- Suvo Strategic Minerals (SUV) has released its latest quarterly report, showing it ended the year well funded with $7.4 million in the bank

- It was a big quarter for the kaolin and silica sand producer, who acquired Imerys’ hydrous kaolin operations which are based in Australia

- SUV successfully raised $6 million in an oversubscribed placement to fund the cost of buying the new operation

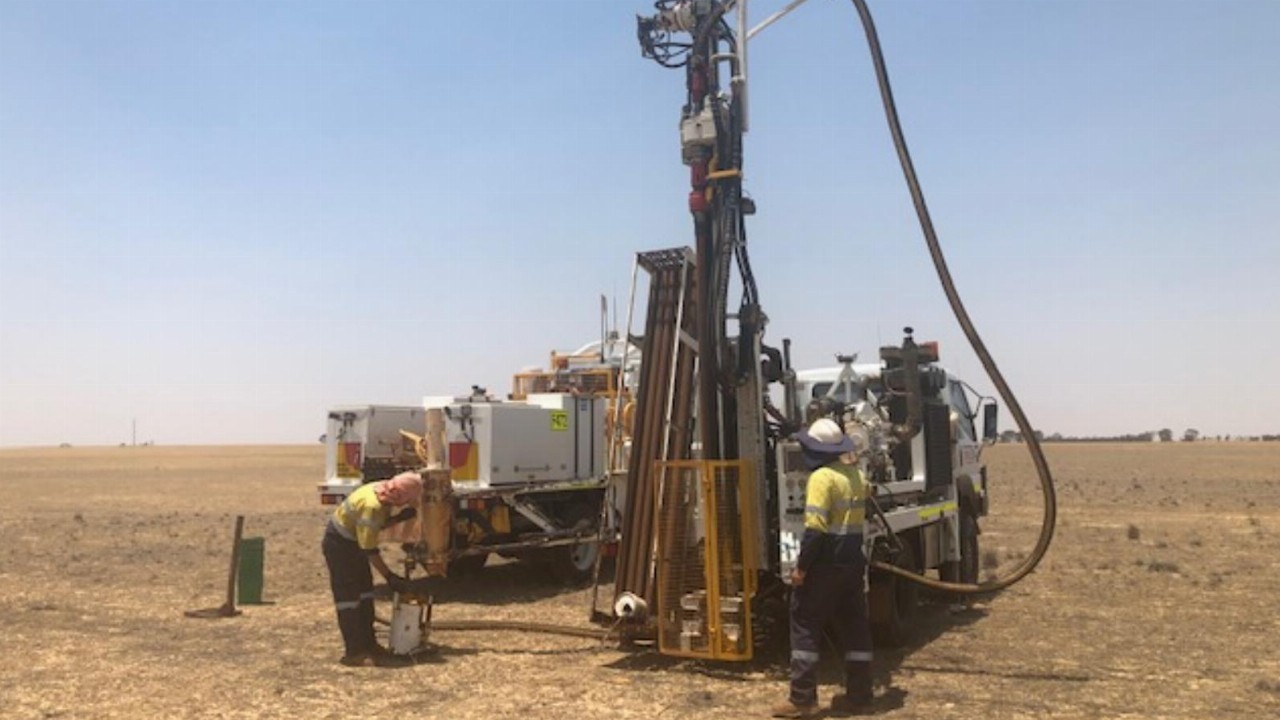

- The company also completed infill and step-out drilling campaigns at the White Cloud Kaolin project in WA

- In addition to this, Suvo wrapped up a drilling program at its Nova Silica Sand project with the results to be used for resource definition

- SUV burnt through $513,000 on operation activities and $2.49 million on investing activities over the period but has enough funds to keep going for another 8.89 quarters

- Shares in Suvo Strategic Minerals are trading steady at 16 cents each

Suvo Strategic Minerals (SUV) has released its latest quarterly report, showing it ended the year well funded with $7.4 million worth of cash in the bank.

December proved to be a big quarter for the kaolin and silica sand producer, who acquired Imerys’ hydrous kaolin operations for $2 million.

The operations in Victoria are Australia’s only operating wet kaolin processing plant and in 2019 it produced and sold 25 thousand tonnes of kaolin products.

Suvo paid for the acquisition via a successful $6 million capital raise which was carried out during the period.

Along with the Imerys purchase, the company also completed both the infill and step-out drilling campaigns at its White Cloud Kaolin project, formerly known as White Knight.

The drilling aimed to upgrade the 31.5 million tonnes of bright white kaolinised granite classification from inferred to indicated, with results from both campaigns expected shortly.

Additionally, Suvo also wrapped up a drilling program at its Nova Silica Sand project with the results from the drilling be used for a resource definition.

Looking at its finances, SUV burnt through $513,000 on operation activities and $2.49 million on investing activities over the period.

But, with more than $7 million in the back, the kaolin producer has enough funds to keep going for another 8.89 quarters if its burn rate remains the same.

Shares in Suvo Strategic Minerals are trading steady at 16 cents each at 3:59 pm AEDT.