- Nanosonics (NAN) has reported an 11 per cent decrease in revenue to $43.1 million for the first half of the 2021 financial year

- The infection prevention company attributes the drop to fewer purchases of its trophon technology due to COVID-19

- trophon is an innovative product that kills bacteria, fungi and viruses — preventing healthcare associated infections and cross-contamination

- In the half-year, Nanosonics saw an 8 per cent increase to $33 million on operating expenditure

- By the end of the year, the company had a healthy cash balance of $87.9 million

- Company shares are down 9.09 per cent and are trading at $5.5o per share

Nanosonics (NAN) has reported an 11 per cent decrease in revenue to $43.1 million for the first half of the 2021 financial year.

The infection prevention specialist says the decrease reflects its partner, GE Healthcare, making less purchases as a result of COVID-19. However, by the December quarter, GE Healthcare resumed purchases as ultrasound procedures slowly recovered.

Due to this and increasing sales by Nanosonics’ direct operations, total revenue grew 54 per cent between the September quarter and December quarter.

“It is very encouraging to see a significant recovery in the underlying growth momentum of the business across trophon adoption, consumables usage and overall growth,” CEO and President Michael Kavanagh said.

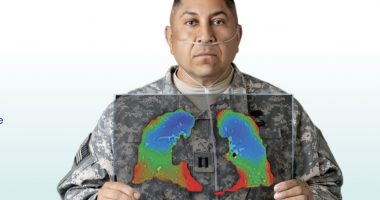

Nanosonics prides itself on developing and commercialising the first major innovation in high level disinfection for ultrasound probes in over 20 years.

The trophon technology generates a hydrogen peroxide mist that kills bacteria, fungi and viruses. Essentially, this prevents cross-contamination and the spread of healthcare-associated infections which have a prevalence of between 7 and 10 per cent.

In the half-year, operating expenditure grew by 8 per cent on the prior corresponding period (pcp) to $33 million and operating profit before tax was $200,000 compared to $6.7 million on the pcp.

By the end of the year, Nanosonics had $87.9 million, which puts it in a strong position for future growth.

“Based on current market improvements the company is anticipating ongoing

growth in total revenue and profitability into the second half, driven by increasing installed base growth and increased usage of consumables across all regions,” Michael concluded.

Nanosonics’ focus for the year is growing its trophon ecosystem, expanding into Asia Pacific, and continuing to invest in research and development and its global growth strategy.

Company shares are down 9.09 per cent and are trading at $5.5o at 11:44 am AEDT.