- Tasmania’s State Government will provide approximately $200,000 in funding for exploration drilling for Venture Minerals’ (VMS) three priority targets in 2020

- The Mount Lindsay project is classified by the Australian Government as a critical minerals project with an advanced tin-tungsten asset

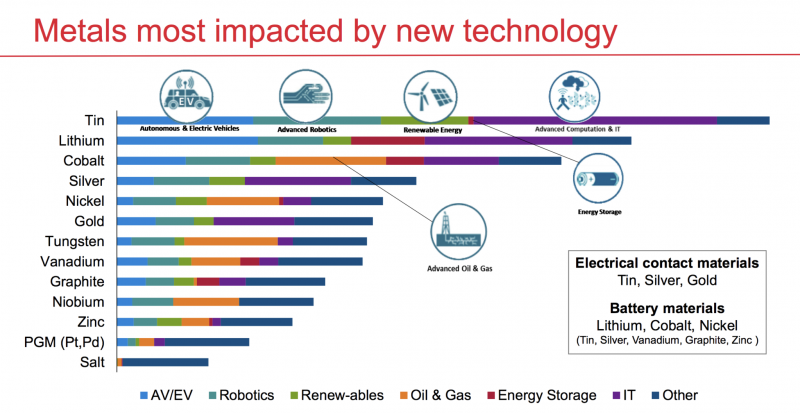

- Tin is now recognised as a fundamental metal to the battery revolution and new technology

- Venture Minerals is down 5.88 per cent on the market this morning, trading at 1.6¢ apiece

Tasmania’s State Government will co-fund up to $202,000 for exploration drilling at Venture Minerals’ (VMS) three priority targets in 2020.

The company has completed a major electromagnetic (EM) survey which has delivered strong EM conductors, interpreted as high priority drill targets at Mt Lindsay.

The EM survey identified several strong conductors along with previously gathered exploration data to define priority drill targets, which included Renison Bell Style High-Grade Tin, Mount Lindsay Style Tin-Tungsten and Nickel Sulfide targets.

Mount Lindsay Project is classified by the Australian Government as a critical minerals project, already boasting an advanced tin-tungsten asset despite only 10 per cent of its targets undergoing testing thus far.

This will be further enhanced by the delineation of several high priority drill targets of the same mineralisation, through the recently completed major EM survey.

Mount Lindsay is already one of the largest undeveloped tin projects in the world, containing in excess of 80,000 tonnes of tin metal and within the same mineralised body is a tungsten resource containing 3.2 million metric tonne unit of tungsten trioxide.

Tin is now recognised as a fundamental metal in the battery revolution and new technology. Tin Association is predicting a surge in demand, driven by the lithium-ion battery market of up to 60,000 tonnes per annum.

The world tin consumption was 363,500 tonnes in 2018. Tin prices have increased by approximately 30 per cent since early 2016 and is currently $24,000 (US$17,000) per tonne.

Managing Director Andrew Radonjic says that the tin and tungsten are globally classified as critical minerals.

“Recently the Australian Government said that global demand for Australian resources has broadened in recent years to include minerals used in a range of emerging high‑tech applications across a variety of sectors such as renewable energy, aerospace, defence, automotive (particularly electric vehicles), telecommunications and agri-tech,” Andrew said.

“Known as critical minerals, this group of minerals is considered essential for

the economic and industrial development of major and emerging economies,” he added.

“With the increased exploration potential at Mount Lindsay combined with its current status as one of the largest undeveloped tin assets in the world, clearly Mount Lindsay is a leading Australian Critical Minerals Project,” Andrew said.

Venture Minerals is down 5.88 per cent on the market this morning, trading at 1.6¢ apiece at 10:11 am AEDT.