- Newcrest Mining (NCM) managed to increase its gold production by 6 per cent over the fourth quarter of the 2021 financial year

- A total of 542,000 ounces gold was produced across NCM’s mines at a reduced all-in sustaining cost (AISC) of $797 per ounce

- Cadia and Telfer mines drove the increase, helping the gold producer hit its guidance for FY21, producing 2.17 million ounces

- Going forward, NCM will continue focussing on exploration decline development works at Red Chris and Havieron

- Newcrest ended Thursday trading 0.42 per cent in the green at $26.18 each

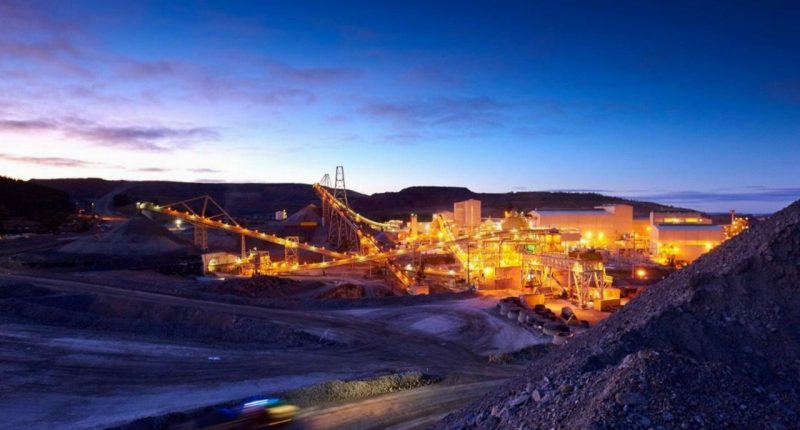

Newcrest Mining (NCM) has managed to increase its gold production by 6 per cent over the fourth quarter of the 2021 financial year.

The leading gold miner released its June quarterly report on Thursday revealing it produced a total of 542,000 ounces gold over the three-month period.

Its all-in sustaining cost (AISC) reduced to $797 per ounce, down from an AISC of $893 per ounce in the March quarter.

NCM said its Cadia and Telfer mines drove the production increase in Q4 and also helped the gold producer hit its guidance for FY21, producing 2.17 million ounces.

Managing Director and Chief Executive Officer Sandeep Biswas said Newcrest has hit its cost guidance for the year as well.

“Newcrest has safely delivered its group production and cost guidance for the year following a strong fourth quarter,” Mr Biswas said.

“Cadia exceeded the top end of its production guidance range and delivered mine and mill throughput records, showcasing the quality of this world-class asset.”

Going forward, NCM will continue focussing on exploration decline development works at Red Chris and Havieron.

The works were required in order for production to commence and Mr Biswas said he was excited to see them progress.

“We have made significant progress advancing our multiple organic gold and copper growth options during the quarter,” Mr Biswas said.

“At Red Chris and Havieron we commenced decline development works which are the critical path to reaching commercial production.

“We are also on track to release the outcomes of several of our exciting growth studies through the remainder of the calendar year which we believe will help articulate the future potential of our business.”

Newcrest ended Thursday trading 0.42 per cent in the green at $26.18 each.