- U.S. Federal Reserve Chair Jerome Powell has warned the impacts of the pandemic on American society have been unequally felt, widening inequality

- A new report shows that “low-income households have experienced, by far, the sharpest drop in employment, while job losses of African Americans, Hispanics, and women have been greater than that of other groups”

- But the Federal Chair also stressed the Reserve would not hesitate to use all weapons in its arsenal to promote maximum employment, stable prices and stability of the financial system

- Market volatility, however, is unlikely to abate, while fears of a second wave of COVID-19 infections are rife and the number of new daily cases continue to mount in several U.S. states and around the world

- Nevertheless, Powell’s address sought to reassure the American people and broader markets that the Federal Reserve is prepared to do whatever it takes, for as long as necessary, to support the recovery

Over the past few months, the U.S. Federal Reserve has implemented extensive pandemic stimulus, already surpassing US$2 trillion and contributing to somewhat of an economic revival in May. Yet the economic impacts of the pandemic are still profound and will likely be felt for many years to come.

In his two-day testimony on the Semiannual Monetary Policy Report, Federal Reserve Chair Jerome Powell warned that the impacts on American society had been unequally felt and that the long-term consequences should not be underestimated.

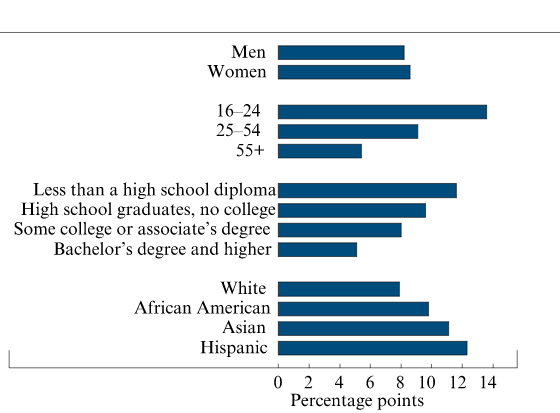

“Low-income households have experienced, by far, the sharpest drop in employment, while job losses of African Americans, Hispanics, and women have been greater than that of other groups,” Jerome said.

“If not contained and reversed, the downturn could further widen gaps in economic well-being that the long expansion had made some progress in closing,” he said in a prepared address to congress.,” he continued.

Since February, 20 million jobs have disappeared and it’s women, younger people, those with lower levels of education and non-white Americans who have been disproportionately affected.

Source: U.S. Bureau of Labor Statistics via Haver Analytics

The Federal Chair also stressed that the Federal Reserve will not hesitate to use all weapons in its arsenal to promote maximum employment, stable prices and stability of the financial system.

“We are committed to using our full range of tools to support the economy and to help assure that the recovery from this difficult period will be as robust as possible,” the Federal Reserve Chair assured.

In March, the Federal Reserve cut its benchmark interest rate to 0-0.25 per cent and Powell reiterated that it will remain negligible until the Fed is confident the economy is on its way to regaining maximum employment and price stability.

Additionally, among other actions, the Federal Reserve has been purchasing Treasury security and agency mortgage-backed securities to support the flow of credit to the economy.

“To sustain smooth market functioning and thereby foster the effective transmission of monetary policy to broader financial conditions, we will increase our holdings of Treasury securities and agency mortgage-backed securities over coming months at least at the current pace. We will closely monitor developments and are prepared to adjust our plans as appropriate to support our goals,” Jerome continued.

Between late February and early March, treasury yields fell steeply, indicating the strain on the Treasury securities and agency mortgage-backed markets.

The 10-year, 20-year and 30-year yields sat at 1.54, 1.84 and 2.01 per cent respectively before falling as low as 0.6, 0.98 and 1.17 per cent respectively on April 24. Progress has since been made, as of June 17, those yields have climbed back up to 0.74, 1.3 and 1.52 per cent respectively.

Market volatility, however, is unlikely to abate, while fears of a second wave of COVID-19 infections are rife and the number of new daily cases continue to mount in several U.S. states and around the world.

“Significant uncertainty remains about the timing and strength of the recovery. Much of that economic uncertainty comes from uncertainty about the path of the disease and the effects of measures to contain it. Until the public is confident that the disease is contained, a full recovery is unlikely,” the Federal Reserve Chair concluded.

Nevertheless, Powell’s address once again sought to reassure the American people and broader markets that the Federal Reserve will not prematurely take its foot off the gas and is prepared to do whatever it takes, for as long as necessary, to support the recovery.