- Australian property prices have been growing at an exuberant rate over the last year, but there are some early signs it may be peaking

- However, there remains a variety of factors that will likely keep upward pressure on housing values, including record-low interest rates, high consumer sentiment and border reopenings

- There has recently been a marked lift in new listings come to market as more vendors take advantage of rising prices and shot selling times

- As state and federal housing grants and income supports come to an end in the face of a strong economic recovery, there is now less support which could result in a reduction in housing market activity

- As prices rise, they become more unaffordable, nine in ten Australians are now worried prices are pushing property ownership out of reach

Australian property prices have been growing at an exuberant rate over the last year, but there are some early signs it may be peaking.

That is according to CoreLogic Research Director Tim Lawless, who said housing values are not about to reverse.

“A more likely scenario is the housing market is moving through a peak rate of growth and the pace of capital gains will gradually taper over coming months,” he said.

There remains a variety of factors that will likely keep upward pressure on housing values, according to Lawless.

This includes record-low interest rates, high-consumer sentiment and border reopenings.

“Overall, we are expecting housing values to continue to rise throughout 2021 and most likely throughout 2022, just not at the unsustainable pace of growth that has been evident over recent months,” Lawless said.

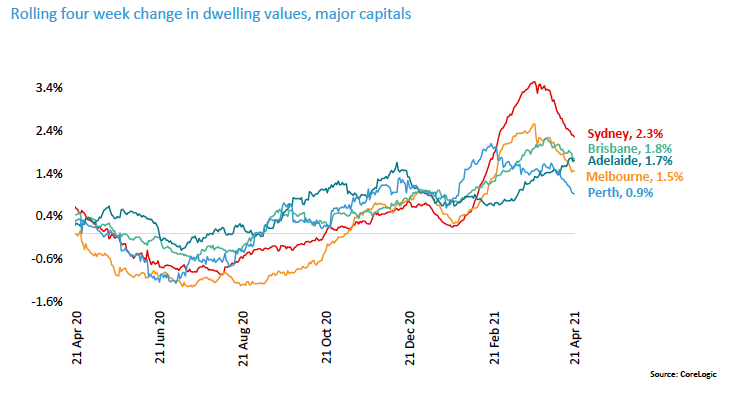

Slowdown in the pace of capital gain

The first clear sign of a slowing in the pace of growth comes from CoreLogic’s daily reading of home values, according to Lawless.

“The daily update of CoreLogic’s benchmark measure of housing values, the hedonic Home Value Index, is showing a clear and broad based slowdown in the rate of housing value growth; a trend that has been evident since late March,” he said.

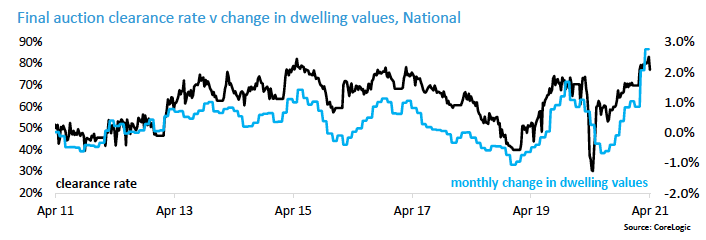

Lower clearance rates

Clearance rates have also dipped, with auction results softening over the Easter weekend.

“The weighted average clearance rate moved through a recent high in the last week of March at 83.1 per cent, and has since drifted lower to reach 78.6 per cent over the week ending April 18th,” Lawless said.

“Historically there has been a strong positive correlation between auction clearance rates and the pace of appreciation in housing values.”

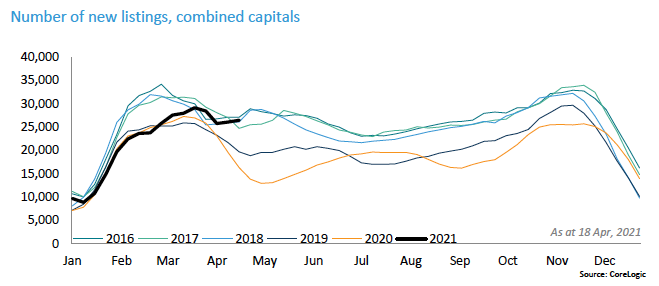

A rise in vendor activity

Much of the talk around property prices has been that the increase in demand has not been matched by an increase in supply.

However, there has recently been a marked lift in new listings come to market as more vendors take advantage of rising prices and shot selling times, according to Lawless.

“The four weeks ending April 18th saw 26,470 newly advertised capital city properties added to the market which was the largest number of new listings for this time of the year since 2016 and 17 per cent above the five year average,” he said.

“Total advertised stock levels (new listings plus re-listings) remain low, tracking -17.5 per cent below the five year average, which implies buyers are still likely to feel some urgency, but the lift in stock additions should gradually support a rebalancing between buyers and sellers, especially if buyer activity slows as new supply levels lift.”

Home construction boom

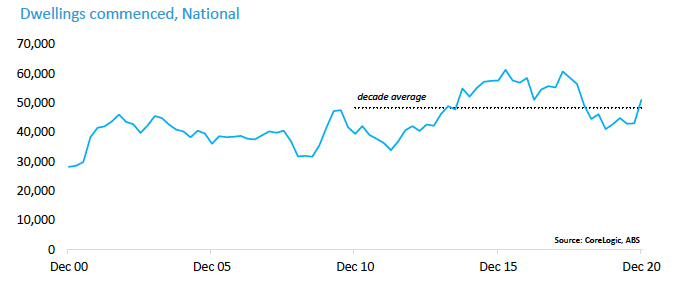

Thanks to state and federal home building stimulus measures, there has been a noticeable life in new housing construction activity, which will inevitably add more supply.

“The unprecedented pipeline of new housing supply will take some time to work through to completions, however it is occurring at a time when demand from population growth has recently turned negative which could progressively create an imbalance between demand and supply,” Lawless said.

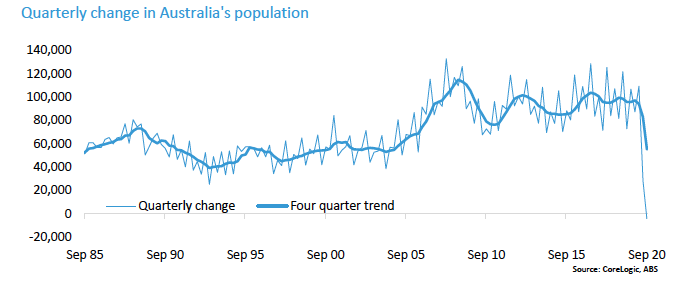

Negative population growth

Population growth has turned negative for the first time since 1916 due to travel restrictions, lockdowns and border closures, and when rates will pick up is uncertain.

Stalled migration has had a more direct and immediate impact on rental markets, due to the fact around 70 per cent of overseas migrants arrive on a temporary basis, according to Lawless.

“Of the roughly 30 per cent of migrants that arrive in Australia with permanent intentions, most would rent before buying, so the impact on buying demand is more gradual,” he said.

Less incentives

As state and federal housing grants and income support come to an end in the face of a strong economic recovery, there is now less support which could result in a reduction in housing market activity.

It has been widely discussed that grants, such as HomeBuilder, have brought demand forward.

“As these stimulus measures expire, along with less migration and rising affordability constraints, it’s reasonable to expect housing demand could be negatively impacted,” Lawless said.

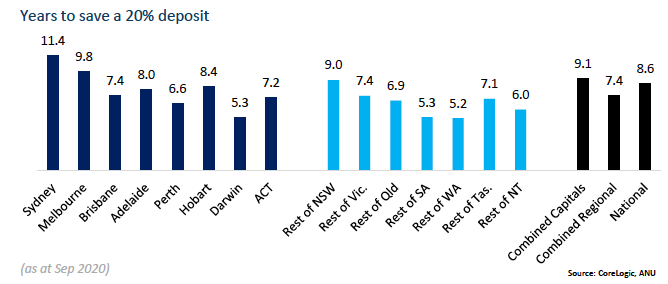

Higher barriers to entry

As prices rise they become more unaffordable, nine in ten Australians are now worried prices are pushing property ownership out of reach.

“For those looking to enter the market, growth in housing values is substantially outpacing incomes, which means a growing deposit hurdle for first home buyers,” Lawless said.

“Based on data to September 2020 (which would have worsened by now considering the 8.2 per cent lift in national housing values since then) it would take the typical Australian household 8.6 years to save a 20 per cent deposit (assuming a household can save 15 per cent of their gross annual income), with households in the most expensive capitals, Sydney and Melbourne, taking a longer 11.4 and 9.8 years to save a deposit.”