- New Zealand is known for placing strict regulations and processes on mining, but ways in which the country can prosper have arguably become the new priority going forward

- As COVID-19 sparked an economic downturn, the NZ Government realised the mining and resources sector might be one of the only ways to stay afloat

- Without abandoning its ethos on environmental protection and sustainability, the Provincial Growth Fund approved a $15 million loan for Tasman Mining to re-establish Blackwater gold mine

- In addition to Tasman, ASX-lister Auris Minerals (AUR) recently acquired the one-million-ounce Sam’s Creek Gold Project in the South Island

- Sam’s Creek is located near the 2.5-million-ounce Reefton Gold Field, which newly-listed Siren Gold (SNG) has a foothold in

- Of course, it’s certainly possible to mine successfully while sticking to environmental and ethical guidelines – much like mining giant, OceanaGold (OGC), has for the last 30 years

- If companies commit to mining in New Zealand, incorporating responsible practices to their operations allows them to create a positive legacy

In recent times, New Zealand has honed in on new ways the country can prosper.

Its mining industry has been recognised as playing a key role in pumping millions of dollars into its economy. In fact, the sector currently contributes about $2 billion per year to its coffers.

However, as the New Zealand Government continues to prioritise environmental protection and Indigenous communities land rights, mining companies and investors have arguably shied away from working in the region.

In spite of the sometimes strict regulations and lengthy process that industry players face, it seems New Zealand is a mining country on the rise.

What’s behind the rise?

COVID-19

The significance of New Zealand’s mining sector was reinforced once COVID-19 began to spread.

As New Zealand went into stage four lockdown, the country realised construction materials such as cement, steel and coal were needed as part of the essential service supply chain.

In fact, New Zealand coal is the largest export to Australia, with gold being the second largest.

Additionally, even as the country moves away from materials with adverse environmental effects, it still needs critical minerals, such as nickel and cobalt to make green technology like batteries, wind turbines and solar panels.

So, how will it achieve this?

The road to sustainability

Last year, the New Zealand Government issued its 2019-2029 Minerals and Petroleum Resource Strategy to map out its transition to a low emissions and sustainable future.

Despite the island nation being renowned for placing heftier restrictions on mining activities, the document didn’t shy from the fact that mining minerals and metals would be needed to help produce these green technologies needed in the future.

Like many western countries, New Zealand is committed to decreasing its carbon emissions. To achieve this, there needs to be some changes within the mining and oil sectors.

Among the guidelines put forward was a strategy to urge miners to improve health and safety conditions by looking for more innovative ways of running extraction operations.

Miners would also need to liaise with local communities and Indigenous landowners to protect the environment and gain access to the land. Currently, this process can take a considerably long time and face several hurdles – one of which being the anti-mining movement.

New Zealand is certainly a nation with opposing opinions on mining’s place. This was evident when an environmentalist from the Coromandel Watchdog of Hauraki slammed the New Zealand Government’s decision to support the revival of the Blackwater mine near Reefton.

At the end of last year, the Provincial Growth Fund approved a $15 million loan for Tasman Mining to re-establish the gold mine and conduct an extensive drilling program to test its viability.

The mine is creating a multitude of jobs and MP, Damien O’Connor, said the operation may attract hundreds of millions of dollars in investments.

But environmentalist Catherine Delahunty, thinks otherwise.

“We think it’s really, really a bad call and quite disgraceful that the Provincial Growth Fund, which is important money for the regions, is being spent on a dinosaur.”

Environmentalist Catherine Delahunty

On the other side of the argument are representatives from the island nation who believe mining can be done in a way which still protects the environment.

Straterra is a collective voice that represents New Zealand’s minerals sector and aims to open access to more mining.

“The resource sector faces a number of reforms, the objective of which is to improve environmental outcomes. The reality is that many aspects of these reforms will simply result in reduced or zero investment.”

Straterra CEO Chris Baker

According to the lobbying organisation, one of the key benefits to mining responsibly within New Zealand is that it takes away the reliance on resources from other countries which may have been mined with lower environmental and safety standards.

Additionally, Straterra argues it’s important the nation recognises which industries have the capacity to support it as it steers its way out of its COVID-19 related economic woes.

As mining is a clear money-maker, lobbyists argue there needs to be more freedom and less unnecessary barriers.

New kids on the block

With a number of prolific gold mines in the North and South islands, certain ASX-listers have set their sights on claiming their piece of New Zealand’s bountiful assets.

Auris Minerals (ASX:AUR)

Among this group is junior minerals explorer, Auris Minerals (AUR), who recently diversified its portfolio by acquiring Sandfire Resources’ Sam’s Creek Gold Project in the northern end of the South Island.

At the turn of the September 2020 quarter, Auris announced it would acquire the gold project after Sandfire, who’s an existing joint venture partner, decided it wasn’t a core asset.

In saying that, once the acquisition was completed, Sandfire took a 19.9 per cent cornerstone shareholding in Auris. This allows it to retain exposure to the potential upside development of Sam’s Creek.

“This is a transformational acquisition for Auris, which once complete, will provide shareholders with exposure to a million-ounce gold project in a tier-1 mining jurisdiction.”

Auris Minerals Managing Director, Mike Hendriks

As part of the transaction, Auris issued 102.5 million fully paid ordinary shares to Sandfire at a deemed price of 8 cents each. At the time, this represented $8.2 million, or roughly 20 per cent of Auris’ outstanding capital.

So what’s so special about the project?

Sam’s Creek has an existing mineral resource estimate of one million ounces at 1.54g/t gold including a higher-grade zone of 588,000 ounces at 2.43g/t gold.

However, drilling began at the project in October with an aim of updating the existing resource even further.

Sam’s Creek also boasts excellent potential with only one out of seven kilometres of strike previously drilled. While it has seen limited exploration, historic data has shown grades of up to 6.0 and 8.5 grams per tonne of gold.

Furthermore, the one-million-ounce project is situated near to the 2.5-million ounce Reefton Gold Field — one of New Zealand’s major gold producing sites.

Siren Gold (ASX:SNG)

As a further testament to the Reefton region gaining interest, newly-listed Australian gold explorer, Siren Gold (SNG) is also focused on the prolific site.

In fact, Siren owns an 815-square kilometre tenement package within the Reefton Gold Field.

“Reefton is a 35-kilometre-long ‘goldfield’ not just a single ‘gold mine’ and I believe that the huge potential of this truly world-class goldfield will unfold as we continue our exploration campaign over the next 12 months,” Siren Gold Managing Director Brian Rodan said.

Since September it has targeted exploration drilling at the Alexander River and Big River projects within the field.

As announced last month, drilling at Alexander River yielded positive results including 8.5 metres at 11g/t from 25 metres and 7.6 metres at 7.8g/t from 28.2 metres.

OceanaGold (ASX:OGC)

Finally one of the big players in the region is OceanaGold (OGC), a billion-dollar ASX-listed company who has pioneered the gold mining industry in New Zealand.

30 years ago, OGC began production at its Macraes operation on the South Island of New Zealand. The world-class project has since become the country’s largest active gold-producing mine — having produced over five million ounces of gold since 1990.

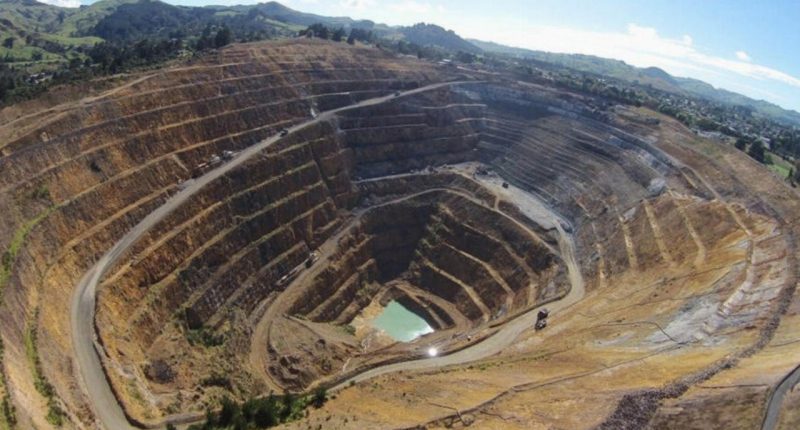

OceanaGold also owns and operates the Waihi Operation which is an underground and open pit operation in the North Island of New Zealand. The Waihi gold mine is the richest gold mine in New Zealand and has a history that spans three centuries.

Th Waihi Operation includes the Martha Underground mine which was approved for development in 2019. The mine extends the Waihi Operation’s life of mine by at least another decade which assures the locals and the 350 employed staff and contractors that it’s there to stay.

“The gold, silver, and copper metals we produce are essential to economic development and societal wellbeing – from renewable energy, to life-saving medical devices, and technologies that connect communities around the world,” the company stated.

To date, OceanaGold has received immense support from the New Zealand Government and wider mining sector because of its commitment to responsible mining, environmental management and social support.

The company has paved the way for other industry players, like Auris, to make a commitment to mining in New Zealand by incorporating responsible and ethical practices to their operations — allowing them to create a positive legacy.

If businesses can get behind these movements, it seems there is plenty of cash to be made in New Zealand’s revitalised mining region.