- Biotech company Next Science (NXS) successfully completes a two tranche institutional placement to raise $10 million

- Around 11.1 million new shares will now be issued to institutional and sophisticated investors at 90 cents

- Next Science will also be undertaking a share purchase plan to raise up to an additional $5 million with participants able to subscribe for up to $30,000 worth of shares

- The company will use the money to accelerate growth, invest in the business, clinical trials and sales and marketing, and strengthen its balance sheet

- Next Science ends the day 11.7 per cent in the red with shares trading at 91 cents

Biotech company Next Science (NXS) has successfully completed a two tranche institutional placement to raise $10 million.

The company entered a trading halt on February 23 but did not disclose how much it intended to raise or what it would be using the funds for once received.

Around 11.1 million new shares will now be issued to institutional and sophisticated investors at 90 cents.

This price represents a 12.6 per cent discount to Next Science’s closing price on February 22 of $1.03 and a 15.5 per cent discount to the five-day volume-weighted average price of $1.07.

Phase one is raising $6 million while phase two, which is subject to shareholder approval, will consist of a $4 million commitment from major shareholder, Lang Walker.

Next Science will also be undertaking a share purchase plan (SPP) to raise up to an additional $5 million.

While the price is unknown, eligible shareholders will be able to apply for up to $30,000 worth of shares which will be priced lower than the placement price of 90 cents and have a two per cent discount to the five-day volume-weighted average price.

If the SPP is oversubscribed, Next Science will scale back applications.

The plan is set to open on March 4 and close on March 23 with shares to be issued on March 29 and begin trading on the ASX on March 29.

Next Science will use the money from both the placement and SPP to accelerate growth, invest in the business, clinical trials and sales and marketing, and strengthen its balance sheet.

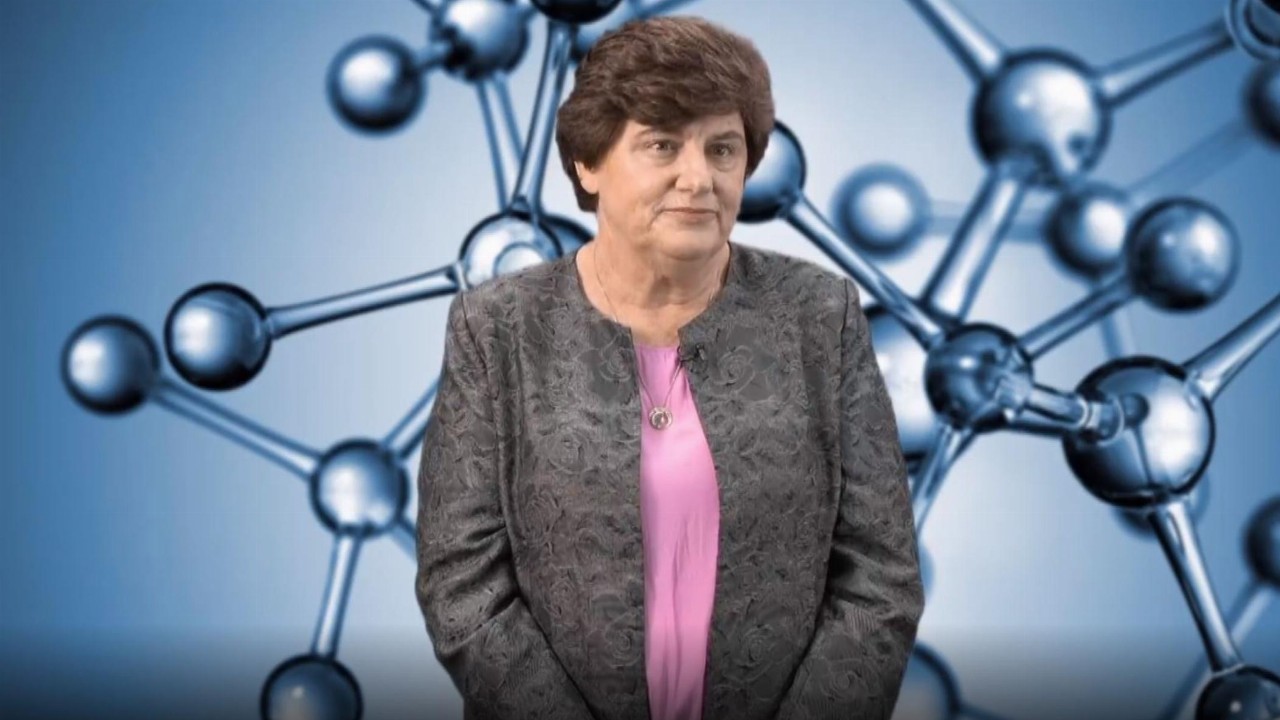

“I am delighted with the strong level of support for the placement and I wish to thank existing shareholders for their continued support and welcome new shareholders to our register,” Managing Director Judith Mitchell said.

“We are pleased to offer eligible shareholders the opportunity to participate in the capital

raising via the SPP at the same price as institutional and sophisticated investors.”

Next Science has ended the day 11.7 per cent in the red with shares trading at 91 cents in a $204 million market cap.