Kalgoorlie Diggers & Dealers 2023 was marked by the dominance of battery metals explorers, showcasing a particular focus on lithium. Despite a price decline from the turbulent year of 2022, lithium continues to be one of the hottest commodities on domestic and overseas markets.

This enduring enthusiasm for lithium is evident in the interest surrounding hard-rock lithium projects, often targeting spodumene mineralisation, as well as brine extraction methods.

However, a well-established but underutilised technology is shaking up the brine side of lithium exploration.

Direct Lithium Extraction (DLE) is a technology that has been around since the 90s but evidently overlooked by many. This growing wave of DLE uptake carries big implications, especially for hard-rock lithium miners who should take heed, given that this technology provides brine miners with a distinct advantage.

Goldman Sachs analysts recently issued a report expressing a preference for brine extraction over traditional mining. This preference is largely attributed to a technology known as Direct Lithium Extraction (DLE).

So, what exactly is DLE?

Contrary to popular belief, the majority of the world’s lithium reserves are not found in hard rock but rather in underground brines.

There’s one well-known way to extract lithium from brine, and that’s using evaporation ponds.

While well understood, evaporation ponds are not necessarily the most environmentally friendly way to do it, given that some 90 per cent of water extracted during brine pumping is then lost, leaving important tapped groundwater aquifers dry.

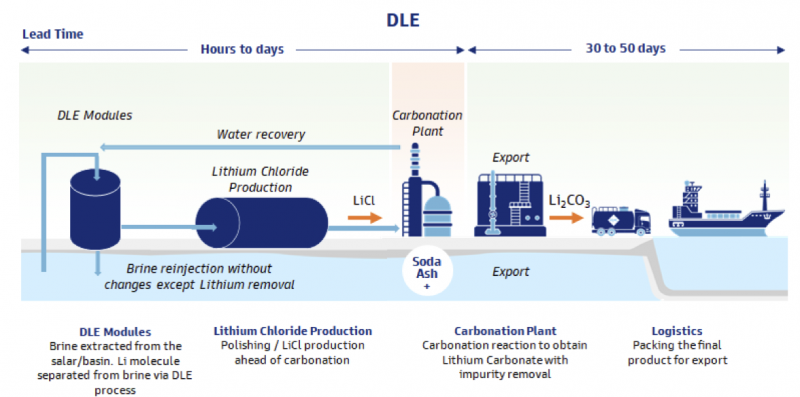

DLE, on the other hand, involves processing brine feedstock to directly extract lithium. The remaining brine, now devoid of its lithium content, is then re-injected underground.

And, as Goldman Sachs points out, DLE technology can achieve reliable lithium recoveries of over 90 per cent — a feat not often achieved by traditional hard-rock projects or evaporation methods.

Why is DLE more favourable?

DLE can double lithium production with higher recoveries compared to evaporation.

This method, according to GS analysts, has the potential to do for the lithium market what shale oil fracking technology did for the US energy sector.

Moreover, DLE provides project operators with a range of options, contributing to its appeal.

A shared feature across various DLE methods is the re-injection of processed brines, positioning DLE as an environmentally friendly process that boosts companies’ green credentials.

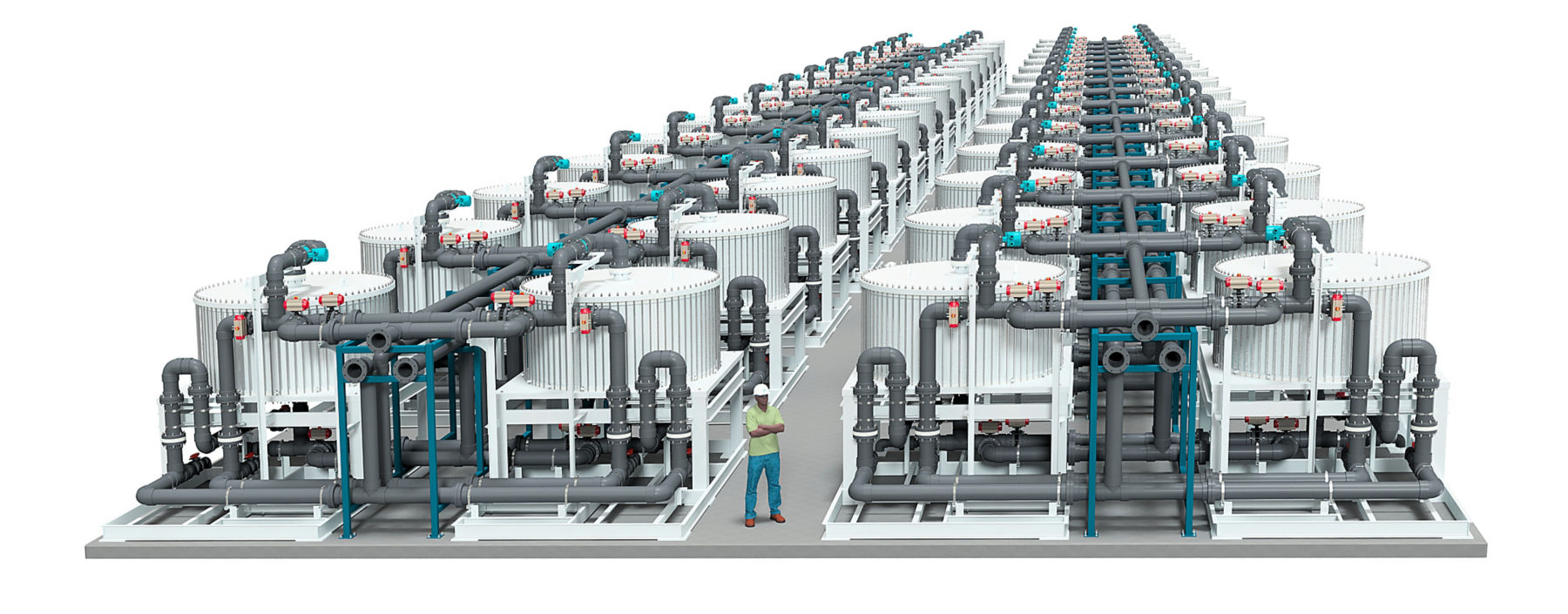

Companies adopting this technology are numerous, despite its decades-old status, with Adsorption DLE gaining particular traction.

The technology was developed in the 1970s and used commercially in 1996.

This was before electric vehicles (EVs) came to the fore some 20 years later.

How does adsorption DLE work?

A strength of A-DLE is that it uses very little chemical reagents, and the main inputs are heat, brine and water.

The sorbent needs to be “washed” with water to desorb the lithium from the sorbent. If simple recycles are built into the process design, this water can be re-used again and again, resulting in a tiny water footprint.

If done right, A-DLE is a low-water use as well as low-carbon way of producing lithium for electric vehicles.

In this manner, A-DLE emerges as the most environmentally friendly iteration of DLE – and it’s gaining traction in unexpected places.

Who else is using the tech?

There are a number of big names at home and overseas picking up A-DLE.

Livent, formerly FMC, is a global Top 3 lithium producer and has used A-DLE in its commercial lithium operations in Argentina for over 25 years. That has enabled Livent to boost production by more than 400 per cent

A range of Chinese producers began using A-DLE in the late 2010s when the EV market for lithium began to materialise, including Lanke Lithium, Zangge Mining and Jintai Lithium.

In Europe, French company Eramet is building an A-DLE type project, also established in Argentina, where the company expects to meet a 24,000 tonnes per annum capacity for world lithium markets.

And the technology has also caught the attention of American Oil & Gas majors.

Exxon Mobil Corp

Firstly among the names using A-DLE that may surprise you is the US-listed energy behemoth Exxon Mobil Corp. Concentrating on a lithium-rich deposit in Arkansas known as the Smackover Formation, which recently gained attention in the US news. Exxon intends to employ A-DLE technology.

Back in May, Exxon raised eyebrows when it purchased more than 120,000 acres of land in Arkansas from Oklahoman company Galvanic Energy, which had acquired the acreage in 2021. With a market capitalisation of US$431 billion, Exxon’s move indicates a significant interest.

Local newspaper reports covering events in Magnolia, with a population of 11,000, highlight its history of benefiting from resource extraction, underscoring Exxon’s strategic decision to explore lithium in a well-supported region.

Koch Industries

Privately held US giant Koch Industries, with revenues of US$115 billion, a major player in the energy sector, has recently enabled Compass Minerals International to develop an A-DLE project in Utah, set to commence in 2025. Ford Motors has already agreed to procure this project.

Vulcan Energy Resources

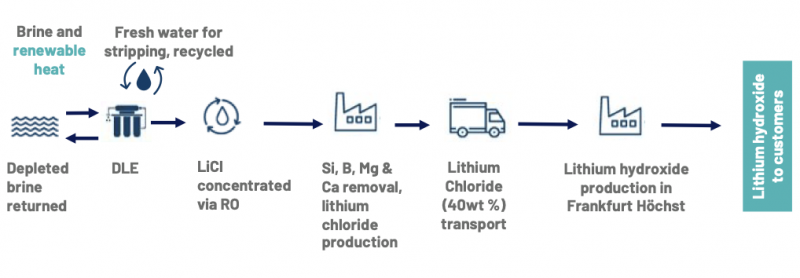

Then there’s Australia’s Vulcan Energy Resources (VUL), which is developing an A-DLE project in the Upper Rhine Valley region of Germany.

That project sees ASX and FSE listed Vulcan using a proprietary aluminium-based sorbent to extract lithium, which not only requires no acid wash but can also be washed with water.

Following standard DLE practices, the spent brine can be reintroduced into the deep reservoir, aligning with Vulcan’s commitment to its Zero Carbon Lithium™ Project aiming to be the first dual lithium chemicals and renewable energy producer with net zero greenhouse gas emissions. Vulcan will generate renewable geothermal heat-powered electricity to bolster its carbon-neutral credentials.

Chevron Corp

Lastly, US energy giant Chevron Corp, with a market cap of US$295 billion, is also exploring A-DLE. The company recently announced its interest in entering this space, likely influenced by Exxon’s early-stage venture into the technological landscape.

Given that the technology involves the manipulation of liquid flows, it makes sense for traditional energy firms to take notice and become involved.

DLE Summary

Reflecting on the insights from Goldman Sachs and considering the aforementioned developments, the advantages of DLE and A-DLE over brine evaporation – let alone hard-rock projects – are evident.

With superior lithium recovery rates of up to 90 per cent, the elimination of the need for acid washes enhances environmental sustainability. Moreover, A-DLE proves to be more cost-effective than evaporation and aligns seamlessly with the growing demand for net-zero solutions as global decarbonization initiatives gain momentum.

Supported by the involvement of well-capitalised US energy conglomerates, the sentiment at Goldman Sachs resonates with optimism.

The vibe, you could say, is electric.