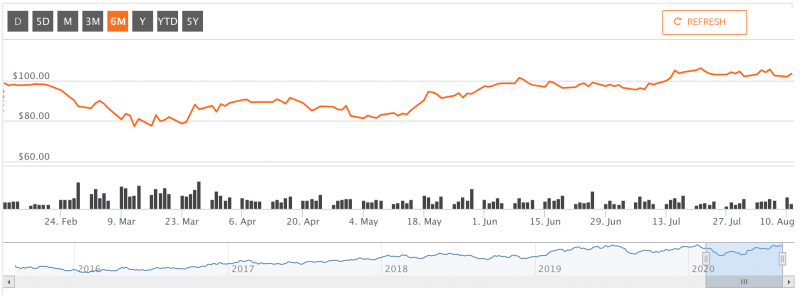

- Rio Tinto’s (RIO) share price hit a six month high in late July, after suffering big drops during March and May

- The global mining giant’s share price topped $106 per share on July 21 — it’s biggest high since January this year

- Nevertheless, COVID-19 wreaked havoc on Rio’s share price in March, sending it to trade for as low as $77 per share as the entire economy adjusted to the pandemic

- Rio has suffered another drop in its share price in May, before rebounding sharply once the company’s mid-year results were released

- Shares in Rio Tinto are currently worth $103.50, up a slight 1.58 per cent

Global mining giant Rio Tinto (RIO) has seen its share price hit an almost six month high, after suffering big drops in value in both March and May this year.

On July 21, the iron-ore producer’s share price hit a high of $106.09 per share — the highest its been since late January when it hit $107.38 on January 22.

Source: Hot Copper

It was a strong result for the company, who suffered noticeable drops in its share price during the previous months as COVID-19 wreaked havoc on the wider economy.

Rio wasn’t immune to the uncertainty, with its share price contracting from the January 22 high to a low of $77.40 per share on March 11.

Its share price rallied slightly in April, selling for well over $80 per share, before diving again in early May.

Source: Hot Copper

The company was widely criticised during that month, amid news it had blown up the 46,000-year-old Juukan Gorge rock shelters in WA’s Pilbara region while widening one of its mines.

Rio had secured consent under WA’s Aboriginal Heritage Act but has since admitted there were other options available to them.

It’s also apologised to the Puutu Kunti Kurrama and Pinikura people and vowed to never allow a similar destruction of a heritage site to occur.

Since May, Rio has also released its 2020 half-year report, showing its earnings before interest, taxes, depreciation and amortisation (EBITDA) had decreased by six per cent.

“Despite the challenging backdrop, we generated underlying EBITDA of $9.6 billion, with a margin of 47 per cent driven by our strong and stable operations, with all of our assets continuing to operate throughout the first half,” Chief Executive J-S Jacques said.

“As a result, we have declared an interim dividend of $2.5 billion, equivalent to US$1.55 per share (around A$2.16) and have reconfirmed our 2020 production guidance across all commodities,” he added.

Following the update, shares in Rio have remained steady.

Now, its securities have continued to sell for over $100 per share, with the turmoil of COVID-19 seemingly behind it.

When it comes to RIO’s share price outlook, the forecasts are pretty mixed. Morningstar has issued a 12-month price target of $100.00, while four analysts hold strong buy, moderate buy, moderate sell and strong sell ratings.

Currently, shares in the company are trading for $103.50, a slight increase of 1.58 per cent at 3.34 pm AEST.