hedging in the form of gold, JPY/USD

(safe haven) and derivatives

is important to mitigate the risks related to earnings, insolvency and geopolitics.