- Newcrest Mining (NCM) agrees to purchase Pretium Resources in a US$2.8 billion (A$3.7 billion) deal

- Pretium is the owner of the Brucejack operation, one of the highest- grade operating gold mine in the world

- For the purchase, Newcrest will pay Pretium shareholders C$18.50 (around A$20.5) per share, this is a 22.5 per cent discount to the last closing price

- The merge of the two companies will create the leading gold miner in British Columbia’s Golden Triangle, operating both the Brucejack and Red Chris mines

- On the market this morning, Newcrest was down 1.87 per cent and is trading at $24.89 per share

Newcrest Mining (NCM) has agreed to purchase Canadian gold miner Pretium Resources in a US$2.8 billion (approx. A$3.7 billion) deal.

Pretium is listed on both the New York Stock Exchange and Toronto Stock Exchange and is the owner of the Brucejack operation in the highly prospective Global Triangle region of British Columbia, Canada.

Brucejack began commercial production in July 2017 and is one of the highest-grade operating gold mine in the world. It is estimated to have gold production of 311,000 ounces per annum at an all-in sustaining cost of $743 per ounce over 13-year mine life.

Notably, Brucejack is around 140 kilometres from Newcrest’s majority-owned and operated Red Chris mine as the company continues its expansions plans in the Americas.

For the purchase, Newcrest will pay Pretium shareholders C$18.50 (around A$20.5) per share, this is a 22.5 per cent discount to the last closing price and has unanimously been recommended by Pretium’s board.

However, there will be an option for shareholders to receive 0.80847 Newcrest shares per Pretium share owned or a 50/50 cash and script deal.

For the purchase to go through, the deal will need approval from 66 per cent of Pretium’s shareholders.

Newcrest, which already owns a 4.8 per cent shareholding in Pretium, is expecting the deal to be completed in the first quarter of the 2022 calendar year.

The merge of the two companies will create the leading gold miner in British Columbia’s Golden Triangle, operating both the Brucejack and Red Chris mines.

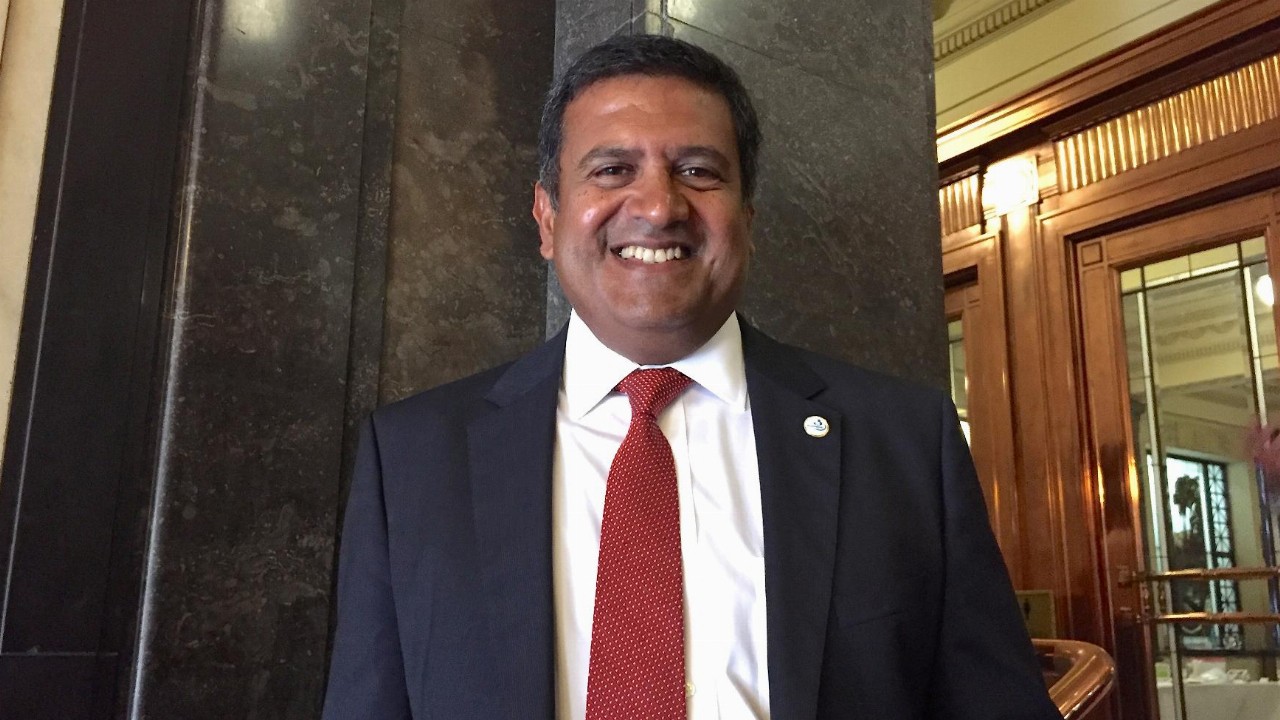

Newcrest Managing Director and Chief Executive Officer Sandeep Biswas is pleased to expand the company’s presence in this highly prospective region.

“Brucejack is a Tier 1 mine in a Tier 1 jurisdiction and will deliver immediate production, free cash flow and earnings diversification to Newcrest and will fit seamlessly into our long life, low cost portfolio,” he said.

“Following this transaction Newcrest will have exposure to six Tier 1 orebodies and a portfolio of organic growth options of unrivalled quality.”

Pretium President and Chief Executive Officer Jacques Perron said the purchase by Newcrest is an “outstanding opportunity for Pretivm and its shareholders”.

“The transaction delivers an immediate and compelling premium for Pretium shareholders that reflects the excellent work of our employees and contractors in developing and operating the Brucejack gold mine, while also offering an opportunity to benefit from potential upside as Newcrest shareholders,” Mr Perron said.

“With this acquisition, Brucejack will join Newcrest’s portfolio of tier one assets, mitigating the inherent risks associated with ownership of a single-asset mining company. Moreover, Newcrest has the financial means and the intention of maximizing the long-term potential of the Brucejack mine and the district scale opportunities in the surrounding Brucejack property.”

On the market this morning, Newcrest was down 1.87 per cent and is trading at $24.89 per share at 10:59 am AEDT.