- Job recruitment tech-business Xref has weathered a lowered share price today, but still gleamed with a record quarterly performance

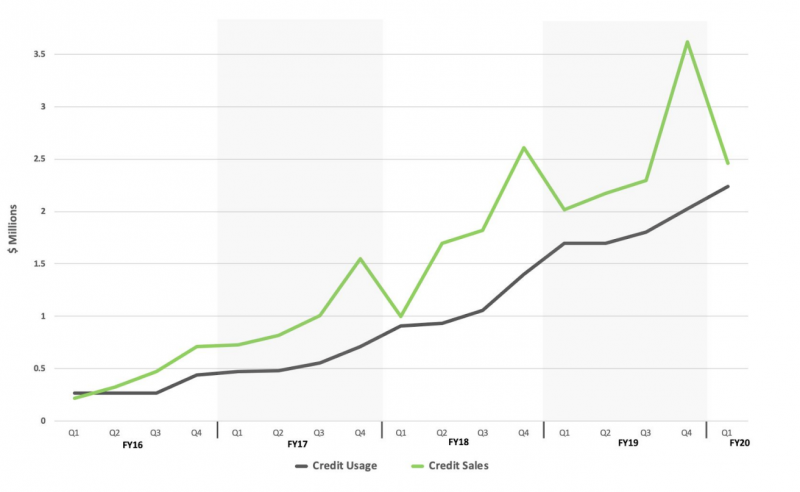

- Coming off the back end of all-time high sales in the final quarter of the 2019 Financial Year, the company etched out record cash receipts of $3.53 million — a 31 per cent increase on the year

- Company management was quick to attribute the continuous growth to the launch of its Xref Life platform earlier this month

- Xref Lite offers a self-serve function to the company’s job recruitment operations — reportedly to speed up the job hiring process

- Despite all this, Xref shares have fallen 6.98 per cent today to trade for an even 40 cents

Shares in job recruitment solution company Xref have fallen 6.98 per cent today, despite announcing records for the quarter.

Xref sales increased by 23 per cent during the just-passed first quarter of the 2020 financial year — reaching $2.46 million.

The company’s credit usage rocketed a further 32 per cent as well, notching a $2.24 million performance — a record number.

“This has been a truly defining quarter for us,” Xref CEO Lee-Martin Seymour said.

“We have seen the company grow and evolve in all aspects – with team growth, direct sales growth, platform expansion and indirect revenue generation, through partnerships and acquisition.”

Image sourced from Xref

According to the company’s media release during today’s trading period, these results were in line with trajections. As well, the first quarter of the financial year is usually the lowest-performing period for the company.

Cash receipts compared to last year showed a 31 per cent increase to hit $3.53 million — reflective of record sales during the last quarter of the 2019 financial year.

“Accelerated growth and profitable scale is now most definitely in our grasp and we are very excited about the opportunity that lies ahead,” Lee-Martin added.

Despite record-breaking numbers and continuous growth, shares in Xref on the Australian market dropped 6.98 per cent to trade for 40 cents each.

Weathering through a lowered share pricing, Xref ticked boxes on valuable clients during the quarter nevertheless; including New Zealand’s Ministry of Social Development, Texas A&M University, and Brussels Airlines.

Xref Executive Director Tim Griffiths spoke on the companies tech-based expansions this quarter, specifically the newly launched “Xref Lite”.

“The amount and level of platform development during this quarter has been phenomenal and we are exceptionally proud of our development team for what’s been achieved,” he said.

“The launch of Xref Lite is a major milestone for us but the introduction of this new platform alternative hasn’t happened in isolation, we have also seen new integrations launch and all of these new offerings translate into a greater competitive edge, faster client acquisitions and, therefore, increased revenue.”

Xref Lite is the latest iteration of the company’s job-application simplification. The platform offers a self-serve version, cutting out extra labour from Xref and allowing clients using the software to reach a faster hire.

Xref Lite was launched on 22 October this year.