- Australian milk-formula king Bubs (BUB) is poised to raise $35 million through a twin share placement plan

- The company throttled into a trading halt this Thursday and is expected to return to form on December 9

- 31.6 million shares will be dished out at 95 cents apiece — 11.8 per cent lower than the company’s average five-day valuation

- The last $5 million will come from 5.3 million shares given to existing investors; Bell Potter Securities and PAC Partners

- Reports indicate the multi-million dollar capital raising is needed to address Asia’s demanding infant milk formula market

- Bubs recently made new deals for popular Chinese retailer Alibaba, and Vietnamese chain Bibo Mart

- Shares in Bubs last closed at $1.07

Australia’s darling baby-milk formula player, Bubs (BUB), has entered yet another trading halt — this time eyeing a $35 million capital raising.

Shares in the company were sent into a halt this Thursday, last closing at $1.07 each.

Details of the plan show the company will dish out roughly 31.6 million shares at 95 cents each — an 11.8 per cent steal compared to the company’s five-day valuation.

A share purchase plan, making up for $5 million of the purchase plan pie, will give 5.3 million shares to existing investors; Bell Potter Securities and PAC Partners.

This capital raise takes place amongst several expansions and changes for the company.

Image sourced from Bubs Australia

Last month the milk-formula dealers joined Vietnam’s largest baby store chain: Bibo Mart.

Bibo Mart stocks mother and child products in over 135 stores. According to Bubs, the Vietnamese infant nutritional market is worth A$2.2 billion, with milk formula products alone valued at A$1.8 billion.

This massive expansion came off the back end of the company etching another innovation for China’s massive online retailer, Alibaba. Bubs launched its goat dairy infant formula range on the retail site at the start of November.

According to Bubs, the Chinese goat dairy market is priced at AU$2 billion.

Reports indicate today’s capital raising from BUB will largely be used for business in the demanding Asian baby formula market, and unspecified mergers and acquisitions.

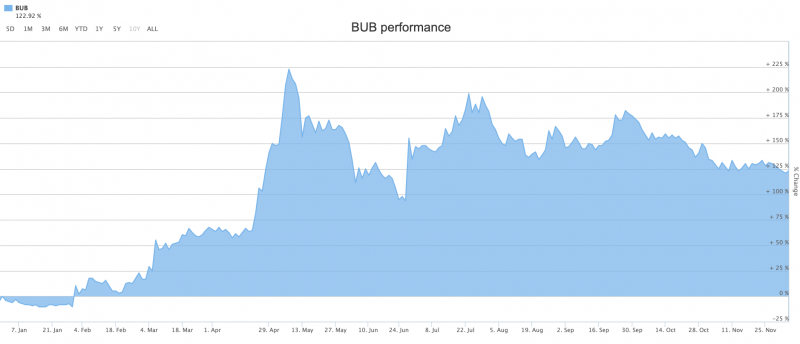

This year has been a whirlwind for the company, relentlessly ticking boxes and seeing expansion after expansion. Since January, Bubs has undergone roughly a 132 per cent upgrade to its share price — climbing from as low as 45 cents at one point.

For the 2019 Financial Year, Bubs generated $44 million in net revenue.

Bubs will emerge from its trading halt on December 9, and is expected to bare another release in relation to capital raising.