- Phoslock Environmental Technologies (PET) has closed its oversubscribed $15 million share purchase plan

- The water cleaning company received nearly $17 million worth of subscriptions

- Given the strong demand, Directors have decided to allocate most shareholders the majority of what they applied for

- For example, shareholders that applied for up to $5000 worth of shares will receive all of their application, while those who applied for more than $5000 will receive 90 per cent

- PET will use the money to further strengthen its balance sheet, accelerate commercialisation in international markets, and take advantage of projects and opportunities

- Company shares are steady today and are currently trading for 49 cents each

Phoslock Environmental Technologies (PET) has closed its oversubscribed $15 million share purchase plan.

The water cleaning company received nearly $17 million worth of subscriptions.

Given the strong demand received from nearly 1200 shareholders, Directors have decided to allocate most shareholders the majority of what they applied for.

For example, shareholders that applied for up to $5000 worth of shares will receive all of their application while those who applied for more than $5000 will receive 90 per cent of their application.

Approximately 30 million shares will be issued to shareholders on May 7.

This share purchase plan follows the $12 million placement that was announced on April 9.

Approximately 24 million shares were issued to institutional investors at a price of 50 cents each.

CEO Lachlan McKinnon, senior executives, and company directors are hoping to contribute an extra $3 million and this will be discussed at the annual general meeting on May 25.

PET will use the money raised from the placement, share purchase plan, and the potential $3 million to further strengthen its balance sheet, accelerate commercialisation in international markets, and take advantage of projects and opportunities.

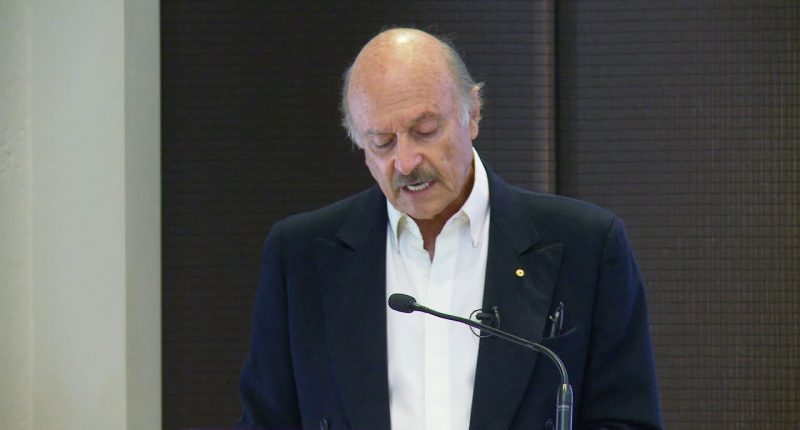

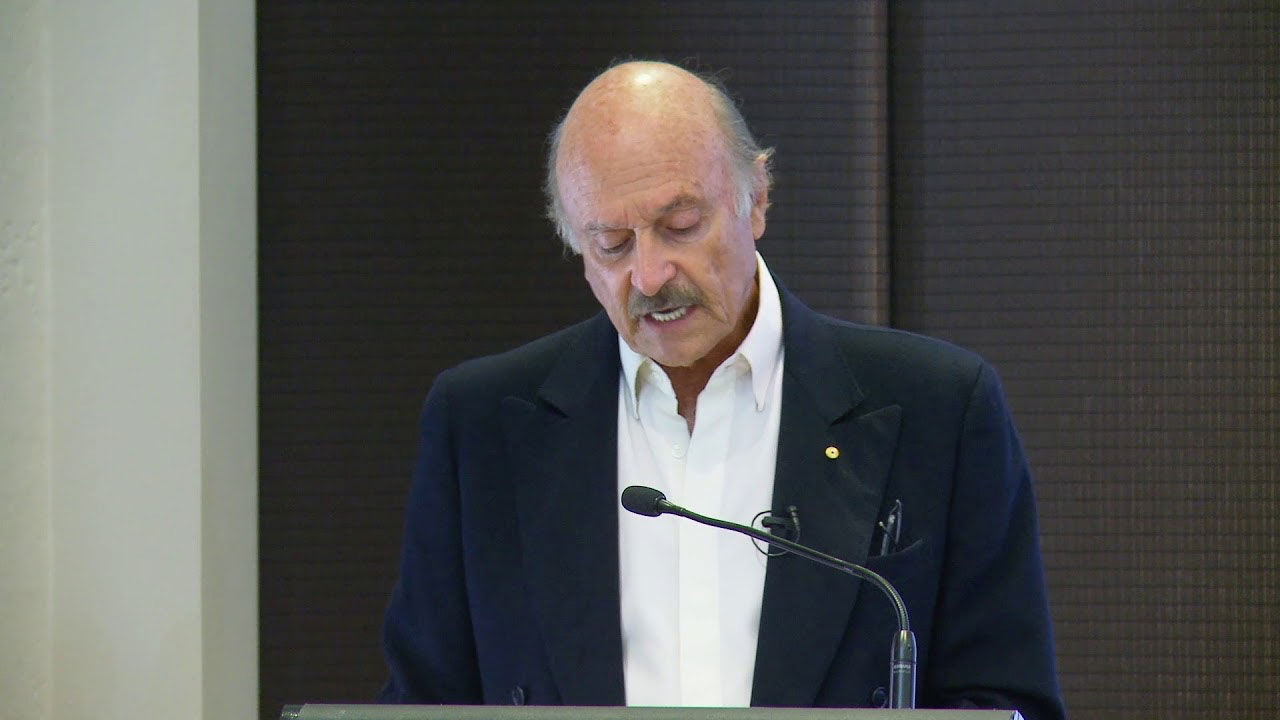

“We are delighted with the unprecedented level of support for the share purchase plan, which is the highest in the history of the company. This, together with the broad-based institutional take-up, is a transformational transaction for the company,” Chairman Laurence Freedman stated.

“With some $55 million in cash and receivables and no debt, our balance sheet is well fortified,” he said.

“This unique level of financial security, together with our substantially increased depth of corporate management, enables us to expand our growth parameters, both geographically and corporately,” he added.

PET shares are steady today and are trading for 49 cents each at 10:52 am AEST.