- Sunrise Energy Metals (SRL) receives conditional finance support for up to $400 million of debt funding for its Sunrise Battery Materials Complex in New South Wales

- The conditional support comes from Export Finance Australia (EFA), which provides financial solutions to support Australian exporters

- Sunrise Energy says the non-binding letter of support from EFA demonstrates the government’s commitment to help bring critical minerals projects to fruition

- Before providing funds, the EFA will complete detailed due diligence on the project

- Sunrise Energy Metals dips 0.45 per cent, trading at $2.19

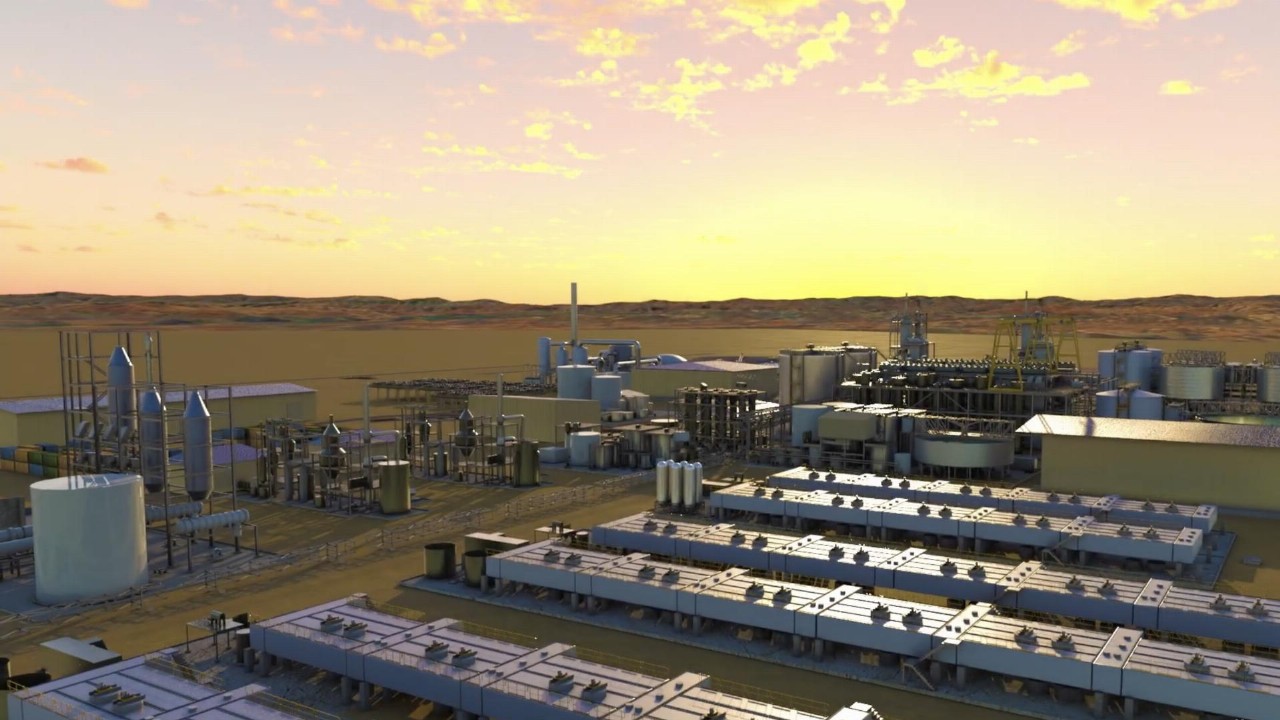

Sunrise Energy Metals (SRL) has received conditional finance support for up to $400 million of debt funding for its Sunrise Battery Materials Complex in New South Wales.

The conditional finance support comes from Export Finance Australia (EFA), which will complete detailed due diligence on the complex.

EFA is Australia’s export credit agency, which provides financial solutions to support Australian exporters through loans, guarantees, bonds and insurance. EFA also manages the Australian Government’s $2 billion critical minerals facility, which supports projects that are aligned with the government’s strategy and national interest.

Sunrise CEO and Managing Director Sam Riggall said the non-binding letter of support from Export Finance Australia demonstrates the government’s commitment to providing material financial assistance to project developers, to help bring critical minerals projects to fruition.

“We are targeting approximately 50 per cent of the project’s capital requirements from commercial bank lenders, and this additional financial support from EFA is most welcome,” said Sam Riggall.

“We look forward to working with EFA as we continue to work towards securing a comprehensive financing package for the Sunrise Project from a range of local and offshore participants who have expressed interest in participating in the development of the project.”

Before providing funds, the EFA will ensure there is an acceptable contracting strategy for the engineering, construction and commissioning of the Sunrise Project, along with a comprehensive funding plan for the project and ensure it complies with EFA’s environmental and social risk policies.

Sunrise Energy Metals said its project is designed to be one of the world’s largest integrated producers of battery-grade nickel and cobalt sulphate, supporting the production of up to 25 kilotonnes per annum (ktpa) of nickel and 7ktpa of cobalt, suitable for precursor feedstocks.

Sunrise Energy Metals dipped 0.45 per cent, trading at $2.19 at 11:05 am AEDT.