- Sydney and Melbourne house prices recorded double-digit growth in the 12 months before coronavirus restrictions hit

- Most of the restrictions affecting the residential property market were put in place in late March, and therefore did not have a noticeable impact on prices in the March quarter.

- Following restrictions on social gatherings and business activities from late March, Australian Property prices went down by 0.4 per cent in May.

- Eligible home buyers and renovators are set to benefit from the $688 million HomeBuilder package set by the Federal Government

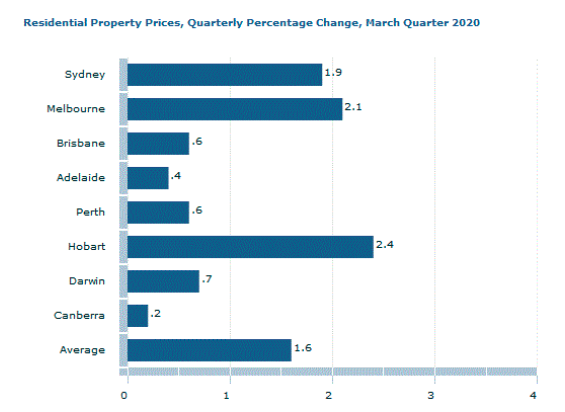

Australia’s residential property prices recorded a 1.6 per cent in the March quarter, led by Sydney and Melbourne, with all capital cities recording a rise in prices, according to the latest figures from the Australian Bureau of Statistics.

Sydney and Melbourne house prices recorded double-digit growth in the 12 months before coronavirus restrictions hit but recent job losses and travel bans have left thousands of homes empty in capital city CBDs.

According to the latest Australian Bureau of Statistics data, property prices in Sydney rose 1.9 per cent in the first quarter of 2020, with houses going up 2.6 per cent and apartments 0.8 per cent. Melbourne home values increased by 2.1 per cent, with houses rising 2.3 per cent and apartments 1.5 per cent.

In the 12 months to March 31, Australia’s residential property prices increased in all capital cities except Perth and Dar except Perth, down 0.9 per cent, and Darwin with a drop of 3.1 per cent win, with a national rise of 7.4 per cent. Melbourne property prices increased by 10.4 per cent during the year, while Sydney increased by 10 per cent. Hobart recorded a 7 per cent increase for the twelve months, Canberra 3 per cent and Brisbane recorded a 2.5 per cent rise.

The total value of residential dwellings in Australia climbed to a record-high $7237.1 billion in the March quarter, rising by $141.6 billion, or 2 per cent, during the quarter.

ABS chief economist Bruce Hockman said the results were in line with expectations. “The majority of restrictions relating to COVID-19 came into effect in late March and therefore did not have a noticeable impact on property prices in the March quarter 2020,” Mr Hockman said.

But restrictions on social gatherings and business activities from late March led to an increase in unemployment and warnings from banks that property markets could face significant price falls.

Property research company Core Logic, which releases a monthly index of property prices, earlier this month said nationally, dwelling values were down by 0.4 per cent in May. This was the first fall in Australian Property prices since mid-2019 and came after half a million people went on the dole in the first three weeks of the shutdowns. Core logic’s Tim Lawless said Australia’s housing values could come under additional downwards pressure if economic conditions haven’t picked up towards the end of the year.

The federal government introduced a $688 million HomeBuilder package in early June, offering eligible home buyers and renovators $25,000 to help boost the construction industry and stimulate activity in the housing market.

The rental market has also eased significantly during the pandemic.

Data from SQM Research, also released earlier this month, found vacancy rate recorded a slight drop to 2.5 per cent in May, from 2.6 per cent in April, with the total number of vacant residential properties across Australia now at 86,398. Sydney’s vacancy rate lifted to 4 per cent in May, from 3.9 per cent the month before, while Melbourne’s increased to 3.1 per cent from 2.8 per cent.

In the Sydney CBD, there were more than 1500 empty homes in May, compared with 745 at the same time last year. In Melbourne, 1900 homes do not have a tenant, up from 431 in May 2019.

SQM Research managing director Louis Christopher said the figure was likely to stay high as international borders remained closed and underlying growth in demand for rentals had typically come from migration. However, he said the markets appeared to be reaching a “short-term peak” in vacancies.

“Weekly rental listings suggest a decline in supply for the first half of June,” he said, adding it appeared some property owners had started pulling down long-term rentals in the hopes demand for Airbnbs would lift as tourists returned.